OK OTC 512-E 2023 free printable template

Show details

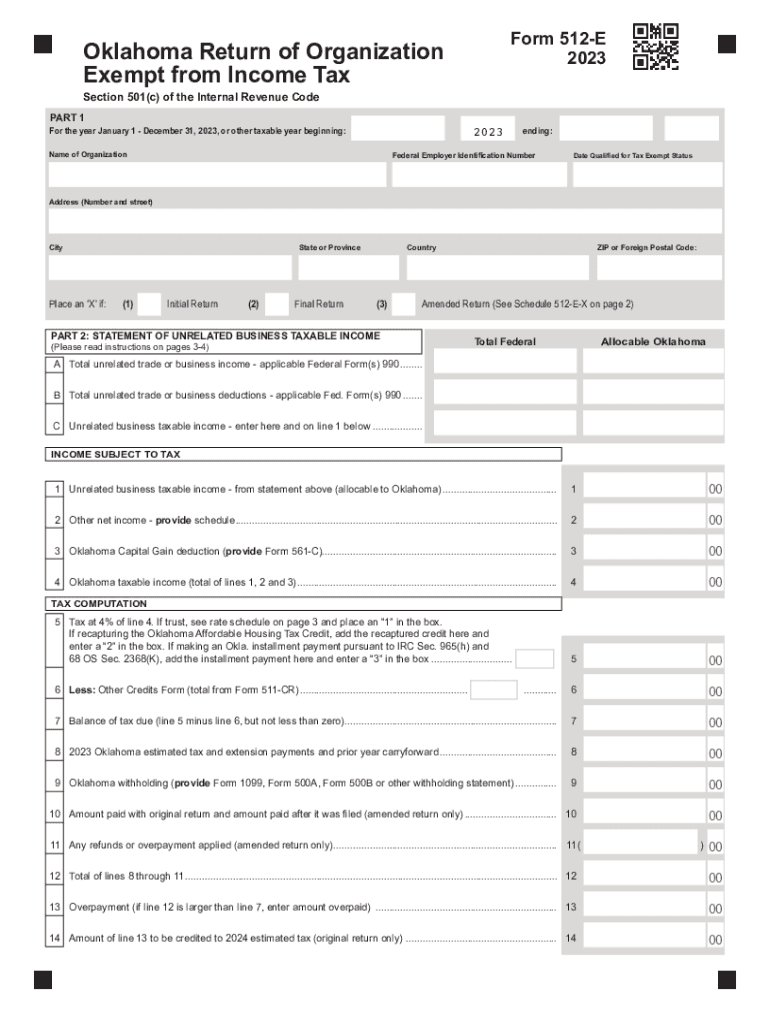

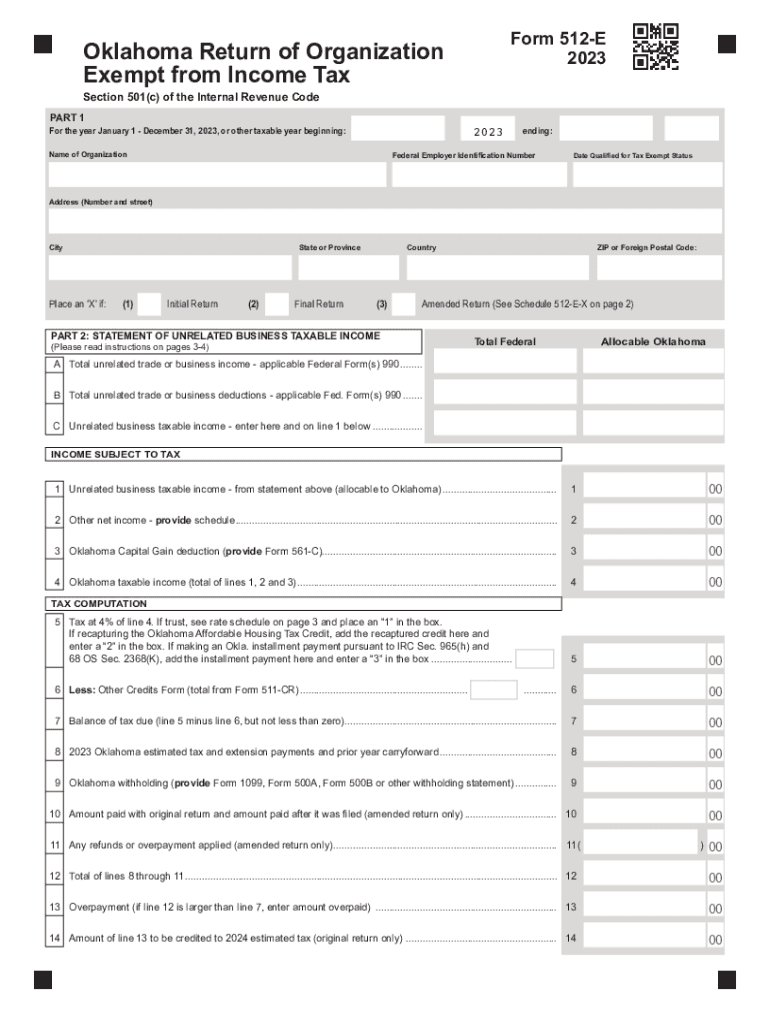

Oklahoma Return of Organization

Exempt from Income TaxForm 512E

2023Section 501(c) of the Internal Revenue Code

PART 1For the year January 1 December 31, 2023, or other taxable year beginning:ending:2023

Name

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 512e tax form

Edit your ok 512e printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oklahoma form 512e form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit oklahoma 512e income online online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ok form 512e download. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK OTC 512-E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out oklahoma return organization print form

How to fill out OK OTC 512-E

01

Obtain the OK OTC 512-E form from the relevant state website or office.

02

Fill in the applicant's details, including name, address, and contact information.

03

Provide information about the specific over-the-counter drugs or products being requested.

04

Indicate the quantity of each item needed.

05

Include any required documentation or proof of eligibility if applicable.

06

Review the form for accuracy and completeness.

07

Submit the form through the designated submission method (mail, online, etc.).

Who needs OK OTC 512-E?

01

Individuals seeking reimbursements for over-the-counter medications.

02

Health care providers submitting claims for patients.

03

Organizations managing health care benefits that include OTC products.

Fill

ok 512e exempt fill

: Try Risk Free

People Also Ask about form 512e organization fill

Do I have to file an Oklahoma state tax return for gambling winnings?

Losses from wagering transactions shall be allowed only to the extent of the gains from such transactions. Whether it's $5 or $5,000 from the track, an office pool, a , or a gambling website, all gambling winnings must be reported on your tax return as "other income" (Form 1040).

Where do I mail my OK form 512e?

Youth and Government Program, Office of the Comptroller, 2500 North Lincoln Boulevard, Room 415, Oklahoma City, OK 73105-4599.

What is an excludable amount of retirement income?

Excludable Income: Income that is not included in the taxpayer's gross income and therefore exempt from federal income tax. Certain income may be exempt from tax but must be reported on the tax return. Form W-4P: Withholding Certificate for Periodic Pension or Annuity Payments.

Is retirement income taxable in Oklahoma?

Oklahoma is tax-friendly toward retirees. Social Security income is not taxed. Withdrawals from retirement accounts are partially taxed. Wages are taxed at normal rates, and your marginal state tax rate is 4.75%.

