IN IT-40RNR 2023 free printable template

Show details

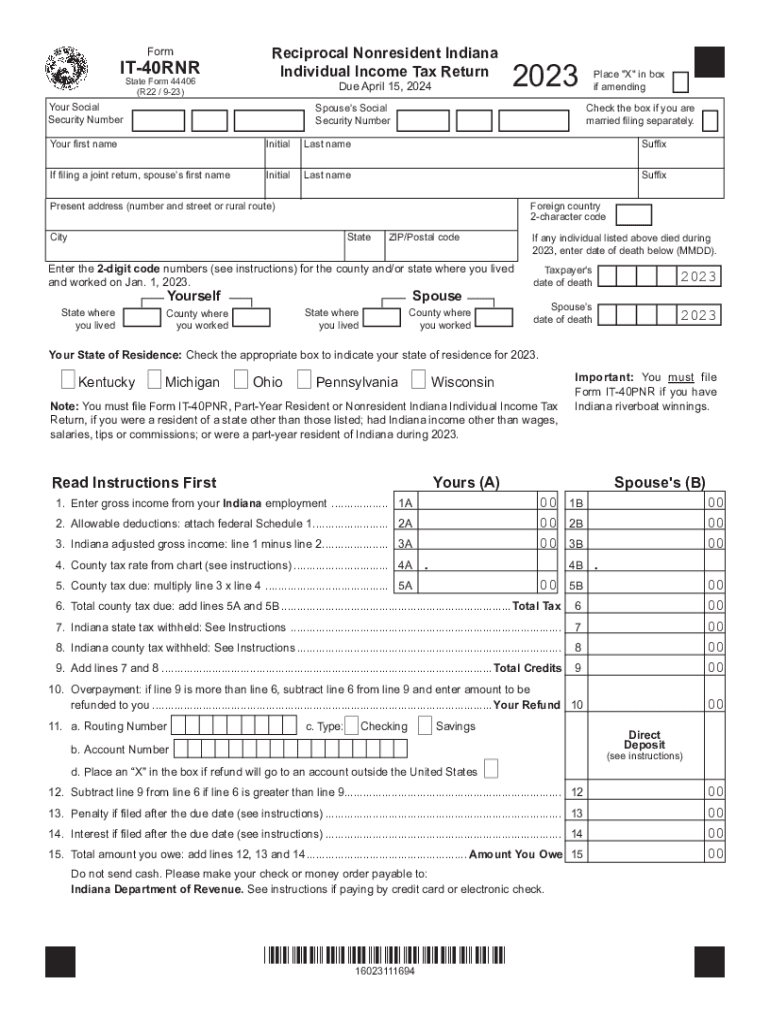

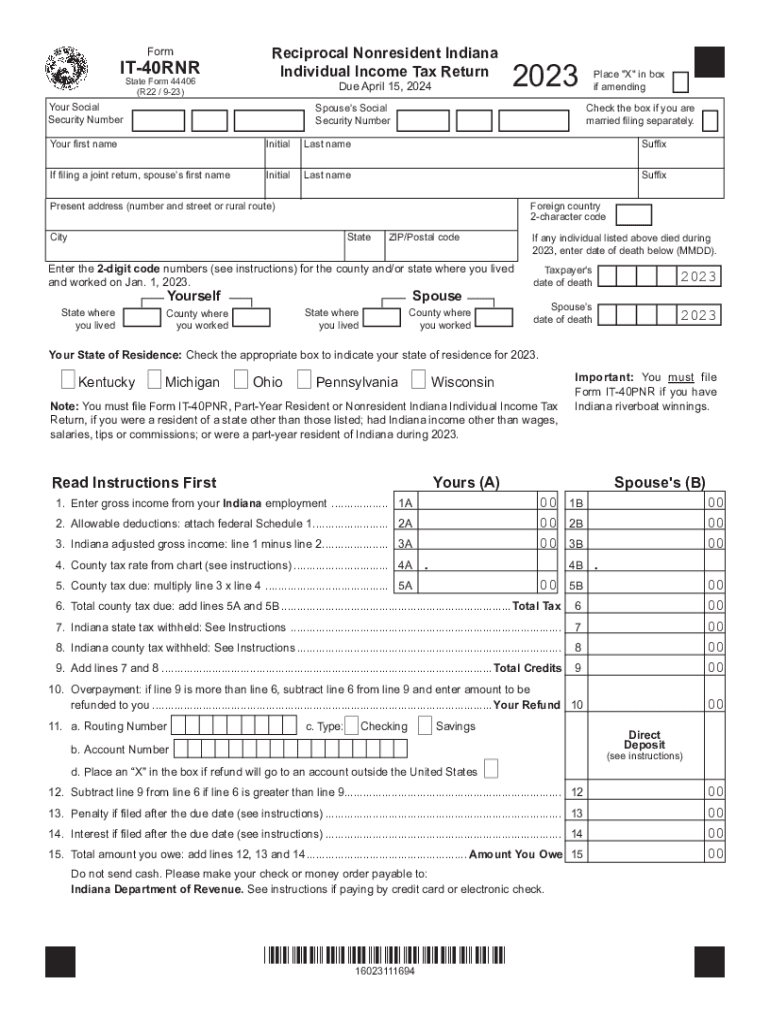

FormIT40RNR

State Form 44406

(R22 / 923)Reciprocal Nonresident Indiana

Individual Income Tax Return

Due April 15, 2024Your Social

Security Number2023Spouses Social

Security NumberPlace "X" in box

if

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign indiana 40rnr reciprocal state create form

Edit your IN IT-40RNR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IN IT-40RNR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IN IT-40RNR online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IN IT-40RNR. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN IT-40RNR Form Versions

Version

Form Popularity

Fillable & printabley

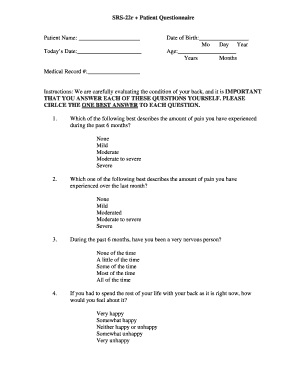

How to fill out IN IT-40RNR

How to fill out IN IT-40RNR

01

Gather all necessary tax documents and information.

02

Obtain the IN IT-40RNR form from the Indiana Department of Revenue website.

03

Fill in your personal information, including name, address, and Social Security number.

04

Report your income by entering the appropriate figures on the income lines.

05

Calculate your deductions and credits according to the guidelines provided.

06

Complete any additional schedules or forms that are required.

07

Review your completed form for accuracy and ensure all necessary signatures are included.

08

Submit the form by mail or electronically, following the submission guidelines.

Who needs IN IT-40RNR?

01

Residents of Indiana who have had their Indiana income taxes withheld but are not required to file a full tax return.

02

Individuals who have minor income and are eligible for a full or partial refund of their state withheld taxes.

