Get the free Trial Court Revenue Distribution Guidelines - Revision 33

Show details

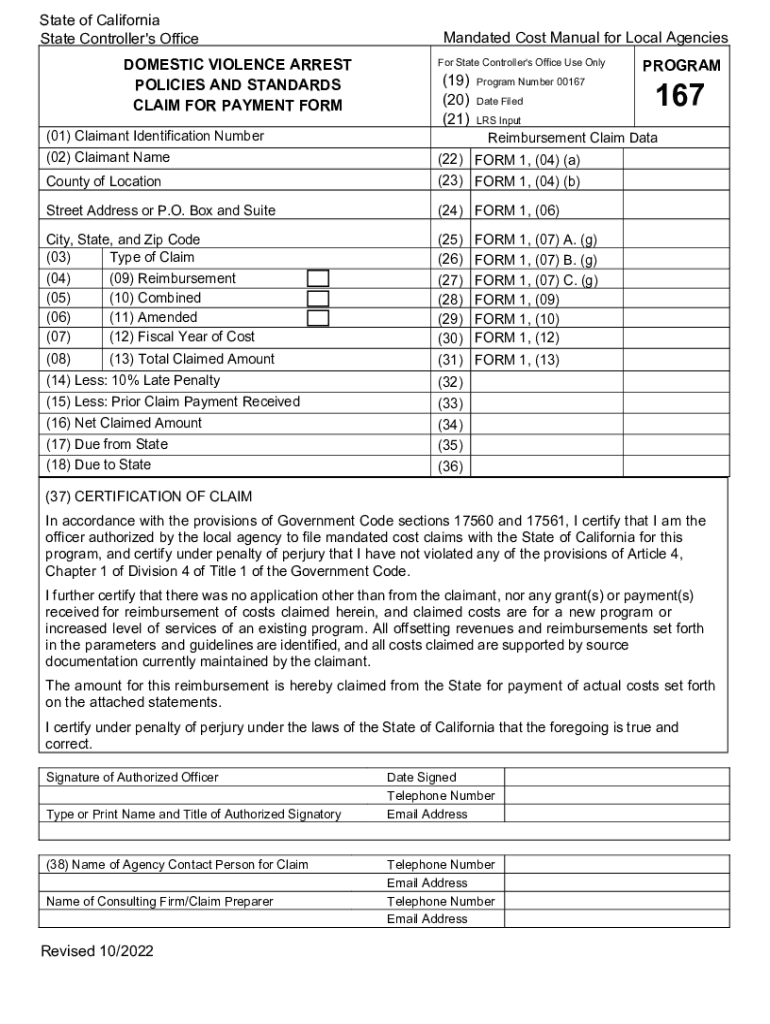

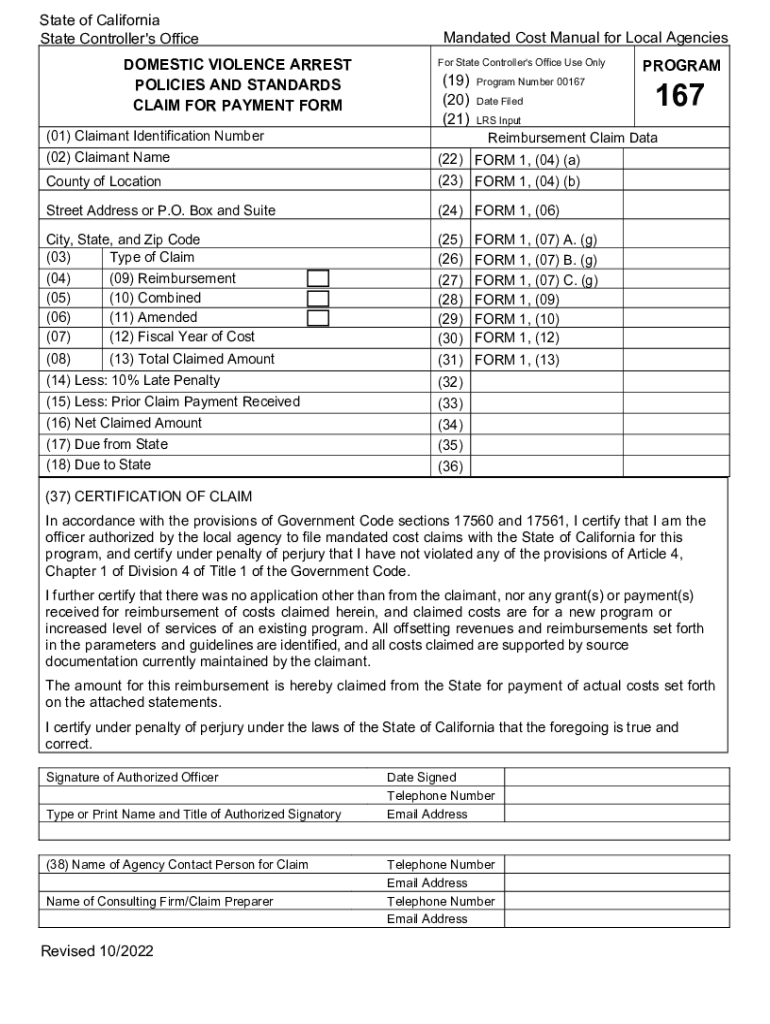

Office of the State Controller StateMandated Costs Claiming Instructions No. 201233 Domestic Violence Arrest Policies and Standards Program No. 167 Revised October 1, 2023 In accordance with Government

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign trial court revenue distribution

Edit your trial court revenue distribution form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your trial court revenue distribution form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit trial court revenue distribution online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit trial court revenue distribution. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out trial court revenue distribution

How to fill out trial court revenue distribution

01

Start by gathering all necessary information and documents related to the trial court revenue distribution.

02

Understand the specific guidelines and requirements for filling out the trial court revenue distribution forms.

03

Begin filling out the forms by providing accurate and complete information, such as the court name, case number, and revenue details.

04

Follow any instructions or prompts provided in the form, including any specific calculations or allocations required.

05

Double-check all the information filled in the forms for errors or omissions before submitting.

06

Submit the completed trial court revenue distribution forms to the appropriate authority or designated office.

07

Keep copies of the filled-out forms and any supporting documents for your records.

08

Follow up to ensure that the revenue distribution process is successfully completed and any necessary payments are received.

Who needs trial court revenue distribution?

01

Trial courts, such as municipal courts, state courts, or federal courts, need trial court revenue distribution.

02

Administrative offices responsible for managing court finances and budgets require trial court revenue distribution to ensure proper allocation of funds.

03

Legal professionals involved in court cases, such as attorneys, may also need trial court revenue distribution to understand the financial aspects of the case.

04

Government agencies, auditors, or regulatory bodies overseeing court operations may require trial court revenue distribution to monitor financial compliance.

05

