OK OTC 512-E 2021 free printable template

Show details

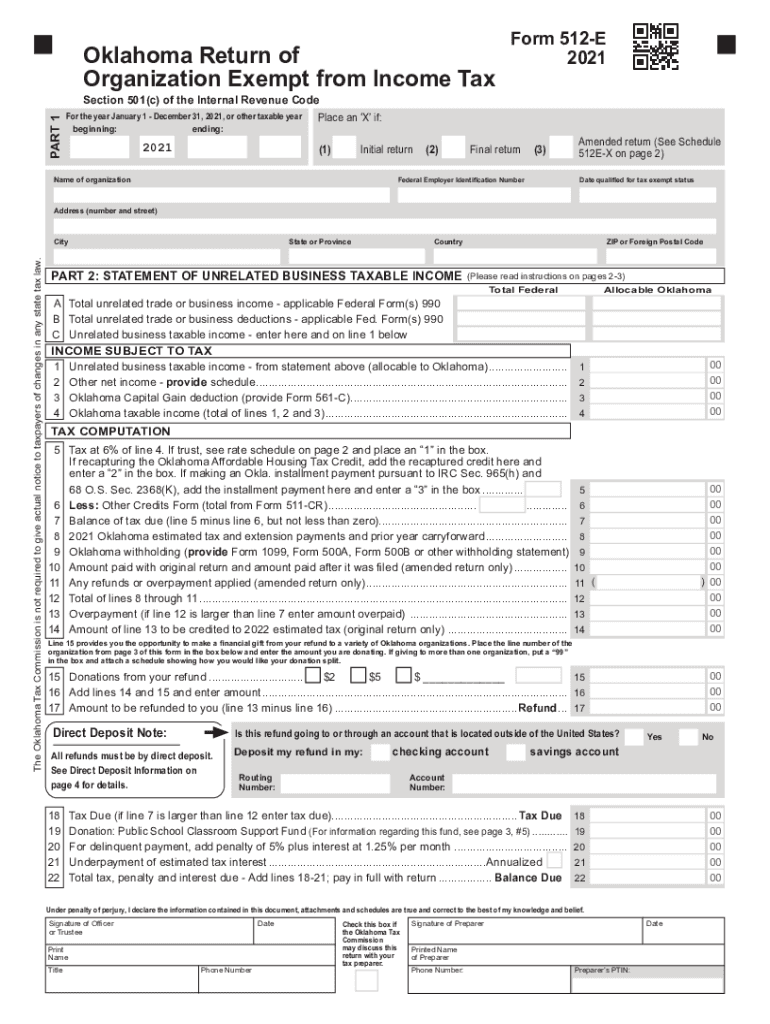

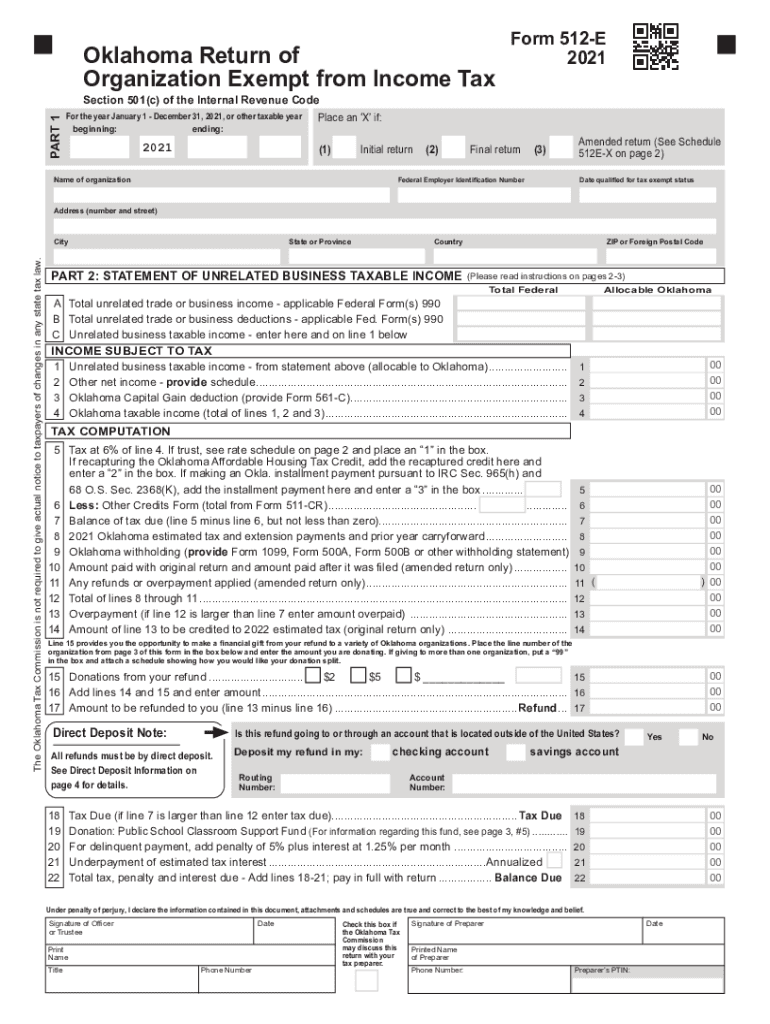

Oklahoma Return of

Organization Exempt from Income Reinform 512E

2021PART 1Section 501(c) of the Internal Revenue Code

For the year January 1 December 31, 2021, or other taxable year

beginning:

ending:2021Place

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OK OTC 512-E

Edit your OK OTC 512-E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OK OTC 512-E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OK OTC 512-E online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit OK OTC 512-E. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK OTC 512-E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OK OTC 512-E

How to fill out OK OTC 512-E

01

Obtain the OK OTC 512-E form from the relevant state agency or their website.

02

Fill out the applicant's full name and address in the designated fields.

03

Provide information about the type of over-the-counter medication being requested.

04

Complete any required information regarding the prescribing physician, including name and contact details.

05

Indicate the quantity of medication needed and any specific instructions if applicable.

06

Review the filled form for accuracy and completeness.

07

Sign and date the form at the bottom where indicated.

08

Submit the completed form to the appropriate state agency, along with any required documentation.

Who needs OK OTC 512-E?

01

Individuals seeking to obtain over-the-counter medications that require state approval.

02

Healthcare providers who need to prescribe non-prescription medications under specific circumstances.

03

Pharmacies that need to process requests for OTC medications requiring formal documentation.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to file an Oklahoma state tax return for gambling winnings?

Losses from wagering transactions shall be allowed only to the extent of the gains from such transactions. Whether it's $5 or $5,000 from the track, an office pool, a , or a gambling website, all gambling winnings must be reported on your tax return as "other income" (Form 1040).

Where do I mail my OK form 512e?

Youth and Government Program, Office of the Comptroller, 2500 North Lincoln Boulevard, Room 415, Oklahoma City, OK 73105-4599.

What is an excludable amount of retirement income?

Excludable Income: Income that is not included in the taxpayer's gross income and therefore exempt from federal income tax. Certain income may be exempt from tax but must be reported on the tax return. Form W-4P: Withholding Certificate for Periodic Pension or Annuity Payments.

