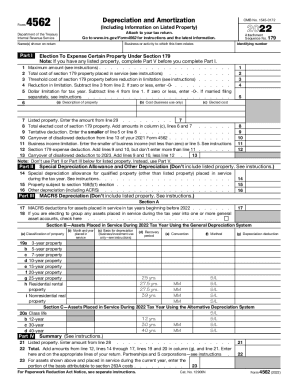

IRS 4562 2023 free printable template

Get, Create, Make and Sign 4562 form

How to edit 4562 form online

Uncompromising security for your PDF editing and eSignature needs

IRS 4562 Form Versions

How to fill out form 4562

How to fill out IRS 4562

Who needs IRS 4562?

Video instructions and help with filling out and completing form 4562

Instructions and Help about form 4562 instructions

I want to quickly talk to you about IRS form 45 62 line by line instructions let's talk about depreciation and amortization rules don't go anywhere so welcome back folks to another edition of the awesome sweetie kiwi show how are you today I hope you are doing fantastic I'm doing marvelous if you already asked me if you are doing as great as I am go grab a cup of coffee or tea or vodka and let's roll in today's conversation I want to talk to you about iris form 4562 line by line instructions depreciation and amortization rules now first let me give you an overview of formula 4562, and we're showing you right now on the screen we're going to show you important worksheets to have and concepts to understand when filing form 4562, so we're showing you right now on the screen the have table a general depreciation system this is for the uh the double uh declining balance the 200 percent this is important to have in mind then you have table b the general depreciation system this is again this is the accelerated depreciation system, so you have 150 percent decline in balance...

People Also Ask about form 4562 for

Is form 4562 required with Form 990?

Who should file form 4562?

Where does depreciation form 4562 go on 1040?

What qualifies for a Section 179 deduction?

Why do I have form 4562?

Do you have to report depreciation?

What is depreciation expense 4562?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the 4562 form in Gmail?

How do I fill out form 4562 using my mobile device?

How can I fill out irs form 4562 on an iOS device?

What is IRS 4562?

Who is required to file IRS 4562?

How to fill out IRS 4562?

What is the purpose of IRS 4562?

What information must be reported on IRS 4562?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.