FL DR-15SW 2015 free printable template

Show details

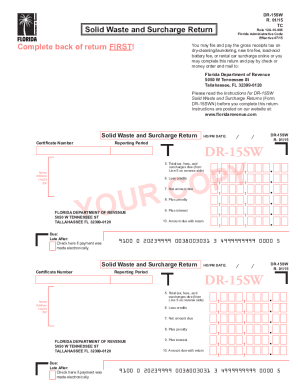

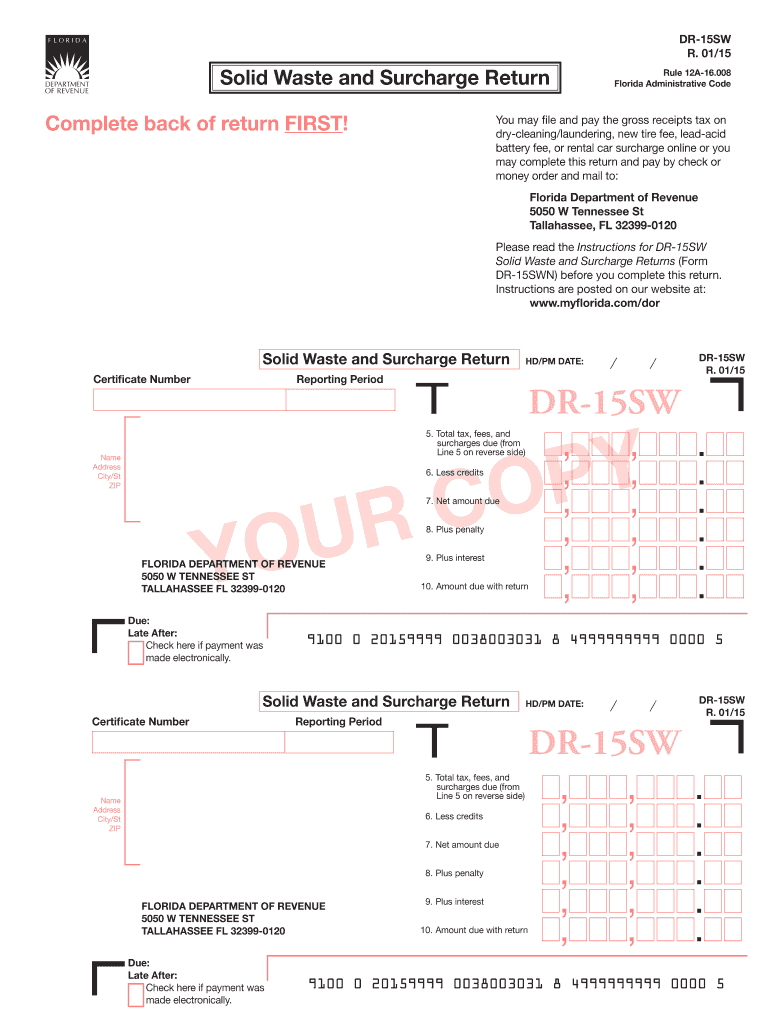

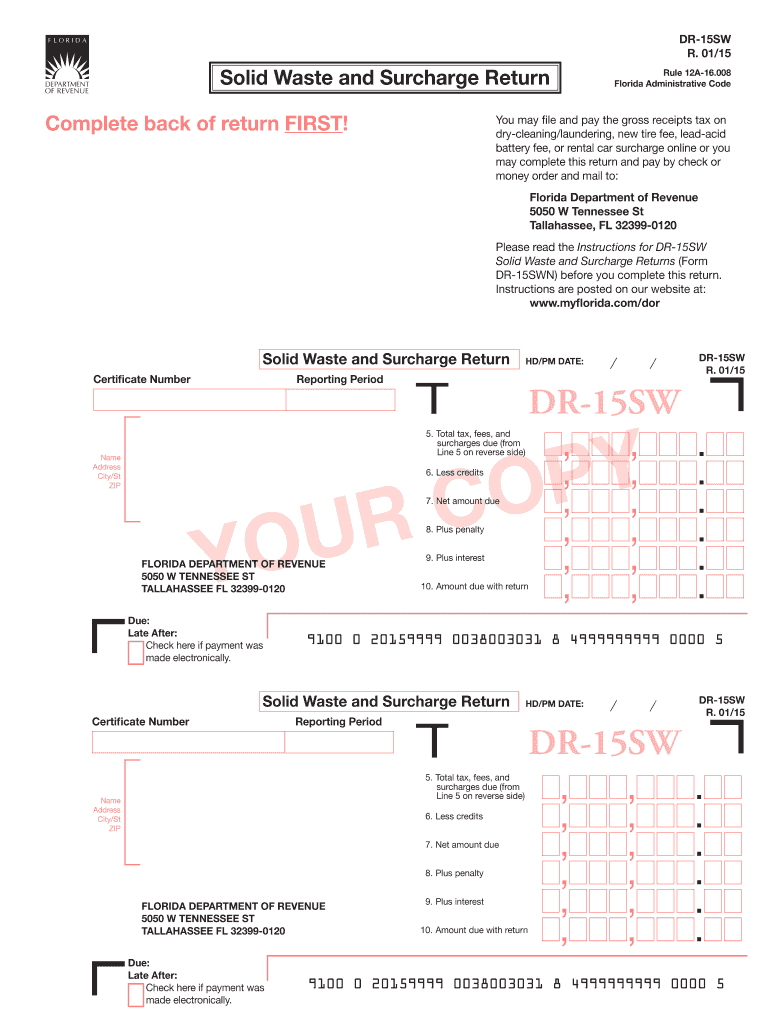

DR-15SW R. 01/15 Solid Waste and Surcharge Return Complete back of return FIRST Rule 12A-16. 008 Florida Administrative Code You may file and pay the gross receipts tax on dry-cleaning/laundering new tire fee lead-acid battery fee or rental car surcharge online or you may complete this return and pay by check or money order and mail to Florida Department of Revenue 5050 W Tennessee St Tallahassee FL 32399-0120 Please read the Instructions for DR-15SW DR-15SWN before you complete this return....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign florida dr 15sw

Edit your florida dr 15sw form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your florida dr 15sw form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit florida dr 15sw online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit florida dr 15sw. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DR-15SW Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out florida dr 15sw

How to fill out FL DR-15SW

01

Obtain the FL DR-15SW form from the Florida Department of Revenue website or a local office.

02

Begin by entering your name, address, and Social Security number at the top of the form.

03

Indicate your filing status by checking the appropriate box (e.g., single, married filing jointly).

04

Provide details of your income sources in the designated sections, including wages and any other income.

05

Fill out any applicable deductions according to the instructions provided on the form.

06

Calculate your total taxable income by subtracting deductions from your total income.

07

Determine the amount of tax owed based on the tax tables or calculations provided.

08

Sign and date the form before submission, ensuring all information is accurate and complete.

Who needs FL DR-15SW?

01

Any individual or business entity seeking a tax exemption or reduced tax rate in Florida may need to fill out the FL DR-15SW form.

02

This form is specifically for those who qualify for certain sales tax exemptions within the state.

Fill

form

: Try Risk Free

People Also Ask about

What is the collection allowance rate in Florida?

When you electronically file and pay on time, you may take a collection allowance. Be sure to calculate it correctly. The collection allowance is 2.5% (.025) of the first $1,200 of tax due, not to exceed $30 for each reporting location.

What is the penalty for filing sales tax late in Florida?

