MD Comptroller 502 2016 free printable template

Show details

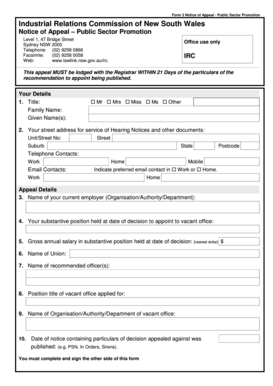

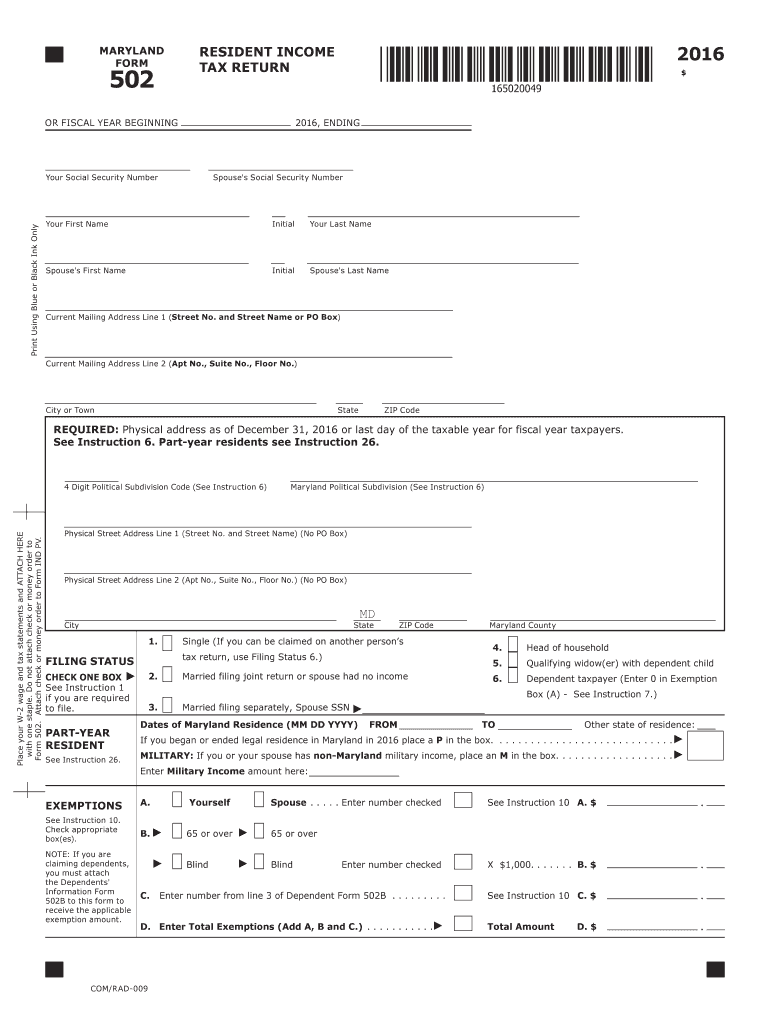

MARYLAND FORM OR FISCAL YEAR BEGINNING 2016 ENDING Your Social Security Number Print Using Blue or Black Ink Only RESIDENT INCOME TAX RETURN Spouse s Social Security Number Your First Name Initial Your Last Name Spouse s First Name Spouse s Last Name Current Mailing Address Line 1 Street No. and Street Name or PO Box City or Town State ZIP Code REQUIRED Physical address as of December 31 2016 or last day of the taxable year for fiscal year taxpayers. See Instruction 6. Part-year residents see...Instruction 26. Place your W-2 wage and tax statements and ATTACH HERE with one staple. Do not attach check or money order to Form 502. Attach check or money order to Form IND PV. 4 Digit Political Subdivision Code See Instruction 6 Maryland Political Subdivision See Instruction 6 Physical Street Address Line 1 Street No. and Street Name No PO Box MD City CHECK ONE BOX if you are required to file. Do not attach check or money order to Form 502. Attach check or money order to Form IND PV. 4 Digit...Political Subdivision Code See Instruction 6 Maryland Political Subdivision See Instruction 6 Physical Street Address Line 1 Street No. and Street Name No PO Box MD City CHECK ONE BOX if you are required to file. EXEMPTIONS Check appropriate box es. NOTE If you are claiming dependents you must attach the Dependents Information Form 502B to this form to receive the applicable exemption amount. Maryland County Married filing joint return or spouse had no income Head of household tax return use...Filing Status 6. See Instruction 6. Part-year residents see Instruction 26. Place your W-2 wage and tax statements and ATTACH HERE with one staple. Do not attach check or money order to Form 502. Attach check or money order to Form IND PV. 4 Digit Political Subdivision Code See Instruction 6 Maryland Political Subdivision See Instruction 6 Physical Street Address Line 1 Street No. and Street Name No PO Box MD City CHECK ONE BOX if you are required to file. EXEMPTIONS Check appropriate box es....NOTE If you are claiming dependents you must attach the Dependents Information Form 502B to this form to receive the applicable exemption amount. Your signature Date Signature of preparer other than taxpayer Spouse s signature Street address of preparer City State ZIP Telephone number of preparer For returns filed without payments mail your completed return to Comptroller of Maryland Revenue Administration Division 110 Carroll Street Annapolis MD 21411-0001 Preparer s PTIN required by law Make...checks payable to Comptroller of Maryland. Do not attach Form IND PV or check/money order to Form 502. Place Form IND PV with attached check/ money order on top of Form 502 and mail to Payment Processing PO Box 8888. MARYLAND FORM OR FISCAL YEAR BEGINNING 2016 ENDING Your Social Security Number Print Using Blue or Black Ink Only RESIDENT INCOME TAX RETURN Spouse s Social Security Number Your First Name Initial Your Last Name Spouse s First Name Spouse s Last Name Current Mailing Address Line 1...Street No* and Street Name or PO Box City or Town State ZIP Code REQUIRED Physical address as of December 31 2016 or last day of the taxable year for fiscal year taxpayers.

