Get the free DETAIL OF SERVICES AND EXPENSES

Show details

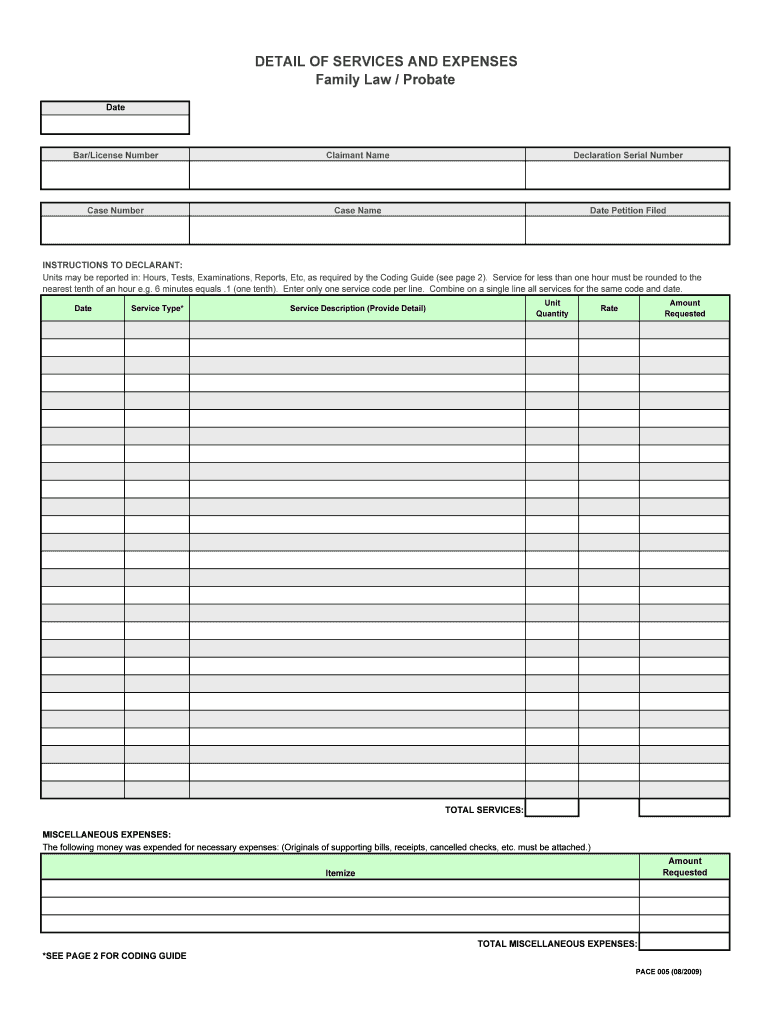

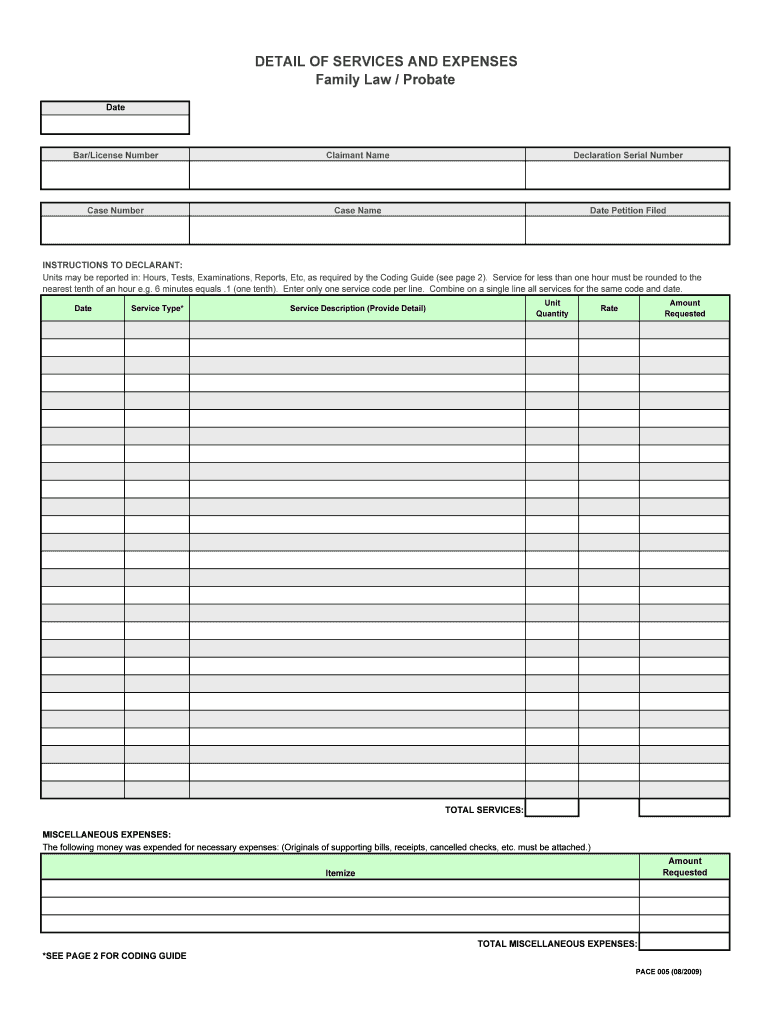

This document details the services provided and expenses incurred in relation to a family law or probate case, including service types, quantities, amounts requested, and necessary supporting documentation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign detail of services and

Edit your detail of services and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your detail of services and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing detail of services and online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit detail of services and. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out detail of services and

How to fill out DETAIL OF SERVICES AND EXPENSES

01

Gather all relevant information regarding the services provided and the expenses incurred.

02

Clearly list each service in a separate line, ensuring to include the date of service.

03

Provide a detailed description for each service, explaining what was done and any relevant specifics.

04

Indicate the cost associated with each service, ensuring clarity in pricing.

05

Add any additional expenses related to the services, detailing them similarly with descriptions and costs.

06

Review the entries for accuracy, ensuring all information is correct and aligns with invoices or receipts.

07

Ensure the total expenses are summarized at the end of the document for clarity.

Who needs DETAIL OF SERVICES AND EXPENSES?

01

Businesses that require a detailed breakdown of services and expenses for accounting purposes.

02

Individuals applying for reimbursements or insurance claims.

03

Contractors and freelancers who need to provide invoices for their work.

04

Organizations complying with regulatory requirements for financial reporting.

Fill

form

: Try Risk Free

People Also Ask about

How to write an expenses list?

How Do You Create an Expense Sheet? Choose a template or expense-tracking software. Edit the columns and categories (such as rent or mileage) as needed. Add itemized expenses with costs. Add up the total. Attach or save your corresponding receipts. Print or email the report.

What are examples of service costs?

Service costing is the process of identifying all costs associated with building, supporting, and delivering your service. Examples of service cost components include equipment, staff labor, professional fees, software, license fees, and data center charges, to name just a few.

What is the meaning of service expenses?

