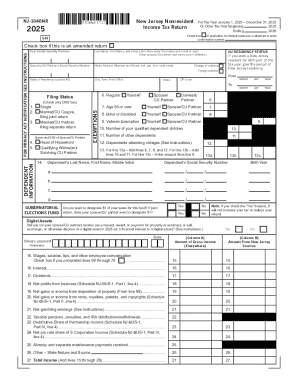

NJ NJ-1040NR 2023 free printable template

Show details

New Jersey Nonresident

Income Tax ReturnNJ1040NR2023For Tax Year January 1, 2023 December 31, 2023

Or Other Tax Year Beginning

, 2023

, 2024

EndingCheck box

if application for federal extension is

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ NJ-1040NR

Edit your NJ NJ-1040NR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ NJ-1040NR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NJ NJ-1040NR online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NJ NJ-1040NR. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ NJ-1040NR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ NJ-1040NR

How to fill out NJ NJ-1040NR

01

Gather all necessary documents, including W-2s, 1099s, and any other income records.

02

Begin filling out your NJ-1040NR form by entering your personal information, such as name, address, and Social Security number.

03

Report your total income, including wages, salaries, and any other sources.

04

Calculate your New Jersey taxable income by applying any deductions or exemptions relevant to your situation.

05

Complete the tax calculations section to determine your tax liability.

06

If applicable, claim any credits to reduce the amount of tax owed.

07

Review your entries for accuracy and completeness.

08

Sign and date the form before submitting it to the New Jersey Division of Taxation.

Who needs NJ NJ-1040NR?

01

Non-residents who earned income in New Jersey during the tax year are required to file the NJ-1040NR.

02

Any individual who is not a resident of New Jersey but has income from New Jersey sources.

03

Individuals who meet the income threshold set by New Jersey for filing state taxes.

Fill

form

: Try Risk Free

People Also Ask about

Can you file New Jersey state taxes online?

New Jersey offers two options for electronically filing state individual income tax returns: the Federal-State Modernized e-File (MeF) program and NJ Online Filing (NJ resident returns only).

Do I need to file 1040NR?

You must file Form 1040-NR, U.S. Nonresident Alien Income Tax Return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Refer to Foreign Students and Scholars for more information.

Do I need to file a NJ nonresident tax return?

A nonresident serviceperson who has income from New Jersey sources such as a civilian job in off-duty hours, income or gain from property located in New Jersey or income from a business, trade or profession carried on in this State must file a New Jersey nonresident return, Form NJ-1040NR.

How do I file my state taxes in New Jersey?

New Jersey State Income Tax Return for Tax Year 2022 (Jan.You have the follow two options to file a NJ tax extension: Pay all or some of your New Jersey income taxes online via: New Jersey Division of Taxation. Complete Form NJ-630, include a Check or Money Order, and mail both to the address on Form NJ-630.

Who must file a NJ non resident tax return?

A nonresident serviceperson who has income from New Jersey sources such as a civilian job in off-duty hours, income or gain from property located in New Jersey or income from a business, trade or profession carried on in this State must file a New Jersey nonresident return, Form NJ-1040NR.

Can I file NJ-1040NR online?

The generic electronic return provides a basis for e-filing the NJ-1040 (Income Tax Resident Return), and the NJ-1040NR (Non-resident Income Tax Return). The NJ-1040 can also be filed as a part year return.

Who is required to file a NJ tax return?

NJ Income Tax – Who Must File your filing status is:and your gross income from everywhere for the entire year was more than the filing threshold:Single Married/CU partner, filing separate return$10,000Married/CU couple, filing joint return head of household, Qualifying widow(er)/surviving CU partner$20,000 May 12, 2021

Who should file 1040NR?

More In Forms and Instructions You may need to file Form 1040-NR if you: Were a nonresident alien engaged in a trade or business in the United States. Represented a deceased person who would have had to file Form 1040-NR. Represented an estate or trust that had to file Form 1040-NR.

What happens if I dont file 1040NR?

If you don't submit IRS Form 1040NR by the due date, you can receive a tax that's 5% of your unpaid taxes for each month that you do not file the necessary form. This penalty maxes out at 25% of your unpaid taxes. The second penalty is known as the failure to pay penalty.

Do I have to file a NJ-1040NR?

If you moved into or out of New Jersey and had New Jersey source income while you were a nonresident of NJ, file a nonresident return (NJ-1040NR) to report your New Jersey source income.

What is form NJ-1040NR?

If New Jersey income tax was erroneously withheld from your military pay, you must file a nonresident return (Form NJ-1040NR) to obtain a refund of the tax withheld.

Who files a NJ-1040NR?

E-file NJ Taxes and Get Your Tax Refund Fast. Form NJ-1040 must be filed by residents who are filing NJ taxes and nonresidents or partial-year residents must file Form NJ-1040NR. New Jersey tax returns can be filed electronically or mailed to the address indicated on the form.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NJ NJ-1040NR from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like NJ NJ-1040NR, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I edit NJ NJ-1040NR on an Android device?

With the pdfFiller Android app, you can edit, sign, and share NJ NJ-1040NR on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

How do I fill out NJ NJ-1040NR on an Android device?

Use the pdfFiller mobile app to complete your NJ NJ-1040NR on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is NJ NJ-1040NR?

NJ NJ-1040NR is a tax form used by non-residents of New Jersey to report income earned in the state and calculate their New Jersey income tax liability.

Who is required to file NJ NJ-1040NR?

Non-residents who earn income in New Jersey, such as wages, interest, dividends, or other sources, are required to file NJ NJ-1040NR.

How to fill out NJ NJ-1040NR?

To fill out NJ NJ-1040NR, gather your income information, complete the form by entering your personal details, report your New Jersey income, calculate your tax, and sign the form before submission.

What is the purpose of NJ NJ-1040NR?

The purpose of NJ NJ-1040NR is to assess and collect income tax from individuals who earned income in New Jersey but are not residents of the state.

What information must be reported on NJ NJ-1040NR?

The information that must be reported on NJ NJ-1040NR includes personal identification details, income earned in New Jersey, allowable deductions, and any tax credits claimed.

Fill out your NJ NJ-1040NR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ NJ-1040nr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.