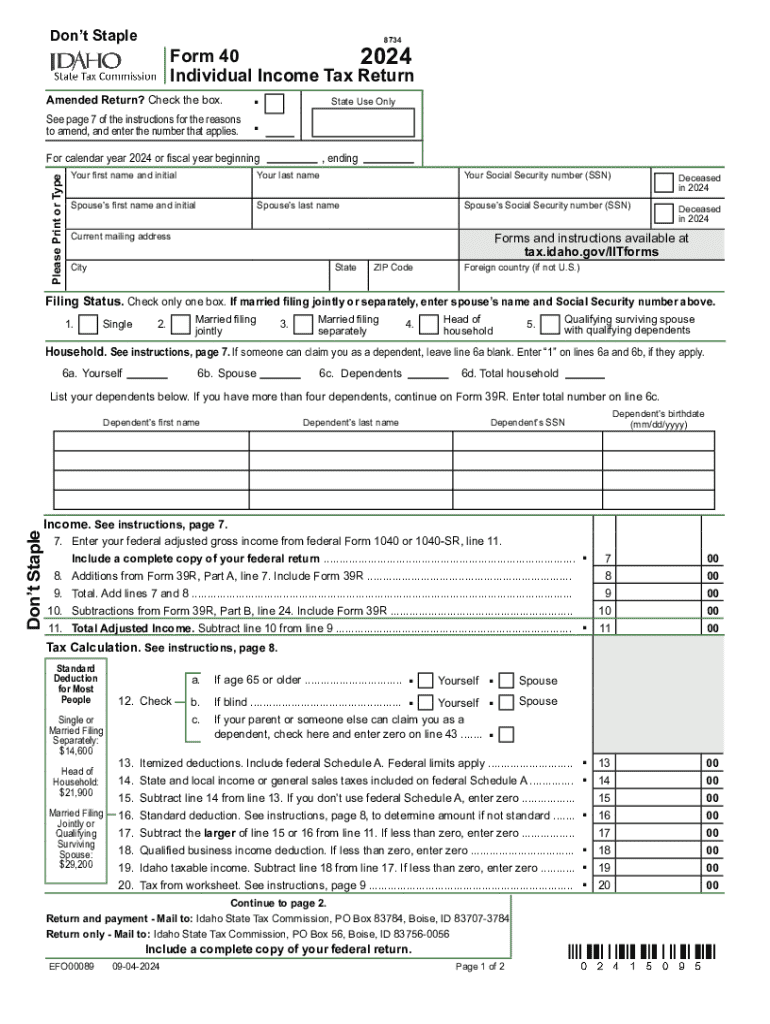

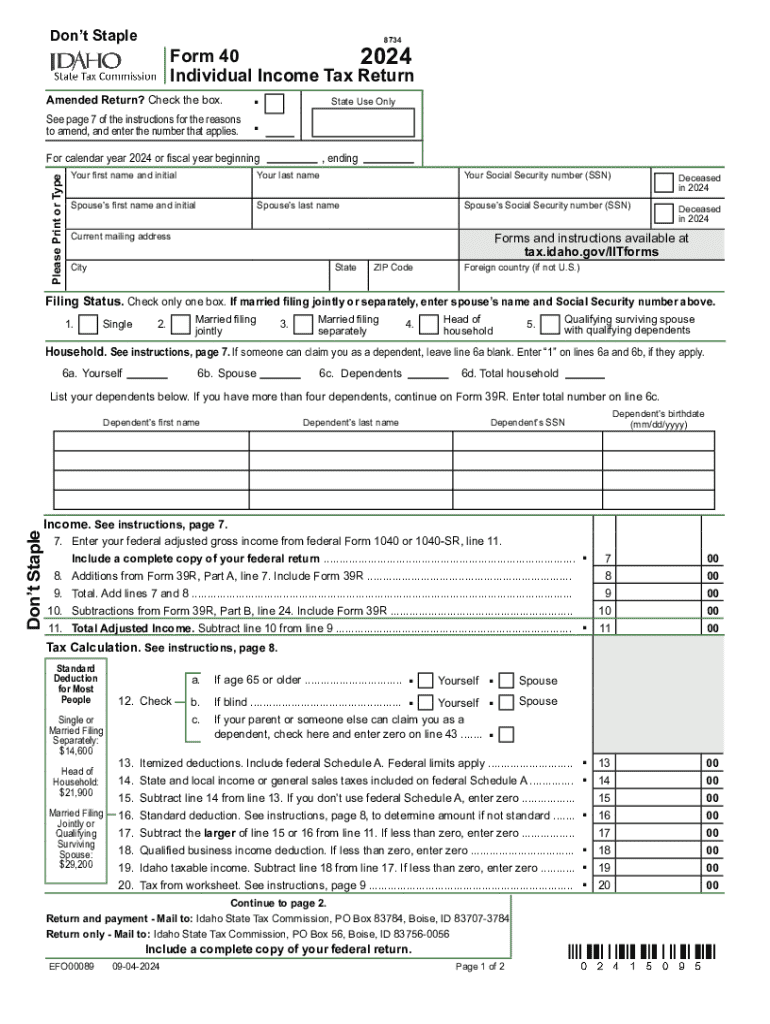

ID Form 40 2024-2025 free printable template

Get, Create, Make and Sign idaho individual income tax

How to edit idaho individual income tax online

Uncompromising security for your PDF editing and eSignature needs

ID Form 40 Form Versions

Your Comprehensive Guide to Tax Idaho Form

Understanding the tax idaho form

The Tax Idaho Form is a crucial document used by residents and businesses in Idaho for reporting income and calculating taxes owed to the state. Each year, taxpayers must navigate a structured process involving various forms designed to capture different types of income and expenses accurately. Completing the correct form not only ensures compliance with state tax regulations but also maximizes potential refunds and minimizes liabilities.

