UT TC-90CB 2023 free printable template

Show details

Clear form

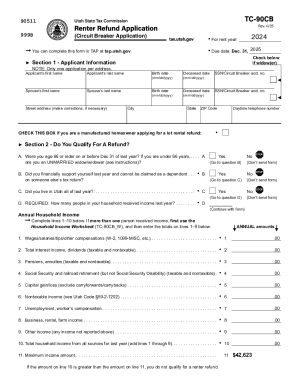

90511

9998

(Circuit Breaker Application) For rent year: Due date: Dec. 31, 2023ORIGINAL

FORM

USTC

You can

complete this form in TAP at tap.utah.gov.Check below

if widow(er)Section

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT TC-90CB

Edit your UT TC-90CB form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT TC-90CB form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UT TC-90CB online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit UT TC-90CB. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-90CB Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT TC-90CB

How to fill out UT TC-90CB

01

Obtain the UT TC-90CB form from the appropriate state agency or download it from their website.

02

Carefully read the instructions provided with the form to ensure understanding of the requirements.

03

Fill out the personal information section, including your name, address, and contact details.

04

Complete the vehicle information section, providing details such as the vehicle identification number (VIN), make, model, and year.

05

Indicate the purpose of the application, whether it's for registration, title transfer, or another reason.

06

Review the completed form for accuracy and completeness before submitting.

07

Sign and date the form where indicated.

08

Submit the form either online, by mail, or in person, following the guidelines provided by the state agency.

Who needs UT TC-90CB?

01

Individuals or businesses looking to register a vehicle in the state.

02

Anyone who is transferring the title of a vehicle.

03

People who are applying for a duplicate title or registration.

04

Individuals who have purchased a vehicle from a dealer or private seller.

Fill

form

: Try Risk Free

People Also Ask about

Does Utah have rent credit?

Utah provides financial relief to qualified renters for the property taxes they pay indirectly to the landlord through their monthly rent. The renter refund applies to both renters and to manufactured homeowners who rent their lots. Who is eligible to receive it?

Is there a Utah w4 form?

Is there a Utah w4 form? All new employees for your business must complete a federal Form W-4. Unlike many other states, Utah does not have a separate state equivalent to Form W-4, but instead relies on the federal form.

What is Utah taxpayer tax credit?

Utah taxpayers may qualify for the taxpayer tax credit. The credit is worth 6% of either your federal standard deduction or itemized deduction (less state taxes paid).

Does Utah require a state tax form?

ing to Utah Instructions for Form TC-40, you must file a Utah income tax return if: You were a resident or part year resident of Utah that must file a federal return.

Is there a Utah withholding form?

Employers must file online using form TC-941E.

What is the circuit breaker refund in Utah?

What is Circuit Breaker – Renter Refund? Utah code provides general relief to qualifying senior citizens, or a surviving spouse, who have income below statutorily mandated levels. The renter refund applies to both renters and manufactured homeowners who rent lots.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit UT TC-90CB from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like UT TC-90CB, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I create an electronic signature for signing my UT TC-90CB in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your UT TC-90CB and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Can I edit UT TC-90CB on an Android device?

With the pdfFiller Android app, you can edit, sign, and share UT TC-90CB on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is UT TC-90CB?

UT TC-90CB is a tax form used in Utah for reporting certain business or financial information, specifically related to tax credits and deductions.

Who is required to file UT TC-90CB?

Businesses and individuals in Utah who are claiming specific tax credits or deductions under state tax law are required to file UT TC-90CB.

How to fill out UT TC-90CB?

To fill out UT TC-90CB, you must provide relevant financial information, claim amounts for the applicable credits, and ensure that all sections are completed accurately according to the instructions provided by the Utah State Tax Commission.

What is the purpose of UT TC-90CB?

The purpose of UT TC-90CB is to facilitate the reporting and claiming of state tax credits to ensure compliance with Utah tax laws.

What information must be reported on UT TC-90CB?

Information reported on UT TC-90CB typically includes taxpayer identification, details of the claimed credits, amounts, and any other required financial data relevant to the tax credits.

Fill out your UT TC-90CB online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT TC-90cb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.