AL Form CPT 2024 free printable template

Show details

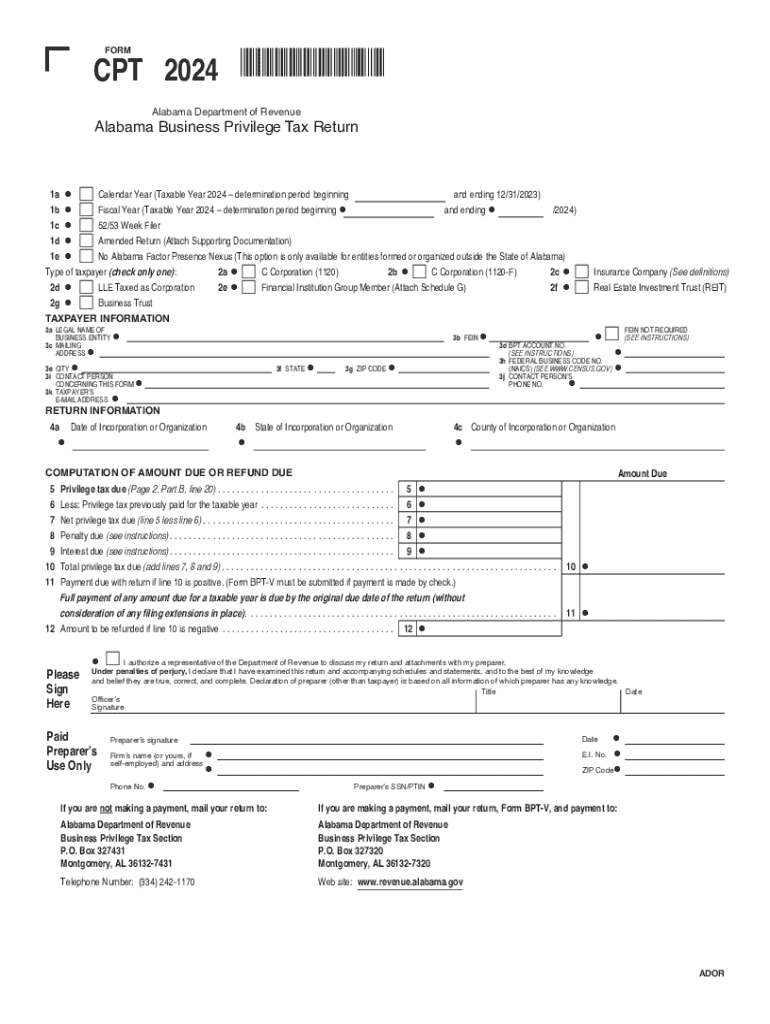

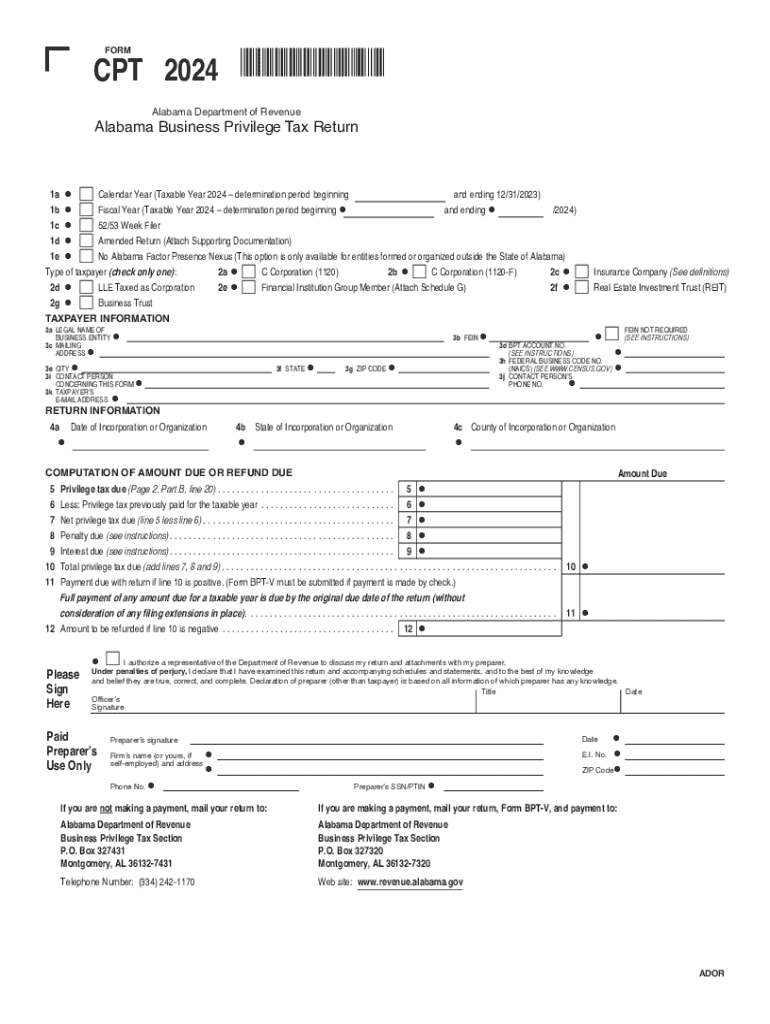

CPT 2024 *240001CP*

FORMAlabama Department of RevenueAlabama Business Privilege Tax Return1a Calendar Year (Taxable Year 2024 determination period beginning

and ending 12/31/2023)

1b Fiscal Year

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign alabama tax return form

Edit your alabama business privilege tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your alabama form cpt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit alabama revenue business privilege tax online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit alabama privilege tax form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AL Form CPT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out alabama privilege tax form

How to fill out AL Form CPT

01

Obtain the AL Form CPT from the appropriate regulatory body or website.

02

Read the instructions carefully to understand what information is required.

03

Fill in your personal information in the designated sections, including full name, address, and contact details.

04

Provide details about your case or purpose for completing the form.

05

Attach any required supporting documentation as outlined in the instructions.

06

Review the completed form for accuracy and completeness.

07

Submit the form by the specified method (online, mail, or in-person) as instructed.

Who needs AL Form CPT?

01

Individuals applying for a specific permit or certification related to their professional or personal activities.

02

Anyone involved in activities that require compliance and reporting as mandated by the regulatory authority.

Fill

al cpt instructions

: Try Risk Free

People Also Ask about alabama business privilege tax return

How do I file business privilege tax in Alabama?

How to File Your Alabama Business Privilege Tax Return Find your business entity's due date and determine your filing fees. Download and complete your tax return. File your return and pay your business privilege tax.

How often is Alabama business privilege tax due?

For Limited Liability Entities, the Alabama business privilege tax return is due no later than two and a half months after the beginning of the taxpayer's taxable year. Taxable year 2021 Form PPT would be due on March 15, 2021, for a calendar year limited liability entity.

What is the difference between form 40 and 40A in Alabama?

The purpose of Form 40 is to calculate how much income tax you owe the state. Nonresident filers will complete Alabama Form 40NR. Taxpayers with simple returns have the option to use Form 40A (Short Form). In general, any full-year resident can choose to file Long Form 40 instead of Short Form 40A.