Is retirement income taxable in Oklahoma?

Oklahoma is tax-friendly toward retirees. Social Security income is not taxed. Withdrawals from retirement accounts are partially taxed. Wages are taxed at normal rates, and your marginal state tax rate is 4.75%.

Do I have to file an Oklahoma extension?

Due Date - Individual Returns - E-filed returns are due April 20. Paper filed returns are due April 15. Extensions - Oklahoma allows an automatic six month extension if no additional tax is due and if a federal extension has been timely filed. A copy of the federal extension must be provided with your Oklahoma return.

What is the retirement exclusion in Oklahoma?

Oklahoma allows for a subtraction on your state return for retirement benefits up to $10,000 but not more than what was included in your federal adjusted gross income. These retirement benefits must have been received from the following and satisfy the requirements of the IRC: Employee pension benefit plan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out OK OTC 512-E using my mobile device?

Use the pdfFiller mobile app to fill out and sign OK OTC 512-E on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit OK OTC 512-E on an iOS device?

Create, modify, and share OK OTC 512-E using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I complete OK OTC 512-E on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your OK OTC 512-E. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is OK OTC 512-E?

OK OTC 512-E is a tax form used in Oklahoma for reporting certain transactions involving cigarette tax and other applicable tobacco products.

Who is required to file OK OTC 512-E?

Entities that manufacture, distribute, or sell tobacco products in Oklahoma are required to file OK OTC 512-E.

How to fill out OK OTC 512-E?

To fill out OK OTC 512-E, provide the necessary taxpayer identification information, detail the quantities and types of tobacco products involved, and calculate the tax owed before submitting it to the appropriate Oklahoma tax authority.

What is the purpose of OK OTC 512-E?

The purpose of OK OTC 512-E is to ensure proper reporting and collection of tobacco taxes within the state of Oklahoma to comply with tax regulations.

What information must be reported on OK OTC 512-E?

OK OTC 512-E requires reporting of the taxpayer's identification, types and quantities of tobacco products sold or distributed, and the total amount of tax liability incurred during the reporting period.

Fill out your OK OTC 512-E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OK OTC 512-E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.