IN IT-40RNR 2024-2025 free printable template

Show details

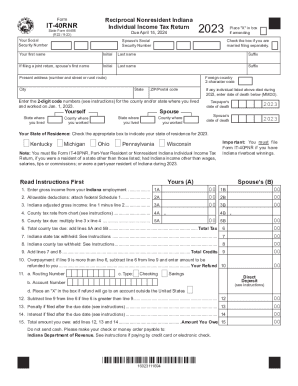

Form IT-40RNR State Form 44406 (R23 / 9-24) Indiana Department of Revenue Reciprocal Nonresident Indiana Individual Income Tax Return Due April 15, 2025 Your Social Security Number 2024 Place \"X\"

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign it 40rnr form

Edit your indiana form it 40rnr form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form it 40rnr form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing it 40rnr form online

Follow the steps below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit indiana it 40rnr 2024-2025. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN IT-40RNR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out indiana it 40rnr 2024-2025

How to fill out IN IT-40RNR

01

Gather all necessary documents, including your federal tax return and any supporting documentation related to your Indiana income tax.

02

Locate the IN IT-40RNR form on the Indiana Department of Revenue website.

03

Begin with your personal information, including your name, address, and Social Security number.

04

Fill out the section regarding your residency status for the tax year.

05

Report your total income and any specific deductions applicable to your situation.

06

Enter the amount of Indiana state tax withheld, if applicable.

07

Complete the calculation sections for any credits or adjustments to your refund.

08

Double-check all entries for accuracy and completeness.

09

Sign and date the form before submission.

10

Submit the completed form to the Indiana Department of Revenue by mail or electronically, if permitted.

Who needs IN IT-40RNR?

01

Residents of Indiana who are not full-time residents but have earned income in the state.

02

Individuals who have income subject to Indiana taxes, but are filing as part-year residents.

03

Taxpayers seeking a refund for any overpaid state tax related to their Indiana income.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to file an Indiana tax return?

If your taxable income is $2,000 or less, then you're not required to file a tax return with Indiana. If your taxable income is more than $2,000, then you must file a tax return with Indiana.

Do non residents pay Indiana county taxes?

INDIANA NO LONGER HAS SEPARATE COUNTY TAX RATES FOR RESIDENTS AND NON-RESIDENTS. (Indiana county income tax withholding is required even if Indiana state tax is not withheld due to a reciprocity agreement with an adjoining state); and.

What is my income tax for fafsa?

Income tax amount is the total of IRS Form 1040---line 22 minus Schedule 2----line 2. If negative, enter a zero here.

Do non residents pay county tax in Indiana?

If a person resides in an Indiana county on January 1, or resides out-of-state on January 1, but has his or her principal place of work or business in an Indiana county as of January 1, he or she is subject to county tax at the rate corresponding to that Indiana county.

How do I find my income tax?

Whether you owe taxes or you're expecting a refund, you can find out your tax return's status by: Using the IRS Where's My Refund tool. Viewing your IRS account information. Calling the IRS at 1-800-829-1040 (Wait times to speak to a representative may be long.)

What do non residents pay tax on?

Nonresident aliens are generally subject to U.S. income tax only on their U.S. source income. They are subject to two different tax rates, one for effectively connected income, and one for fixed or determinable, annual, or periodic (FDAP) income.

Where do I find the income tax on my 1040?

Where to find income tax on 1040 IRS Form 1040: Subtract line 46 from line 56 and enter the total. IRS Form 1040A: Subtract line 36 from line 28 and enter the total. IRS Form 1040EZ: Use Line 10.

How does county tax work in Indiana?

An individual who lives or works in an Indiana County that has a county tax is subject to county tax. Tax is due to the county where the individual LIVED on January 1 regardless of where he/she worked. No tax will be due to the county where he worked.

Where is income tax located on 1040?

Income tax paid is the total amount of IRS Form 1040-line 13 minus Schedule 2-line 46.

How do I check my income tax?

Step 1: Go to the e-Filing portal homepage. Step 2: Click Income Tax Return (ITR) Status. Step 3: On the Income Tax Return (ITR) Status page, enter your acknowledgement number and a valid mobile number and click Continue. Step 4: Enter the 6-digit OTP received on your mobile number entered in Step 3 and click Submit.

Who is not required to file income tax return?

Assuming there is no other income than salary, if a salaried employee's total income after claiming HRA, LTA tax exemption and standard deduction do not exceed Rs 2.5 lakh in a financial year, then he/she is not required to mandatorily file ITR.”

What happens if you don't file your taxes in Indiana?

Failure to pay tax: 10% of the unpaid tax liability or $5, whichever is greater. This penalty is also imposed on payments which are required to be remitted electronically, but are not. Failure to file a tax return; preparation by Department: 20% penalty.

Do you have to pay local taxes in Indiana?

Larry DeBoer of Purdue University. Hoosiers pay state and local income taxes together, but local revenues are distributed back to counties based on past collections.

How do I download my Income Tax Return?

Step 1: Go to the official income tax filing portal.Filling out the XML File After saving the XML file, log in to the portal and select the “Income tax return” option under the “e-file” tab. Verify the return using e-mail. Verify the return by using an Aadhar OTP or a Net Banking OTP.

What is the minimum income to file taxes in 2022?

Minimum income to file taxes $12,550 if under age 65. $14,250 if age 65 or older.

Is total tax the same as income tax?

Tax credits are available to all qualifying taxpayers, whether they itemize deductions or not. Total tax liability is the amount of federal income tax owed by the taxpayer to the federal government.

How do I figure out my income tax?

Whether you owe taxes or you're expecting a refund, you can find out your tax return's status by: Using the IRS Where's My Refund tool. Viewing your IRS account information. Calling the IRS at 1-800-829-1040 (Wait times to speak to a representative may be long.)

Does Indiana require you to file a tax return?

An Indiana individual income tax return may need to be filed if you lived in Indiana and received income greater than your exemptions or you lived outside Indiana and received income from Indiana.

How do I find my income tax on 1040 without Schedule 2?

If there's no Schedule 2, then you subtract zero, just like if there was a Schedule 2 with nothing but zeroes on it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit indiana it 40rnr 2024-2025 in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing indiana it 40rnr 2024-2025 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I fill out indiana it 40rnr 2024-2025 using my mobile device?

Use the pdfFiller mobile app to complete and sign indiana it 40rnr 2024-2025 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How can I fill out indiana it 40rnr 2024-2025 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your indiana it 40rnr 2024-2025, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is IN IT-40RNR?

IN IT-40RNR is the Indiana Individual Income Tax Return for Nonresidents and Part-Year Residents, used to report income earned in Indiana by individuals who do not reside in the state for the entire tax year.

Who is required to file IN IT-40RNR?

Nonresidents and part-year residents of Indiana who have income sourced from Indiana are required to file the IN IT-40RNR form.

How to fill out IN IT-40RNR?

To fill out IN IT-40RNR, taxpayers need to collect income information, determine deductions, complete the form by entering personal and income details, and follow the instructions provided by the Indiana Department of Revenue.

What is the purpose of IN IT-40RNR?

The purpose of IN IT-40RNR is to allow nonresidents and part-year residents to report their Indiana-sourced income and calculate the tax owed to the state.

What information must be reported on IN IT-40RNR?

Information that must be reported on IN IT-40RNR includes the taxpayer's name, address, social security number, details of income earned in Indiana, applicable deductions, and any tax credits.

Fill out your indiana it 40rnr 2024-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indiana It 40rnr 2024-2025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.