What is a business privilege license Alabama?

A privilege license is a license requirement of every person, firm, company or corporation engaged in any business, vocation, occupation or profession described in Title 40, Chapter 12, Code of Alabama 1975.

What is the threshold for business privilege tax in Alabama?

Minimum Privilege Tax: Section 40-14A-22(c), Code of Alabama 1975, establishes a minimum business privilege tax levy of $100 for S-corporations, LLEs, and disregarded entities – even for business privilege tax years that are short years.

What is the business privilege tax law in Alabama?

Business Privilege Tax Rate The tax rate for business privilege tax is graduated based on the entity's federal taxable income apportioned to Alabama. The rates range from $0.25 to $1.75 for each $1,000 of net worth in Alabama. The minimum business privilege tax is $100.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get al business privilege tax?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the al cpt in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I execute alabama privilege tax return online?

pdfFiller has made filling out and eSigning al business privilege tax form easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I fill out alabama business annual report using my mobile device?

Use the pdfFiller mobile app to complete and sign ador cpt on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is AL Form CPT?

AL Form CPT, or the Alabama Corporate Partnership Tax form, is a tax return that must be filed by corporations and partnerships operating in Alabama to report their income and calculate their tax liability.

Who is required to file AL Form CPT?

Any corporation or partnership that conducts business in Alabama and meets the state's filing requirements must file AL Form CPT.

How to fill out AL Form CPT?

To fill out AL Form CPT, taxpayers need to provide their business information, income details, deductions, and tax credits based on the specific instructions provided by the Alabama Department of Revenue.

What is the purpose of AL Form CPT?

The purpose of AL Form CPT is to calculate the corporate or partnership income tax due to the state of Alabama based on reported income and applicable deductions.

What information must be reported on AL Form CPT?

AL Form CPT requires reporting of total income, allowable deductions, tax credits, and any other relevant financial information that affects the tax calculation.

Fill out your AL Form CPT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Alabama Business Privilege Return Report is not the form you're looking for?Search for another form here.

Keywords relevant to alabama revenue tax

Related to alabama tax return

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.