AL Form CPT 2023 free printable template

Show details

CPT 2023 *230001CP*

FORMAlabama Department of RevenueAlabama Business Privilege Tax Return

and Annual Report

1a Calendar Year (Taxable Year 2023 determination period beginning

and ending 12/31/2022)

1b

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AL Form CPT

Edit your AL Form CPT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AL Form CPT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AL Form CPT online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit AL Form CPT. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AL Form CPT Form Versions

Version

Form Popularity

Fillable & printabley

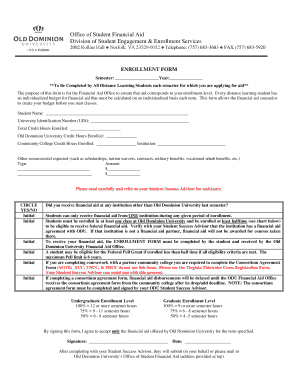

How to fill out AL Form CPT

How to fill out AL Form CPT

01

Obtain AL Form CPT from the official website or relevant authority.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal information, including your name, address, and contact details.

04

Provide necessary details about your employment or internship position.

05

Specify the dates for your CPT authorization period.

06

Collect any required supporting documents (e.g., job offer letter).

07

Review the form for accuracy and completeness.

08

Submit the completed AL Form CPT to the designated office or authority.

Who needs AL Form CPT?

01

Students enrolled in a relevant program who are seeking practical training.

02

International students under F-1 visa status applying for Curricular Practical Training.

03

Individuals who have received a job offer related to their field of study.

Fill

form

: Try Risk Free

People Also Ask about

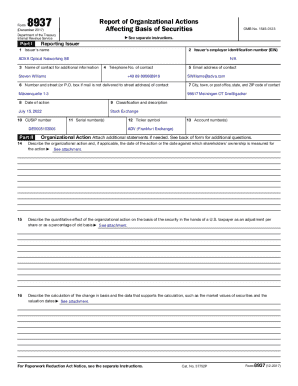

How do I file business privilege tax in Alabama?

How to File Your Alabama Business Privilege Tax Return Find your business entity's due date and determine your filing fees. Download and complete your tax return. File your return and pay your business privilege tax.

How often is Alabama business privilege tax due?

For Limited Liability Entities, the Alabama business privilege tax return is due no later than two and a half months after the beginning of the taxpayer's taxable year. Taxable year 2021 Form PPT would be due on March 15, 2021, for a calendar year limited liability entity.

What is the difference between form 40 and 40A in Alabama?

The purpose of Form 40 is to calculate how much income tax you owe the state. Nonresident filers will complete Alabama Form 40NR. Taxpayers with simple returns have the option to use Form 40A (Short Form). In general, any full-year resident can choose to file Long Form 40 instead of Short Form 40A.

What is a business privilege license Alabama?

A privilege license is a license requirement of every person, firm, company or corporation engaged in any business, vocation, occupation or profession described in Title 40, Chapter 12, Code of Alabama 1975.

What is the threshold for business privilege tax in Alabama?

Minimum Privilege Tax: Section 40-14A-22(c), Code of Alabama 1975, establishes a minimum business privilege tax levy of $100 for S-corporations, LLEs, and disregarded entities – even for business privilege tax years that are short years.

What is the business privilege tax law in Alabama?

Business Privilege Tax Rate The tax rate for business privilege tax is graduated based on the entity's federal taxable income apportioned to Alabama. The rates range from $0.25 to $1.75 for each $1,000 of net worth in Alabama. The minimum business privilege tax is $100.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send AL Form CPT to be eSigned by others?

Once your AL Form CPT is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit AL Form CPT online?

With pdfFiller, the editing process is straightforward. Open your AL Form CPT in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit AL Form CPT on an Android device?

You can make any changes to PDF files, like AL Form CPT, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is AL Form CPT?

AL Form CPT is a specific tax form used in Alabama for filing corporate income tax returns.

Who is required to file AL Form CPT?

Corporations doing business in Alabama or those with income derived from Alabama sources are required to file AL Form CPT.

How to fill out AL Form CPT?

To fill out AL Form CPT, gather financial information, complete the required fields on the form, and ensure accuracy in reporting income and deductions.

What is the purpose of AL Form CPT?

The purpose of AL Form CPT is to report corporate income and calculate the taxes owed to the state of Alabama.

What information must be reported on AL Form CPT?

The information that must be reported on AL Form CPT includes gross income, deductions, credits, tax liability, and other relevant financial data pertaining to the corporation.

Fill out your AL Form CPT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AL Form CPT is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.