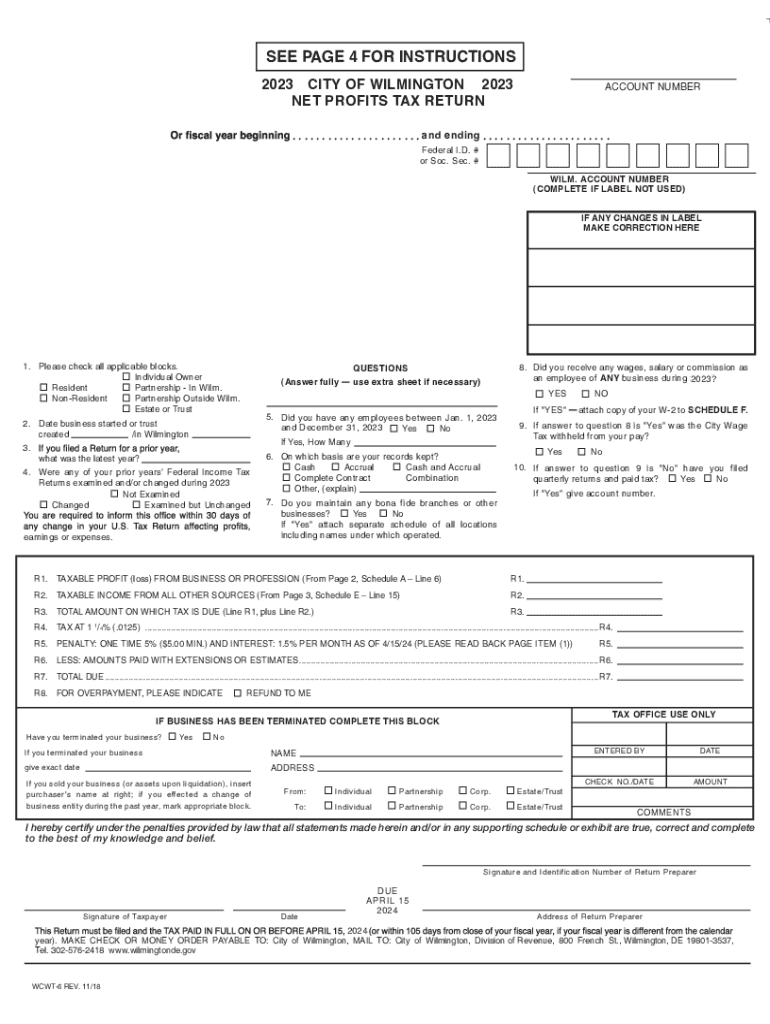

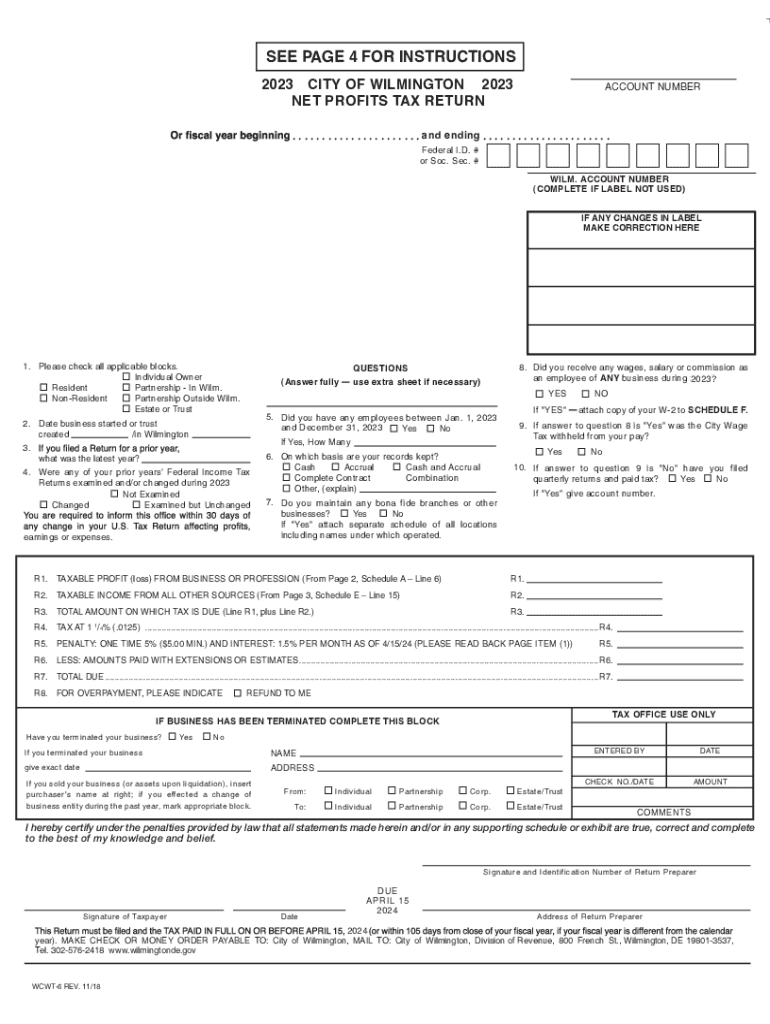

DE WCWT-6 - Wilmington 2023 free printable template

Get, Create, Make and Sign 2023 wcwt 5 form

Editing delaware wilmington net profits online

Uncompromising security for your PDF editing and eSignature needs

DE WCWT-6 - Wilmington Form Versions

How to fill out wcwt 6 fillable form

How to fill out DE WCWT-6 - Wilmington

Who needs DE WCWT-6 - Wilmington?

Video instructions and help with filling out and completing city of wilmington net profits tax return

Instructions and Help about de wilmington form return

Hey miss simplified here answering guys dating questions from a girls' perspective this is another special video for my friends over at coffee meets bagel as you know one my favorite free online dating sites that utilizes your network on Facebook, and they just launched in San Francisco grants you guys and lucky for anybody in the Bay Area who can now use coffee meets bagel that's awesome news on to our question guys who use coffee meets bagel want to know what's the best way to approach women okay here are three ways you can approach women in a public setting number one make a comment about something she's wearing or caring that's an attention-seeker so what constitutes an attention-seeker well it could be something that's either fun or quirky out of the ordinary, or she's trying to make a segment for example anything with a sports team or a college name on it if she's wearing a t-shirt that has SF Giants on it chances are she's a family so FAM now you know something about her, and you can live with it here's a little secret if a girl wearing or carrying something that's making a statement she's looking for attention for example I'm not going to wear this a crazy necklace on a day when I want to feel invisible I'm looking for someone to make a comment about it hey nice necklace reminds me of Fruit Loops my favorite cereal smooth the second approach is to make a comment about the situation the best opportunities are when you're waiting online at the grocery store or window waiting subway to come basically a situation when there's idle time, but you're anticipating