Get the free Charities, Non-Profits & Fundraisers FAQsNew York State ...

Show details

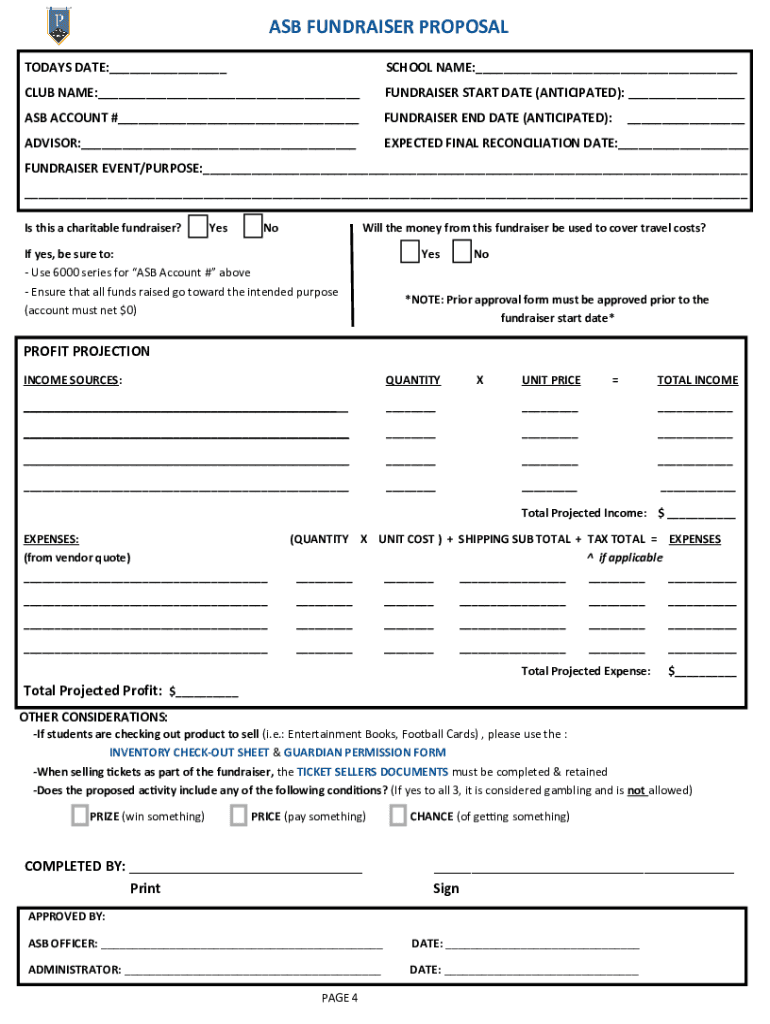

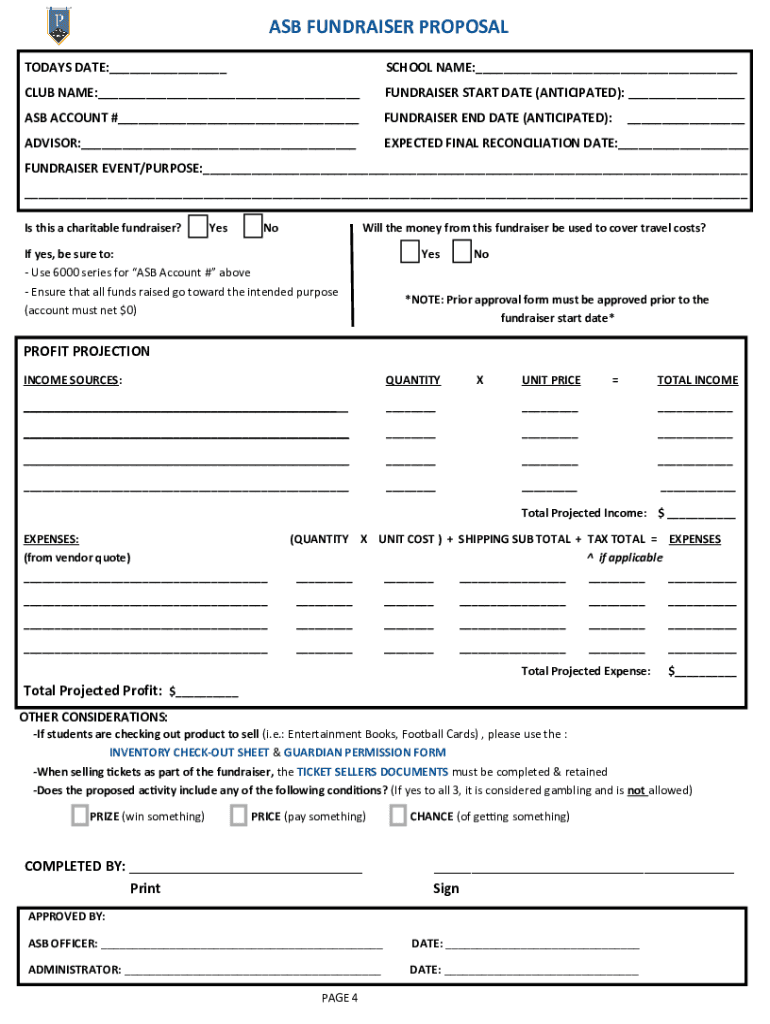

Fundraising Survival GuideBefore you start a fundraiser You must have received fundraising training by the Finance Department or your school administrationVisit our website to access the full ASB

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charities non-profits amp fundraisers

Edit your charities non-profits amp fundraisers form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charities non-profits amp fundraisers form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit charities non-profits amp fundraisers online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit charities non-profits amp fundraisers. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charities non-profits amp fundraisers

How to fill out charities non-profits amp fundraisers

01

To fill out charities, non-profits & fundraisers, follow these steps:

02

Research and identify the charities, non-profits, or fundraisers you want to support. Choose organizations that align with your values or causes you are passionate about.

03

Visit the organization's website or contact them directly to gather information about their mission, programs, and impact.

04

Understand the various ways you can contribute, such as making a monetary donation, volunteering your time, or organizing a fundraising event.

05

Determine the amount or level of involvement you are comfortable with. Set a budget for your donation or commit the necessary time for volunteering.

06

Fill out any necessary forms or applications required by the organization. This could include providing personal information, specifying your donation amount, or stating your desired volunteer role.

07

If making a donation, choose the payment method that suits you best. This can be through online platforms, direct bank transfers, or mailing a check.

08

Keep a record of your contribution for tax purposes if applicable. Some donations may be tax-deductible, but consult with a tax professional for accurate information.

09

Follow up with the organization to ensure your donation or volunteer commitment has been received and acknowledged.

10

Consider promoting the organization's work within your network to encourage others to get involved or donate.

11

Continuously stay engaged with the organization by attending events, staying updated on their progress, or considering long-term partnerships.

12

Remember, different organizations may have specific guidelines or procedures, so always check their website or contact them for detailed instructions.

Who needs charities non-profits amp fundraisers?

01

Charities, non-profits, and fundraisers are needed by various individuals, communities, and causes. Here is a list of who may benefit from them:

02

- Individuals and families facing financial hardships or health crises who require immediate support.

03

