FL RT-83 2023-2025 free printable template

Show details

RT83

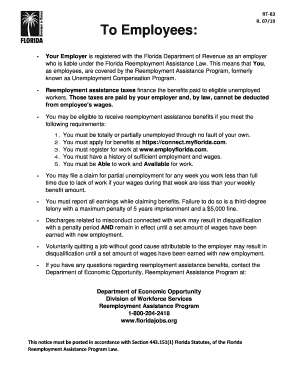

R. 08/23To Employees:

Your Employer is registered with the Florida Department of Revenue as an employer who is

liable under the Florida Reemployment Assistance Law. This means that You, as employees,

are

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign fl rt 83 pdf form

Edit your fl rt83 employees sample form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fl 83 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit florida rt 83 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit florida rt 83 form search. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL RT-83 Form Versions

Version

Form Popularity

Fillable & printabley

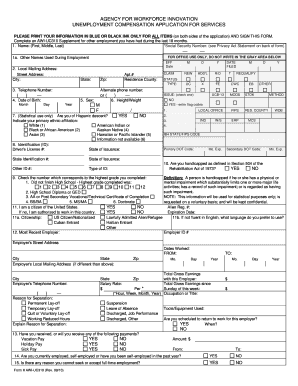

How to fill out unemployment benefits florida form

How to fill out FL RT-83

01

Obtain the FL RT-83 form from the Florida Department of Revenue website or your local office.

02

Review the form instructions to understand what information is required.

03

Fill in the taxpayer identification information at the top of the form accurately.

04

Complete the sections regarding the property details, including the type of property and its location.

05

List any exemptions you are applying for and provide necessary documentation if required.

06

Fill in the income and expense sections if applicable.

07

Double-check all entries for accuracy before submission.

08

Submit the completed FL RT-83 form to the appropriate tax authority by the specified deadline.

Who needs FL RT-83?

01

Property owners who wish to apply for property tax exemptions in Florida.

02

Individuals who have recently acquired property and need to inform the tax authorities.

03

Real estate investors looking to claim specific deductions or exemptions on their properties.

Video instructions and help with filling out and completing unemployment filing florida

Instructions and Help about florida rt 83 form

Fill

florida any unemployment form

: Try Risk Free

People Also Ask about florida rt 83 template

Is Florida paying unemployment 2022?

DUA is available for weeks of unemployment beginning September 25, 2022, until April 1, 2023, as long as the individual's unemployment continues to be a direct result of the disaster. The deadline to submit a claim for DUA benefits is December 30, 2022.

Is unemployment in Florida still giving extra 600?

Under FPUC, eligible individuals received an additional $600 per week for the week beginning March 29, 2020, through the week ending July 25, 2020, and $300 per week for the week beginning December 27, 2020, through the week ending June 26, 2021, in addition to their weekly state Reemployment Assistance or other CARES

How do I apply for unemployment for the first time in Florida?

How to apply for Unemployment Benefits in Florida? If you have been separated from work, you can file your initial claim during your first week of total or partial unemployment. You can file your first claim in one of the two ways: by calling the TeleClaim Center or visiting a One-Stop Career Center close to you.

What will disqualify you from collecting unemployment Florida?

You are receiving unemployment benefits from another state. You made a false or fraudulent misrepresentation to obtain benefits. You are receiving income, such as retirement pay, or severance pay. You are not monetarily eligible (i.e., you do not have enough wages in the base period).

How do I get a Florida unemployment tax form?

Your 1099-G Form will be available in your Reemployment Assistance account inbox no later than January 31. If you chose US mail as your communication method, we will also mail you a copy. If you would like to update your method of communication from the Department, you can do so in your Reemployment Assistance account.

How much unemployment will I get in Florida?

People who are eligible for unemployment in Florida will receive a weekly payment amount between $32 and $275. The maximum length of Florida unemployment benefits is 19 weeks.

How do I get my Florida w2 from unemployment?

Visit the Florida Department of Economic Opportunity's Tax Information webpage to view options for requesting tax documents.

How do I set up unemployment in Florida?

You can register for an account with the DOR either online or on paper. Once registered, you'll be issued a reemployment tax (RT) account number. To register online, use the DOR's online registration website. To register on paper, use Form DR-1, Florida Business Tax Application.

Will Florida Unemployment send me a 1099?

Unemployed Floridians should receive a 1099G tax document from the Florida Department Of Economic Opportunity by the end of the month.

How do I apply for unemployment for the first time in Florida?

All claims in Florida must be completed online. The process should take approximately 30-60 minutes to complete. » File your online unemployment claim.File Your Florida Unemployment Claim Read the Reemployment Assistance FAQs. Email a Reemployment Assistance agent. Call the Reemployment Assistance Hotline: 1-800-204-2418.

How much is unemployment in Florida right now 2022?

Florida Economic Indicators for September 2022 include: Unemployment rate is 2.5 percent, 0.2 percentage point lower than the previous month's rate and 1.0 percentage point below the national rate of 3.5 percent.

What are the requirements to file for unemployment in Florida?

Who is eligible for this program? Unemployed, and. Worked in Florida during the past 12 months (this period may be longer in some cases), and. Earned a minimum amount of wages determined by Florida guidelines, and. Actively seeking work each week you are collecting benefits.

Can I get a copy of my 1099 online?

Get a copy of your Social Security 1099 (SSA-1099) tax form online. Need a replacement copy of your SSA-1099 or SSA-1042S, also known as a Benefit Statement? You can instantly download a printable copy of the tax form by logging in to or creating a free my Social Security account.

Can I file my taxes without my 1099G form?

You are required and responsible for reporting any taxable income you received - including state or local income tax refunds - even if you did not receive Form 1099-G.

What are the requirements for unemployment in Florida?

Your employment for the last 18 months including for each employer: Name, address, and phone number. First and last day of work. Gross earnings (before taxes are taken out) during the listed dates.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute florida rt 83 employees pdf online?

pdfFiller has made filling out and eSigning rt 83 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit fl rt 83 employees form make online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your florida rt83 employees form and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I fill out florida rt 83 pdf using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign florida rt 83 employees form fill. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is FL RT-83?

FL RT-83 is a form used in the state of Florida for reporting certain tax-related information, specifically regarding rental transactions.

Who is required to file FL RT-83?

Entities and individuals engaged in rental activities and liable for the collection and remittance of rental taxes in Florida are required to file FL RT-83.

How to fill out FL RT-83?

To fill out FL RT-83, you need to provide details such as rental income, the period for which the report is made, and any applicable deductions or exemptions. Follow the instructions on the form carefully.

What is the purpose of FL RT-83?

The purpose of FL RT-83 is to ensure compliance with state tax regulations by providing a standardized way for reporting rental income and related tax obligations.

What information must be reported on FL RT-83?

FL RT-83 requires reporting of rental income, the number of rental units, any exemptions, detailed calculations of tax due, and relevant taxpayer information.

Fill out your FL RT-83 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fl 83 Employees Form Online is not the form you're looking for?Search for another form here.

Keywords relevant to florida rt 83 form sample

Related to fl rt 83 form get

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.