It's essential to be aware of the various deadlines associated with the Idaho Tax Form submissions. Typically, individual tax returns are due on April 15th, while corporate returns may follow different timelines. Staying informed about these deadlines helps taxpayers avoid penalties and interest charges, ensuring a smooth tax season.

Types of tax forms available in idaho

Idaho residents and businesses have access to several different tax forms, tailored to meet specific filing conditions. The primary forms include:

In addition to these essential forms, there are others designed for specific situations, such as non-residents and individuals seeking exemptions. Understanding the purpose and requirements of each form is vital for proper tax filing.

Key steps for filling out the idaho tax form

Navigating the Idaho Tax Form can seem daunting, but breaking down the process into key steps makes it manageable. Here’s how to ensure accurate completion:

Each step is crucial, so take your time to double-check entries and calculations to prevent common errors that could lead to tax complications.

Interactive tools to simplify your tax filing

Utilizing technology can significantly streamline the tax filing process. Tools like pdfFiller offer interactive features that transform how you complete your Idaho Tax Form. For instance, using templates can save you time and ensure that your forms are correctly formatted from the start.

Additionally, pdfFiller's e-signature tools enable faster processing, allowing you to sign your forms digitally without the hassles of printing and scanning. These features also support collaboration, making it easier for teams and families filing together to manage their documents securely in one place.

Submitting your idaho tax form

The submission of your Idaho Tax Form can be done through two primary methods: e-filing and paper filing. Each has its advantages. E-filing is typically faster, often results in quicker refunds, and allows for real-time tracking of your submission status. Conversely, paper filing may be preferred by those who like to maintain physical records.

If you choose to e-file your Idaho Tax Form via pdfFiller, follow the clear guidelines provided by the platform. After submission, it’s important to confirm submission status through the Idaho State Tax Commission's website to ensure your form has been received and accepted.

Managing your tax documents efficiently

Efficient management of your tax documents is vital, not only during tax season but throughout the year. Best practices include organizing your files by category (income, deductions, and credits) and storing them in a secure cloud-based system. Tools like pdfFiller can revolutionize this process by offering features tailored for tax-related documents.

Beyond organization, security is paramount. Always ensure your sensitive information is protected, utilizing encrypted storage solutions. By managing your documents properly, you safeguard yourself against potential audits and future complications.

Resources for additional support

Should you encounter complexities while navigating the Idaho Tax Form, numerous resources are available to assist you. The Idaho State Tax Commission offers comprehensive support via their helpline. Furthermore, accessing online forums can provide valuable insights and shared experiences from fellow taxpayers.

Additionally, utilizing dedicated support services can enhance your understanding of Idaho tax laws and regulations, ensuring compliance and optimization of your tax situation.

Frequently asked questions (faqs)

Taxpayers often have questions that arise during the filing process. Some common queries include understanding eligibility for different deductions, what to do if you miss a filing deadline, and how to handle errors post-filing.

Also, many seek clarity on the distinctions between state and federal forms. Addressing these FAQs helps taxpayers navigate potential stumbling blocks, ensuring a smoother tax experience.

Related forms and guides for comprehensive filing

In addition to the standard Idaho Tax Form, it’s essential to be aware of other related forms that may apply to your unique financial situation. For instance, businesses may need to file supplementary documents such as the Idaho Business Property Tax Declaration.

Accessing these additional resources can make the difference between a straightforward filing experience and a cumbersome one. Ensure to explore links to guides and forms that provide insight into various tax obligations, including property and business taxes.

Stay updated with tax regulations

Tax regulations can change, impacting your filing process significantly. Keeping abreast of changes in Idaho tax laws is crucial for compliance and optimizing your tax strategy. Utilizing subscriptions to credible tax news sources or blogs can ensure you remain informed.

By proactively engaging with updates in the tax landscape, you can navigate your tax obligations effectively and safeguard against potential pitfalls.

People Also Ask about

What is form 40 used for?

Does everyone have to fill out a 10/40 form?

Where do I find my PA 40 form?

What is the Idaho rebate for 2023?

Will I get the Idaho tax rebate?

Am I required to file an Idaho tax return?

What form do I use for estimated tax payments in Idaho?

What is a form 40 Idaho?

What is the Idaho state tax rebate for 2023?

What is a form 40?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my idaho individual income tax in Gmail?

How do I make changes in idaho individual income tax?

Can I create an eSignature for the idaho individual income tax in Gmail?

What is form 40?

Who is required to file form 40?

How to fill out form 40?

What is the purpose of form 40?

What information must be reported on form 40?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.