for something to happen this R train is so unpredictable to do you know if its running today perfect now you can bond about the situation you're in without being a creep third approach is the direct approach this is going to be the hardest but most effective way of approaching a woman, so you go up to her and say hi I think you're beautiful, and then you ask an action-oriented question you think I could buy you a drink mind if I walk with you for a bit listen every girl loves being told oh she's beautiful but just don't make it seem like he's in stalking all day okay, so now you know the three approaches I'm going to give you three warning signs number one don't interrupt she's got her headphones on or if she's walking superfast, or she's on her phone don't interrupt her nothing more annoying than someone interrupting you while you're trying to get something done am I right but if she's just leisurely walking around a farmers market, or she's waiting for the bartender at the bar those are opportune time to go in warning number two no no guys this is a mistake a lot of you make which is when you get a note you keep pushing somehow you're going to convince her to keep talking to you well guess what if she tells you know whether verbally you would physically leave her alone poor number three never leave out her friends if you see that she's got her friends round include them in the...

People Also Ask about wcwt 6

Who is required to file a Delaware tax return?

What is the city of Wilmington Delaware withholding tax?

Is Wilmington Delaware no tax?

Do I need to file a Wilmington tax return?

Does Wilmington Delaware have a city tax?

Who pays Wilmington city tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get delaware wilmington profits tax return?

Can I edit wilmington net profits return on an iOS device?

How do I complete city of wilmington wcwt 1 form on an iOS device?

What is DE WCWT-6 - Wilmington?

Who is required to file DE WCWT-6 - Wilmington?

How to fill out DE WCWT-6 - Wilmington?

What is the purpose of DE WCWT-6 - Wilmington?

What information must be reported on DE WCWT-6 - Wilmington?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.