If you file your return or pay tax late, a late filing penalty of 10% of the amount of tax owed, but not less than $50, may be charged. The $50 minimum penalty applies even if no tax is due. A floating rate of interest applies to underpayments and late payments of tax.

What is discretionary sales surtax in Florida?

What is Discretionary Sales Surtax? Discretionary sales surtax, also called a local option county tax, is imposed by most Florida counties and. applies to most transactions subject to sales tax. The selling dealer must collect the surtax in addition to. Florida's general sales tax of 6%.

What is the collection allowance for Dr 15 in Florida?

File and Pay Online to Receive a Collection Allowance. When you electronically file your tax return and pay timely, you are entitled to deduct a collection allowance of 2.5% (. 025) of the first $1,200 of tax due, not to exceed $30.

What is the Florida sales tax collection allowance?

The collection allowance is 2.5% (. 025) of the first $1,200 of the amount due, not to exceed $30. Discretionary sales surtax is a county-imposed tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get florida dr 15sw?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific florida dr 15sw and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make changes in florida dr 15sw?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your florida dr 15sw and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How can I fill out florida dr 15sw on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your florida dr 15sw. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is FL DR-15SW?

FL DR-15SW is a tax form used in Florida for reporting sales and use tax information specifically for certain businesses.

Who is required to file FL DR-15SW?

Businesses in Florida that have collected sales and use tax and are required to report this information to the state are obligated to file FL DR-15SW.

How to fill out FL DR-15SW?

To fill out FL DR-15SW, businesses should provide their tax identification number, report the amount of taxable sales, calculate the total tax due, and provide any deductions or exemptions claimed.

What is the purpose of FL DR-15SW?

The purpose of FL DR-15SW is to allow businesses to report their sales and use tax obligations to the Florida Department of Revenue.

What information must be reported on FL DR-15SW?

The information that must be reported on FL DR-15SW includes the business name, tax identification number, total sales, total tax collected, any exemptions claimed, and net taxable amount.

Fill out your florida dr 15sw online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Florida Dr 15sw is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.