ED IDR 2018 free printable template

Show details

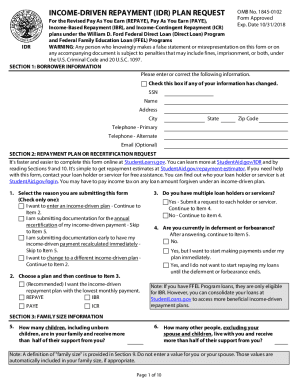

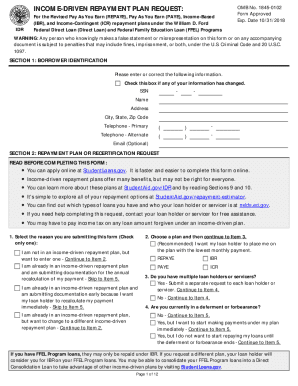

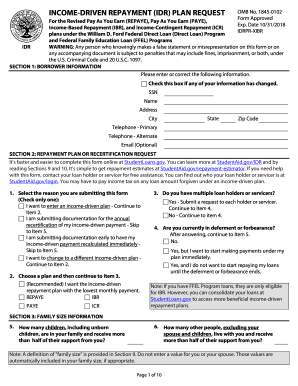

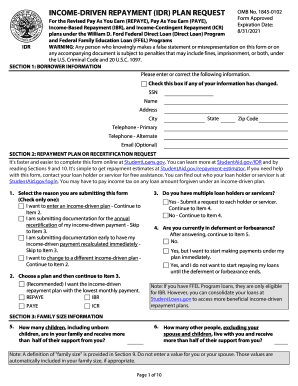

Gov. It is faster and easier to complete this form online. Income-driven repayment plans offer many benefits but may not be right for everyone. You can learn more about these plans at StudentAid.gov/IDR and by reading Sections 9 and 10. It s simple to explore all of your repayment options at StudentAid.gov/repayment-estimator. INCOME-DRIVEN REPAYMENT PLAN REQUEST IDR For the Revised Pay As You Earn REPAYE Pay As You Earn PAYE Income-Based IBR and Income-Contingent ICR repayment plans under...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ED IDR

Edit your ED IDR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ED IDR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ED IDR online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ED IDR. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ED IDR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ED IDR

How to fill out ED IDR

01

Gather your financial documents, including your income, expenses, and any relevant tax forms.

02

Visit the ED IDR application page on the official website.

03

Fill out the application form with accurate details about your financial situation.

04

Provide any required supporting documentation as specified in the instructions.

05

Review your application for completeness and accuracy before submitting.

06

Submit the application electronically and save a copy for your records.

Who needs ED IDR?

01

Students or graduates with federal student loans experiencing financial hardship.

02

Individuals seeking to lower their monthly loan payments based on income.

03

Borrowers interested in loan forgiveness options available through income-driven repayment plans.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to get IDR approval?

It usually takes about two weeks for your servicer to process an IDR application or recertification — however, some borrowers have experienced longer delays.

How do I update my income-driven repayment plan?

Recertify income-driven repayment plan online Go to the Federal Student Aid's income-driven repayment plan page. Scroll down to “Returning IDR Borrowers” Click “Log In to Recertify” (use your FSA ID to log in) Follow instructions and upload any required documents.

How do I apply for IDR?

Income-driven repayment (IDR) plans are designed to make your student loan debt more manageable by reducing your monthly payment amount. You can apply for an IDR plan request on our website. Log in to your account and go to the Income-Driven Repayment (IDR) Plan Request page to complete an IDR application.

What is an IDR form?

Income-driven repayment (IDR) plans are designed to make your student loan debt more manageable by giving you a monthly payment based on your income and family size. If your outstanding federal student loan debt represents a significant portion of your annual income, an IDR plan might be right for you.

What documents are needed for IDR?

Most recent federal income tax return or transcript. (The IDR Data Retrieval tool will link your tax information directly to your application.) Pay stubs. Letter from your employer stating your gross pay. Signed statement explaining your income, if formal documentation is unavailable.

How do you prove income for income-driven repayment?

Proof of income: You must submit your most recent tax return to show your updated income. If you don't have your tax return, you may submit alternative documentation, such as recent pay stubs or a letter from your employer.

How to calculate income-driven student loan repayment?

The income-driven plan you use 10% of your discretionary income. 10% of discretionary income if you borrowed on or after July 1, 2014; 15% of discretionary income if you owed loans as of July 1, 2014. 20% of discretionary income or fixed payments over a 12-year term — whichever is less.

What is proof of income for IDR?

Proof of income: You must submit your most recent tax return to show your updated income. If you don't have your tax return, you may submit alternative documentation, such as recent pay stubs or a letter from your employer. Signature: Your signature is your guarantee that all information is accurate.

What documents are needed for income-driven repayment?

Documentation will usually include a pay stub or letter from your employer listing your gross pay. Write on your documentation how often you receive the income, for example, “twice per month” or “every other week." • You must provide at least one piece of documentation for each source of taxable income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ED IDR directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your ED IDR as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Where do I find ED IDR?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific ED IDR and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an eSignature for the ED IDR in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your ED IDR right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is ED IDR?

ED IDR stands for 'Economic Development Information Disclosure Report,' which is a document required for certain entities to disclose financial and operational data.

Who is required to file ED IDR?

Entities that receive economic development incentives or funds from government sources are typically required to file ED IDR.

How to fill out ED IDR?

To fill out an ED IDR, entities must collect relevant financial and performance data, complete the designated form, and submit it to the appropriate government agency as per the guidelines provided.

What is the purpose of ED IDR?

The purpose of ED IDR is to promote transparency and accountability in the use of public funds by requiring entities to report on their economic development activities and outcomes.

What information must be reported on ED IDR?

The ED IDR typically requires reporting information such as project details, funding amounts, job creation statistics, and other relevant economic impact data.

Fill out your ED IDR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ED IDR is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.