Do I have to file an Oklahoma extension?

Due Date - Individual Returns - E-filed returns are due April 20. Paper filed returns are due April 15. Extensions - Oklahoma allows an automatic six month extension if no additional tax is due and if a federal extension has been timely filed. A copy of the federal extension must be provided with your Oklahoma return.

What is the retirement exclusion in Oklahoma?

Oklahoma allows for a subtraction on your state return for retirement benefits up to $10,000 but not more than what was included in your federal adjusted gross income. These retirement benefits must have been received from the following and satisfy the requirements of the IRC: Employee pension benefit plan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find ok 512e exempt income?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the oklahoma 512e organization fillable in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I complete ok 512e return blank online?

pdfFiller has made filling out and eSigning oklahoma otc organization blank easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit oklahoma 512e tax fill in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing ok 512e tax fillable and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

What is OK OTC 512-E?

OK OTC 512-E is a form used by certain businesses in Oklahoma to report and pay their taxes related to the sale of over-the-counter (OTC) drugs and medicines.

Who is required to file OK OTC 512-E?

Businesses that sell over-the-counter drugs and medicines in Oklahoma and are subject to sales tax regulations are required to file OK OTC 512-E.

How to fill out OK OTC 512-E?

To fill out OK OTC 512-E, businesses need to provide information such as the total sales of OTC products, the applicable tax rate, and the total tax due. The form typically requires details about the seller, sales figures, and any exemptions.

What is the purpose of OK OTC 512-E?

The purpose of OK OTC 512-E is to ensure that businesses report their sales of OTC drugs and pay the appropriate taxes to the state of Oklahoma.

What information must be reported on OK OTC 512-E?

The form must report information such as the business name, address, total sales of OTC items, applicable tax rate, tax amount collected, and any deductions or exemptions claimed.

Fill out your OK OTC 512-E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oklahoma Form 512e Tax is not the form you're looking for?Search for another form here.

Keywords relevant to 512e return organization income

Related to ok otc 512e

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.