03

People with tax credits or special circumstances that warrant a refund of their withheld taxes.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to file an Indiana tax return?

If your taxable income is $2,000 or less, then you're not required to file a tax return with Indiana. If your taxable income is more than $2,000, then you must file a tax return with Indiana.

Do non residents pay Indiana county taxes?

INDIANA NO LONGER HAS SEPARATE COUNTY TAX RATES FOR RESIDENTS AND NON-RESIDENTS. (Indiana county income tax withholding is required even if Indiana state tax is not withheld due to a reciprocity agreement with an adjoining state); and.

What is my income tax for fafsa?

Income tax amount is the total of IRS Form 1040---line 22 minus Schedule 2----line 2. If negative, enter a zero here.

Do non residents pay county tax in Indiana?

If a person resides in an Indiana county on January 1, or resides out-of-state on January 1, but has his or her principal place of work or business in an Indiana county as of January 1, he or she is subject to county tax at the rate corresponding to that Indiana county.

How do I find my income tax?

Whether you owe taxes or you're expecting a refund, you can find out your tax return's status by: Using the IRS Where's My Refund tool. Viewing your IRS account information. Calling the IRS at 1-800-829-1040 (Wait times to speak to a representative may be long.)

What do non residents pay tax on?

Nonresident aliens are generally subject to U.S. income tax only on their U.S. source income. They are subject to two different tax rates, one for effectively connected income, and one for fixed or determinable, annual, or periodic (FDAP) income.