Stakeholders involved in court-related activities, such as judges, court staff, or legal aid organizations, may also need trial court revenue distribution to assess funding and resource allocation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my trial court revenue distribution directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign trial court revenue distribution and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I get trial court revenue distribution?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the trial court revenue distribution in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I complete trial court revenue distribution on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your trial court revenue distribution by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is trial court revenue distribution?

Trial court revenue distribution refers to the process of allocating and distributing the revenues collected by trial courts, such as filing fees, fines, and other charges, to various state and local entities, including specific funds and programs as mandated by law.

Who is required to file trial court revenue distribution?

Typically, trial court clerks or court administrators are required to file trial court revenue distribution reports to ensure accurate accounting and distribution of the revenues collected by the court.

How to fill out trial court revenue distribution?

To fill out trial court revenue distribution, one must gather data on the total revenues collected, categorize them according to predefined categories (such as civil, criminal, family, etc.), and then report the amounts allocated to each designated fund or agency as prescribed by relevant state laws.

What is the purpose of trial court revenue distribution?

The purpose of trial court revenue distribution is to ensure that the funds collected by the court are allocated appropriately to support various state and local programs, including public safety, legal aid services, court administration, and victim services.

What information must be reported on trial court revenue distribution?

The information that must be reported on trial court revenue distribution includes the total amount collected, detailed categories of revenues, the distribution amounts for each fund, and any deductions made from the total revenue.

Fill out your trial court revenue distribution online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Trial Court Revenue Distribution is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.