Get the free Credit Card Convenience Fees for July 2013 - ftp ci auburn in

Show details

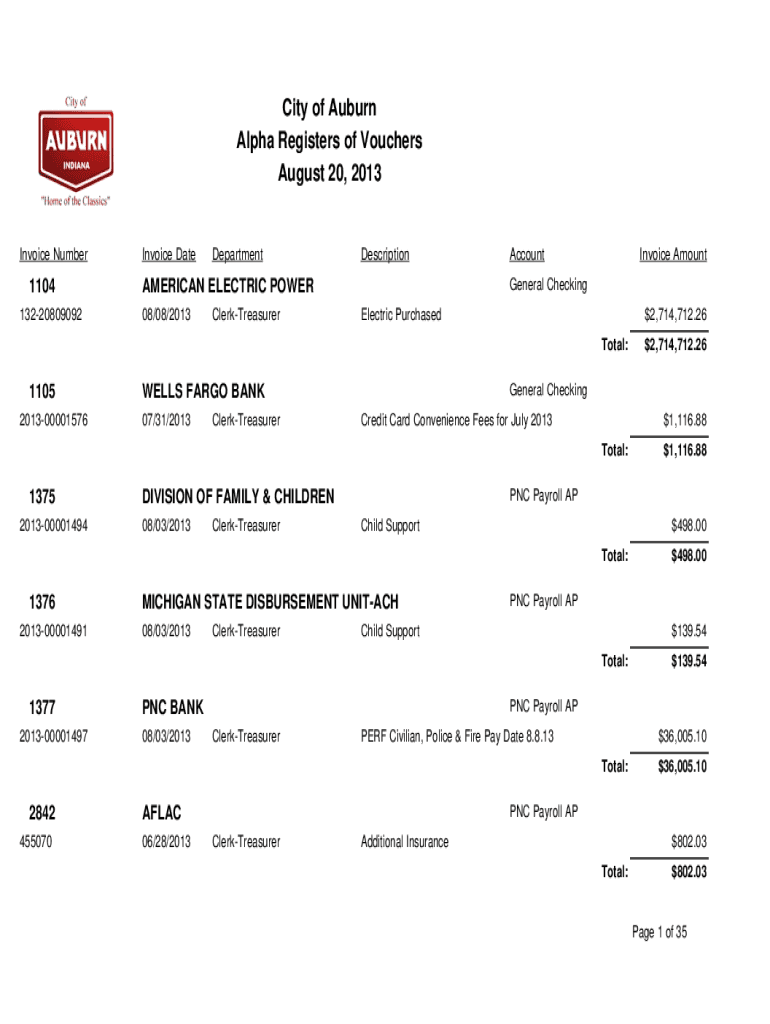

City of Auburn

Alpha Registers of Vouchers

August 20, 2013Invoice Number1104

13220809092Invoice DateDepartmentDescriptionClerkTreasurerInvoice AmountGeneral CheckingAMERICAN ELECTRIC POWER

08/08/2013AccountElectric

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit card convenience fees

Edit your credit card convenience fees form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit card convenience fees form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit card convenience fees online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit card convenience fees. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit card convenience fees

How to fill out credit card convenience fees

01

To fill out credit card convenience fees, follow these steps:

02

Determine the amount of the convenience fee that will be charged to customers for using a credit card for payment.

03

Ensure that your business is legally allowed to charge convenience fees. Familiarize yourself with the laws and regulations regarding convenience fees in your jurisdiction.

04

Update your payment processing system to include the option to charge convenience fees during the checkout process. This may involve working with your payment processor or service provider to enable this feature.

05

Clearly communicate the convenience fee to your customers. Display the fee prominently during the checkout process on your website or point of sale system.

06

Consider offering alternative payment methods that do not incur convenience fees, such as cash or check, to give customers options.

07

Keep track of the convenience fees collected and ensure proper reporting and accounting for these fees.

08

Regularly review and update your convenience fee policy based on any changes in regulations or customer feedback.

Who needs credit card convenience fees?

01

Credit card convenience fees are typically needed by businesses that want to recover the costs associated with credit card processing.

02

Here are some examples of businesses that might need credit card convenience fees:

03

- Small businesses with low profit margins that want to offset transaction fees charged by credit card companies.

04

- Service-oriented businesses, such as utility companies or government agencies, that want to provide convenient payment options while covering the costs of processing credit card payments.

05

- Online businesses that want to offer credit card payment options but also want to discourage customers from using credit cards for small or low-profit purchases.

06

- Businesses that have high-volume credit card transactions and want to minimize the impact of processing fees on their bottom line.

07

Ultimately, the need for credit card convenience fees varies based on the specific business and its financial goals and constraints.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find credit card convenience fees?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific credit card convenience fees and other forms. Find the template you want and tweak it with powerful editing tools.

How do I execute credit card convenience fees online?

pdfFiller makes it easy to finish and sign credit card convenience fees online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an eSignature for the credit card convenience fees in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your credit card convenience fees directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is credit card convenience fees?

Credit card convenience fees are additional charges that businesses may impose on customers who choose to pay with a credit card, primarily to offset the costs of processing these transactions.

Who is required to file credit card convenience fees?

Businesses that charge convenience fees for credit card payments are required to file these fees in accordance with local regulations and guidelines.

How to fill out credit card convenience fees?

To fill out credit card convenience fees, businesses should accurately calculate the fee amount based on the transaction value and ensure compliance with relevant regulations before reporting.

What is the purpose of credit card convenience fees?

The purpose of credit card convenience fees is to help businesses recover the costs associated with processing credit card transactions, such as transaction fees charged by card networks and payment processors.

What information must be reported on credit card convenience fees?

Businesses must report the total convenience fees collected, the related transactions, and relevant customer details as required by local regulations.

Fill out your credit card convenience fees online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Card Convenience Fees is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.