Where do I find the income tax on my 1040?

Where to find income tax on 1040 IRS Form 1040: Subtract line 46 from line 56 and enter the total. IRS Form 1040A: Subtract line 36 from line 28 and enter the total. IRS Form 1040EZ: Use Line 10.

How does county tax work in Indiana?

An individual who lives or works in an Indiana County that has a county tax is subject to county tax. Tax is due to the county where the individual LIVED on January 1 regardless of where he/she worked. No tax will be due to the county where he worked.

Where is income tax located on 1040?

Income tax paid is the total amount of IRS Form 1040-line 13 minus Schedule 2-line 46.

How do I check my income tax?

Step 1: Go to the e-Filing portal homepage. Step 2: Click Income Tax Return (ITR) Status. Step 3: On the Income Tax Return (ITR) Status page, enter your acknowledgement number and a valid mobile number and click Continue. Step 4: Enter the 6-digit OTP received on your mobile number entered in Step 3 and click Submit.

Who is not required to file income tax return?

Assuming there is no other income than salary, if a salaried employee's total income after claiming HRA, LTA tax exemption and standard deduction do not exceed Rs 2.5 lakh in a financial year, then he/she is not required to mandatorily file ITR.”

What happens if you don't file your taxes in Indiana?

Failure to pay tax: 10% of the unpaid tax liability or $5, whichever is greater. This penalty is also imposed on payments which are required to be remitted electronically, but are not. Failure to file a tax return; preparation by Department: 20% penalty.

Do you have to pay local taxes in Indiana?

Larry DeBoer of Purdue University. Hoosiers pay state and local income taxes together, but local revenues are distributed back to counties based on past collections.

How do I download my Income Tax Return?

Step 1: Go to the official income tax filing portal.Filling out the XML File After saving the XML file, log in to the portal and select the “Income tax return” option under the “e-file” tab. Verify the return using e-mail. Verify the return by using an Aadhar OTP or a Net Banking OTP.

What is the minimum income to file taxes in 2022?

Minimum income to file taxes $12,550 if under age 65. $14,250 if age 65 or older.

Is total tax the same as income tax?

Tax credits are available to all qualifying taxpayers, whether they itemize deductions or not. Total tax liability is the amount of federal income tax owed by the taxpayer to the federal government.

How do I figure out my income tax?

Whether you owe taxes or you're expecting a refund, you can find out your tax return's status by: Using the IRS Where's My Refund tool. Viewing your IRS account information. Calling the IRS at 1-800-829-1040 (Wait times to speak to a representative may be long.)

Does Indiana require you to file a tax return?

An Indiana individual income tax return may need to be filed if you lived in Indiana and received income greater than your exemptions or you lived outside Indiana and received income from Indiana.

How do I find my income tax on 1040 without Schedule 2?

If there's no Schedule 2, then you subtract zero, just like if there was a Schedule 2 with nothing but zeroes on it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the IN IT-40RNR in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your IN IT-40RNR and you'll be done in minutes.

How do I edit IN IT-40RNR straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing IN IT-40RNR, you can start right away.

How can I fill out IN IT-40RNR on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your IN IT-40RNR from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is IN IT-40RNR?

IN IT-40RNR is a form used by non-resident individuals to report their Indiana state income tax unless they are qualifying for an exemption.

Who is required to file IN IT-40RNR?

Non-resident individuals who earn income from Indiana sources and meet the state tax filing requirements must file IN IT-40RNR.

How to fill out IN IT-40RNR?

To fill out IN IT-40RNR, gather your income information, complete personal information sections, report Indiana-source income, calculate adjustments, and follow the instructions for deductions and credits, before signing and submitting the form.

What is the purpose of IN IT-40RNR?

The purpose of IN IT-40RNR is to allow non-resident individuals to report income earned in Indiana and to ensure compliance with Indiana state income tax regulations.

What information must be reported on IN IT-40RNR?

The information that must be reported on IN IT-40RNR includes your name, address, Social Security number, Indiana-source income, any exemptions or deductions, and tax credits applicable to your situation.

Fill out your IN IT-40RNR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IN IT-40rnr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.