pdfFiller is not affiliated with any government organization

Instructions and Help about MD Comptroller 502

How to edit MD Comptroller 502

How to fill out MD Comptroller 502

Instructions and Help about MD Comptroller 502

How to edit MD Comptroller 502

To edit the MD Comptroller 502 Tax Form, you will need a digital copy of the form saved on your device. You can use pdfFiller to access various editing tools that allow you to customize the form with the necessary information. This includes adding or modifying text, adjusting fields, and incorporating required signatures.

How to fill out MD Comptroller 502

Filling out the MD Comptroller 502 requires careful attention to detail. Begin by gathering relevant financial records and information needed for the form. Follow these steps:

01

Obtain a copy of the form from the official Maryland Comptroller website or through pdfFiller.

02

Review the instructions to understand each section of the form.

03

Enter your complete name, address, and identification information.

04

Fill out the income and deductions fields as applicable.

05

Sign and date the form before submission.

About MD Comptroller previous version

What is MD Comptroller 502?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About MD Comptroller previous version

What is MD Comptroller 502?

MD Comptroller 502 is a tax form used by residents and businesses in Maryland to report income and claim any necessary deductions. This form is particularly important for ensuring compliance with state tax laws and accurately tracking taxable income.

What is the purpose of this form?

The purpose of the MD Comptroller 502 Tax Form is to report income to the Maryland state government and facilitate the calculation of tax liability or refund. This form helps taxpayers document earnings, eligible deductions, and credits they may qualify for during the tax year.

Who needs the form?

Individuals and businesses in Maryland who have taxable income are generally required to complete the MD Comptroller 502 form. This includes employees, self-employed individuals, and anyone receiving income subject to state taxation.

When am I exempt from filling out this form?

Exemptions from filling out the MD Comptroller 502 may apply to individuals or organizations that earn below a specified income threshold, or those whose income is entirely non-taxable. Additionally, certain governmental entities and non-profit organizations may not be required to file this form.

Components of the form

The MD Comptroller 502 consists of several key components, including sections for personal identification, income sources, deductions, credits, and signatures. Each section must be completed accurately to ensure proper processing by the Maryland Comptroller’s office.

What are the penalties for not issuing the form?

Failure to issue the MD Comptroller 502 when required can result in various penalties, including fines or interest on unpaid taxes. Additionally, not filing the form can lead to legal complications or increased scrutiny from tax authorities.

What information do you need when you file the form?

When filing the MD Comptroller 502, you will need to provide personal identification information, a record of all income received, and any pertinent documentation related to deductions or credits. This may include W-2 forms, 1099s, or other income statements.

Is the form accompanied by other forms?

The MD Comptroller 502 may be accompanied by other forms depending on specific tax situations. For example, if you're claiming certain credits or deductions, additional supporting documents might be necessary to reinforce your claims.

Where do I send the form?

The completed MD Comptroller 502 should be mailed to the address indicated on the form itself. It is essential to check for the correct mailing address to ensure that the form is processed efficiently by the Maryland Comptroller's office.

See what our users say