ID Form 40 2023 free printable template

Show details

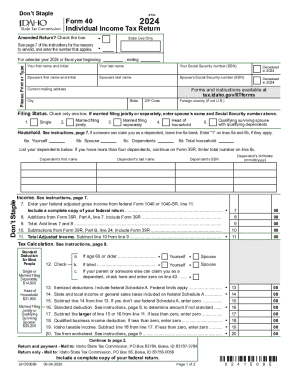

Dont Staple8734Form 40 2023 Individual Income Tax ReturnAmended Return? Check the box. See page 7 of the instructions for the reasons to amend, and enter the number that applies.State Use OnlyPlease

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ID Form 40

Edit your ID Form 40 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ID Form 40 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ID Form 40 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ID Form 40. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ID Form 40 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ID Form 40

How to fill out abcd01-117 - texas sales

01

Obtain the abcd01-117 form from the Texas Comptroller's website or office.

02

Fill in the required information such as your name, address, and tax identification number.

03

Provide details of the sale including the date, description of the items sold, and the total amount of the sale.

04

Sign and date the form before submitting it to the Texas Comptroller's office.

Who needs abcd01-117 - texas sales?

01

Businesses in Texas that engage in selling taxable goods or services need to fill out abcd01-117 - texas sales for reporting sales tax to the state.

Fill

form

: Try Risk Free

People Also Ask about

What is form 40 used for?

Application Form 40 is filled and submitted to the regulatory body to obtain a biological license to import Biological products in India.

Does everyone have to fill out a 10/40 form?

Virtually everybody uses the regular form 1040, but there are also three schedules you may or may not have to tack onto it, depending on your tax situation and whether you want to claim certain deductions and credits. Some people may not have to file any of these schedules.

Where do I find my PA 40 form?

Many forms are available for download on the Internet. Order forms online to be mailed to you. You may call 1-888-PATAXES (1-888-728-2937) to leave a message to have forms mailed to you.

What is the Idaho rebate for 2023?

The IRS announced on February 10, 2023, that taxpayers who received Idaho's tax rebates won't need to report these payments on their 2022 federal income tax returns. Idahoans also don't need to report the rebates on their state income tax returns.

Will I get the Idaho tax rebate?

People who were full-time residents in Idaho and who filed an Idaho tax return or grocery credit reform fund (Form 24) for 2020 and 2021 were eligible for a tax rebate as part of Idaho Gov. Brad Little's bill to direct $500 million of the state's surplus back to taxpayers.

Am I required to file an Idaho tax return?

You must file individual income tax returns with Idaho if you're any of the following: An Idaho resident. A part-year Idaho resident with income from Idaho sources or income earned while an Idaho resident. A nonresident of Idaho with income from Idaho sources.

What form do I use for estimated tax payments in Idaho?

Use Form 51 to calculate any payment due for a valid tax year 2022 extension or make estimated payments for tax year 2023 (check the appropriate year on the form). You can also use Form 51 to make payments of Qualified Investment Exemption (QIE) recapture when you don't file your income tax return by the due date.

What is a form 40 Idaho?

If you need to change or amend an accepted Idaho State Income Tax Return for the current or previous Tax Year, you need to complete Form 40 (residents) or Form 43 (nonresidents and part-year residents). Forms 40 and 43 are Forms used for the Tax Amendment.

What is the Idaho state tax rebate for 2023?

The IRS announced on February 10, 2023, that taxpayers who received Idaho's tax rebates won't need to report these payments on their 2022 federal income tax returns. Idahoans also don't need to report the rebates on their state income tax returns.

What is a form 40?

2021 Form OR-40, Oregon Individual Income Tax Return for Full-year Residents, 150-101-040.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ID Form 40 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including ID Form 40. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send ID Form 40 to be eSigned by others?

To distribute your ID Form 40, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete ID Form 40 on an Android device?

Complete ID Form 40 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is abcd01-117 - texas sales?

abcd01-117 - texas sales is a form used to report sales tax collected in the state of Texas.

Who is required to file abcd01-117 - texas sales?

Businesses operating in Texas that collect sales tax are required to file abcd01-117 - texas sales.

How to fill out abcd01-117 - texas sales?

To fill out abcd01-117 - texas sales, businesses need to report the total amount of sales made and the corresponding amount of sales tax collected.

What is the purpose of abcd01-117 - texas sales?

The purpose of abcd01-117 - texas sales is to report the sales tax collected by businesses in Texas.

What information must be reported on abcd01-117 - texas sales?

On abcd01-117 - texas sales, businesses must report the total amount of sales made and the total amount of sales tax collected.

Fill out your ID Form 40 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ID Form 40 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.