Wells Fargo BBG6185 2016 free printable template

Get, Create, Make and Sign Wells Fargo BBG6185

How to edit Wells Fargo BBG6185 online

Uncompromising security for your PDF editing and eSignature needs

Wells Fargo BBG6185 Form Versions

How to fill out Wells Fargo BBG6185

How to fill out Wells Fargo BBG6185

Who needs Wells Fargo BBG6185?

Instructions and Help about Wells Fargo BBG6185

[Narrator]: We know that money doesn't grow on trees, but Wells Fargo's customers have found the bank accounts do appear out of nowhere. [Senator Elizabeth Warren]: It's a bank, right? They're supposed to keep track of people's money, safety, security. [Narrator]: Welcome to Watchdog News, the weekly series where we break down news stories that might be on your radar. In this installment, we're counting down 5 crucial facts you should know about the Wells Fargo account scandal. [Sen. Warren]: If they really didn't know, then that tells me this is a bank that is simply too big to manage. [Narrator]: Wells Fargo is considered one of the Big Four Banks in the United States, along with JPMorgan Chase, Bank of America and Citigroup. According to Rel Banks, Well's Fargo was the largest bank in the world in 2015 in terms of market cap, operating in 35 countries and serving over 70 million customers worldwide. In fact, Wells Fargo was ranked as the 7th largest public company on the planet by Forbes in 2016. The bank, which today is headquartered in San Francisco, has its origins in the mid-nineteenth-century Gold Rush. It was founded by Henry Wells and William Fargo, who were also part founders of American Express, in 1852. In its early years, Wells Fargo was one of the few banks to survive the Panic of 1857, which saw a collapse in the banking system. In recent years, a series of controversies has dogged the brand, including fines for overdraft issues administered in 2010, allegations of racial discrimination in 2011, inadequate risk disclosures in 2012 and violations of New York credit card rules in 2015, as well as high-profile revelations in 2014 surrounding the earnings of executive figures. In September 2016, it was revealed that employees at Wells Fargo had been covertly creating and operating extra bank accounts without customer authorization. An investigation found that at least 1.5 million bogus accounts and over half a million credit cards had been opened since 2011, without customers' knowledge. The fraud was committed as a means of not only making more money for the bank, but more importantly to boast sales figures so that employees involved could reach quotas and qualify for incentive bonuses. It's reported that in some instances, fake pins and email addresses were used in order to sign customers up for services without their knowledge. Wells Fargo has taken responsibility for the problem, which has been blamed by some critics on the incentives given to employees and also seemingly results from inadequate monitoring, checks and control procedures. [Sen. Warren]: Either they knew, or they didn't know, in which case how can you run a giant multinational bank... ? [Narrator]: The bank has been hit with 185 million dollars in fines, 100 million dollars of which goes to the Consumer Financial Protection Bureau's civil penalty fund, and it's been ordered to pay a further 5 million dollars as compensation to the customers affected. In many cases,...

People Also Ask about

How do I add an authorized user to my Wells Fargo business account?

Who will receive money from Wells Fargo lawsuit?

What is the Wells Fargo hold harmless agreement?

Does Wells Fargo allow authorized users on credit cards?

How much will each person get from Wells Fargo settlement?

Can I add an authorized user to my Wells Fargo checking account?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in Wells Fargo BBG6185?

How do I fill out Wells Fargo BBG6185 using my mobile device?

How do I complete Wells Fargo BBG6185 on an iOS device?

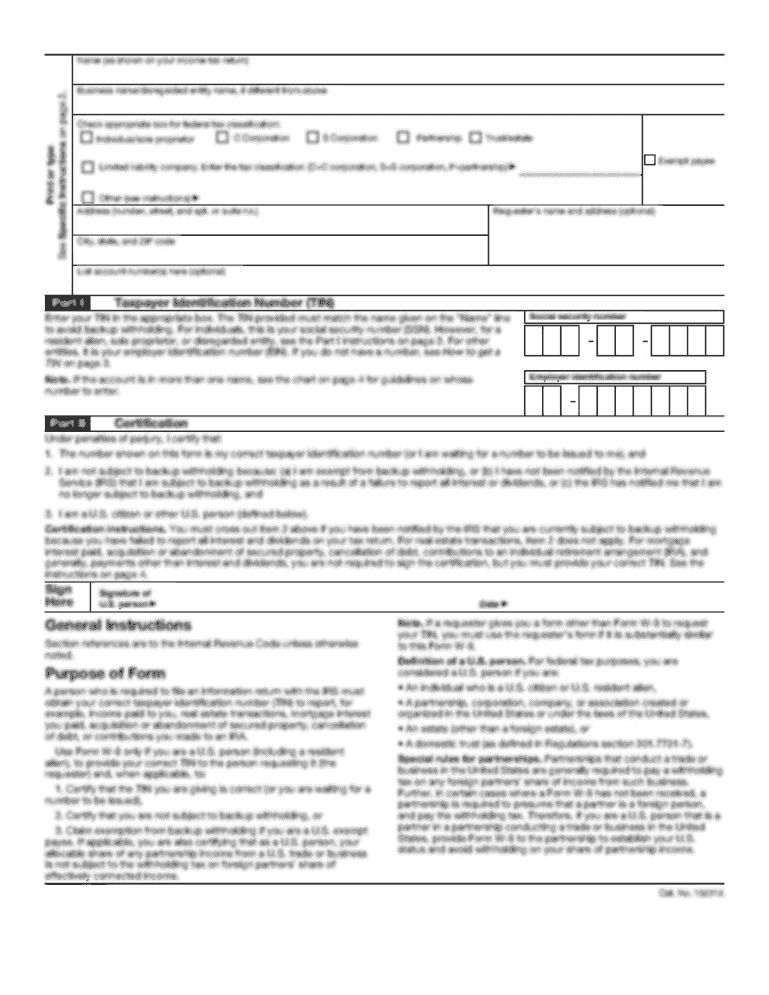

What is Wells Fargo BBG6185?

Who is required to file Wells Fargo BBG6185?

How to fill out Wells Fargo BBG6185?

What is the purpose of Wells Fargo BBG6185?

What information must be reported on Wells Fargo BBG6185?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.