Service Expenses means fees for activities covered by the definition of "service fee" contained in Article III, Section 26(b) of the Rules of Fair Practice of the National Association of Securities Dealers, Inc., which provides that service fees shall mean payments by an investment company for personal service and/or

What are expense details?

An expense report is a form that allows you to capture the essential details of a business purchase. It includes expenses such as purchases, budgets, and the cost of employees traveling as part of their roles. This ensures organizations can track their expenditures, taxes and returns accurately.

What is the meaning of expenses in English?

a. : financial burden or outlay : cost. built the monument at their own expense. b. : an item of business outlay chargeable against revenue for a specific period.

What are the four types of expenses?

A service charge is a fee collected to pay for services related to the primary product or service being purchased. The charge is usually added at the time of the transaction. Many industries collect service charges, including restaurants, banking, and travel and tourism.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is DETAIL OF SERVICES AND EXPENSES?

DETAIL OF SERVICES AND EXPENSES is a document or form used to itemize and provide detailed descriptions of services rendered and expenses incurred, typically for financial reporting or tax purposes.

Who is required to file DETAIL OF SERVICES AND EXPENSES?

Individuals or organizations that provide services and incur expenses that need to be reported for financial accountability or regulatory compliance are typically required to file DETAIL OF SERVICES AND EXPENSES.

How to fill out DETAIL OF SERVICES AND EXPENSES?

To fill out DETAIL OF SERVICES AND EXPENSES, one must accurately list all services provided along with associated expenses, including dates, amounts, and descriptions, ensuring that each entry is clear and properly documented.

What is the purpose of DETAIL OF SERVICES AND EXPENSES?

The purpose of DETAIL OF SERVICES AND EXPENSES is to provide transparency and accountability in financial reporting, making it easier to track services rendered and expenses, which is essential for audits and compliance.

What information must be reported on DETAIL OF SERVICES AND EXPENSES?

The information that must be reported on DETAIL OF SERVICES AND EXPENSES includes the date of service, description of services provided, the amount charged for each service, and any related expenses.

Fill out your detail of services and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Detail Of Services And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.