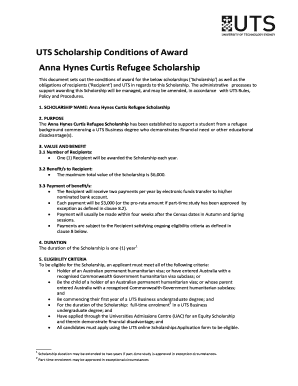

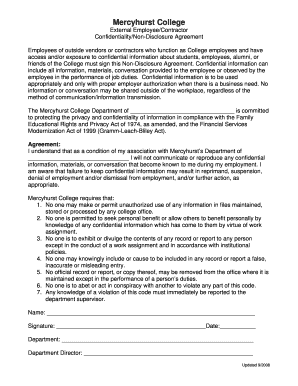

Get the free Independent Contractor or Employee Determination form RSU3 Rev2021a

Show details

Independent Contractor or Employee Determination Form Considering hiring someone for a service? There are 2 major concerns to be recognized:1) Independent Contractor or Employee We must be accurate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign independent contractor or employee

Edit your independent contractor or employee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your independent contractor or employee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing independent contractor or employee online

Follow the guidelines below to benefit from a competent PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit independent contractor or employee. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out independent contractor or employee

How to fill out independent contractor or employee

01

Determine the classification criteria: First, understand the criteria that differentiate an independent contractor from an employee. These criteria generally involve factors such as control over work, payment method, provision of tools and materials, and degree of integration into the company's operations.

02

Identify the worker's relationship: Assess the worker's relationship to the company's business. Consider whether the worker is providing a specific service on a project basis or if they are integrated into the daily operations of the company.

03

Use the appropriate form: Depending on the classification, use the relevant tax forms for reporting the worker's income. For independent contractors, use Form 1099-MISC to report payments. For employees, use Form W-2 to report wages and taxes withheld.

04

Gather the necessary information: Collect all the required information from the worker, including their full name, address, Social Security number or Tax Identification number, and any other necessary details for tax reporting purposes.

05

Fill out the form accurately: Ensure that all the information recorded on the tax form is accurate and complete. Double-check all entries before submitting the form to avoid any errors or discrepancies.

06

Submit the form on time: Be aware of the deadlines for reporting and filing tax forms. Make sure to submit the completed form and provide a copy to the worker before the due date to comply with tax regulations.

07

Maintain proper records: Keep copies of all tax forms and associated documentation for future reference or potential audits. Maintain records of payments made to independent contractors or wages paid to employees for the required period of time.

08

Seek professional guidance if needed: If you have any uncertainties or complex situations regarding the classification or tax reporting process, consult with a tax professional or legal advisor to ensure compliance with applicable laws and regulations.

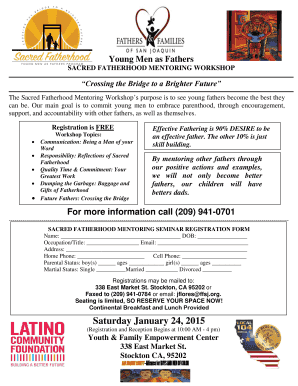

Who needs independent contractor or employee?

01

Businesses in need of specialized services: Independent contractors are often hired for specific projects or tasks that require specialized skills or expertise. Businesses that require these services may opt to utilize independent contractors instead of hiring full-time employees.

02

Companies experiencing fluctuating workloads: If a company's workload varies throughout the year, hiring independent contractors allows them to scale up or down quickly as needed. This provides more flexibility in terms of staffing without the long-term commitment that comes with hiring employees.

03

Startups and small businesses: Startups or small businesses with limited resources may find it more cost-effective to engage independent contractors rather than hiring employees. Independent contractors are typically responsible for their own taxes, benefits, and equipment, reducing the financial burden on the company.

04

Businesses with short-term or project-based needs: When a company has a specific short-term need or project, it may be more efficient to hire an independent contractor for the duration of that project rather than hiring an employee.

05

Companies looking to reduce legal and financial obligations: Independent contractors generally have their own business structure and are responsible for their own taxes and benefits. This reduces the legal and financial obligations that a company would have if they were to hire an employee.

06

Businesses seeking specialized expertise outside their core competencies: Independent contractors often bring specialized skills or knowledge that may not be within the core competencies of a business. Engaging independent contractors allows businesses to access these skills without having to invest in extensive training or hiring additional personnel.

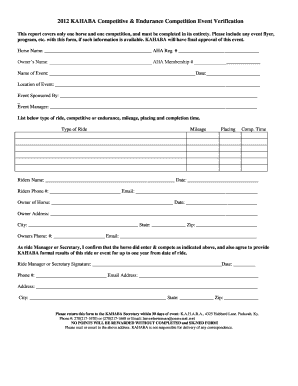

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my independent contractor or employee in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your independent contractor or employee and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I create an eSignature for the independent contractor or employee in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your independent contractor or employee directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit independent contractor or employee straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing independent contractor or employee right away.

What is independent contractor or employee?

An independent contractor is a self-employed individual who provides services to clients under terms specified in a contract, while an employee is someone who works for a company and is subject to its control over work hours, procedures, and compensation.

Who is required to file independent contractor or employee?

Businesses that pay independent contractors $600 or more in a calendar year are required to file specific forms to report those payments. Employees are reported on W-2 forms by employers.

How to fill out independent contractor or employee?

To fill out forms for either category, you need to provide information such as your legal name, Social Security number or Employer Identification Number, address, and the total amount paid to independent contractors during the reporting period.

What is the purpose of independent contractor or employee?

The purpose of distinguishing between independent contractors and employees is to properly classify workers for payroll taxes, labor rights, and benefits, ensuring compliance with tax laws and regulations.

What information must be reported on independent contractor or employee?

For independent contractors, the information required includes the contractor's name, address, taxpayer identification number, and the total amount paid. For employees, the reporting includes wages, taxes withheld, and employee details on the W-2 form.

Fill out your independent contractor or employee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Independent Contractor Or Employee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.