- Underprivileged communities lacking access to basic necessities like food, shelter, education, or healthcare.

04

- Victims of natural disasters or emergencies who need assistance in rebuilding their lives.

05

- Animals in need of rescue, shelter, or medical care.

06

- Research institutions and medical foundations searching for cures and advancements.

07

- Educational institutions lacking necessary resources to provide quality education.

08

- Art and cultural organizations striving to preserve heritage and promote creativity.

09

- Environmental and conservation groups working towards sustainability and protecting ecosystems.

10

Ultimately, anyone who believes in making a positive impact in society can contribute to or benefit from charities, non-profits, and fundraisers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit charities non-profits amp fundraisers from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including charities non-profits amp fundraisers, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send charities non-profits amp fundraisers for eSignature?

When you're ready to share your charities non-profits amp fundraisers, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an electronic signature for signing my charities non-profits amp fundraisers in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your charities non-profits amp fundraisers right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is charities non-profits amp fundraisers?

Charities, non-profits, and fundraisers are organizations that operate for purposes other than making a profit. They typically focus on providing community support, social welfare, education, or other beneficial initiatives.

Who is required to file charities non-profits amp fundraisers?

Organizations that are recognized as charities or non-profits, as well as those that conduct fundraisers, are typically required to file annual reports or tax returns to maintain their tax-exempt status.

How to fill out charities non-profits amp fundraisers?

To fill out the required forms, organizations should gather financial records, details about their activities, and information about their governance. They should ensure all sections are completed accurately and submit them by the required deadline.

What is the purpose of charities non-profits amp fundraisers?

The purpose of charities, non-profits, and fundraisers is to address social issues, support public welfare, and advance a specific mission that benefits the community or society as a whole.

What information must be reported on charities non-profits amp fundraisers?

Organizations must report financial statements, details about their programs and services, governance structure, and any relevant changes in their operations or mission.

Fill out your charities non-profits amp fundraisers online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charities Non-Profits Amp Fundraisers is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.