IRS 2678 2023 free printable template

Show details

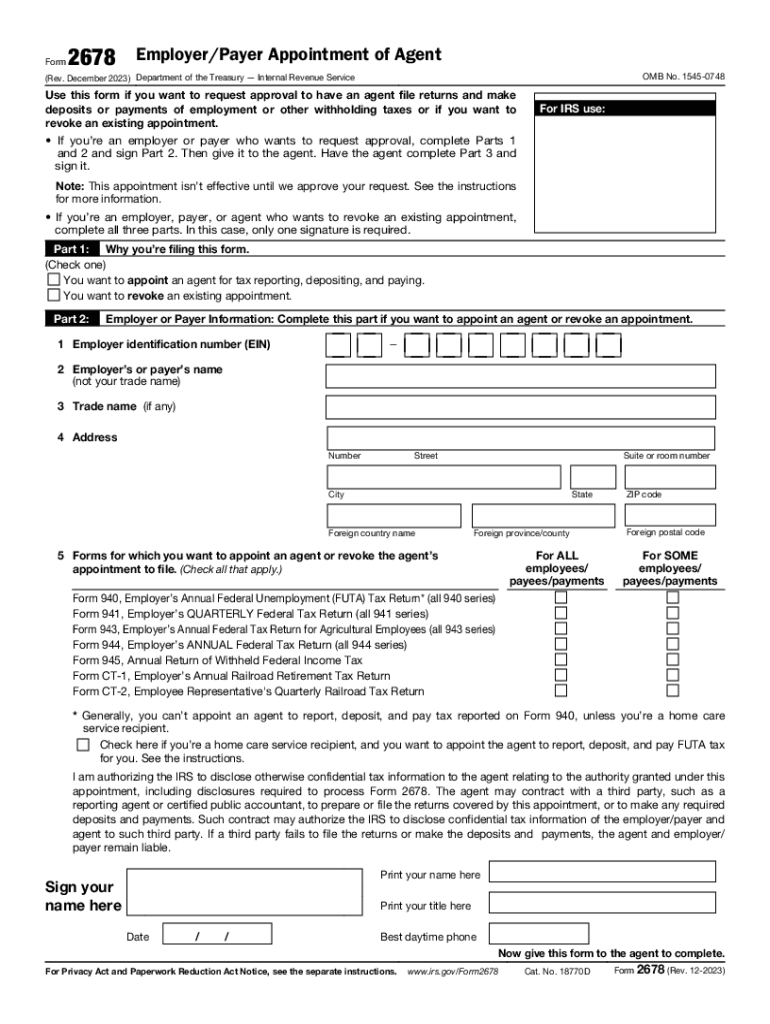

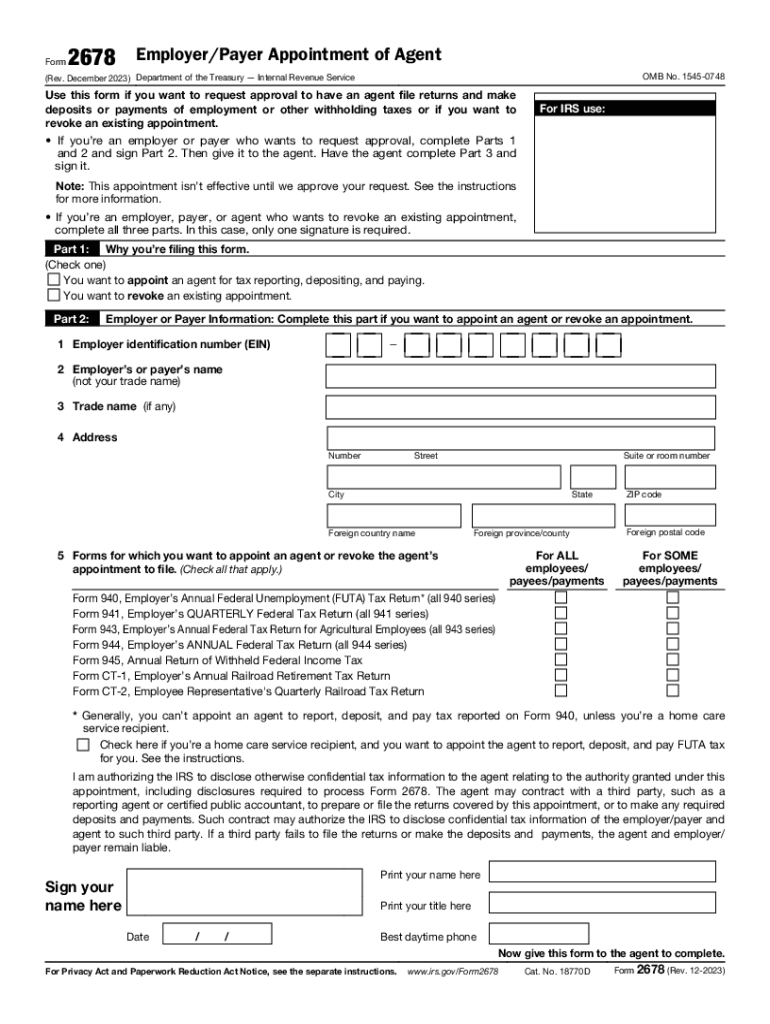

Form2678Employer/Payer Appointment of Agent

OMB No. 15450748(Rev. December 2023) Department of the Treasury Internal Revenue ServiceUse this form if you want to request approval to have an agent

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign irs appointment agent form

Edit your irs payer appointment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2678 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2678 form fillable online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit irs 2678 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 2678 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out employer payer sample form

How to fill out IRS 2678

01

Obtain IRS Form 2678 from the IRS website or a local IRS office.

02

Fill in your name, address, and taxpayer identification number in Part I.

03

Specify the type of entity for which you are requesting to be recognized as a statutory employer.

04

Complete Part II by providing the information of the agent you are appointing.

05

Review the instructions carefully to determine if any additional information is required.

06

Sign and date the form at the bottom.

07

Submit the completed form to the appropriate IRS address as stated in the instructions.

Who needs IRS 2678?

01

Business owners who want to appoint an agent for tax purposes.

02

Any entity that employs individuals and wants to clarify tax responsibilities.

03

Employers who need to report employment taxes correctly under a statutory employer scenario.

Fill

2678 download

: Try Risk Free

People Also Ask about

What are the rules for the common paymaster?

What is the Common Paymaster Rule? A solution is the common paymaster rule. The rule states that the parent entity is allowed to calculate payroll taxes for these wandering employees as though they had a single employer for the entire calendar year.

What is a common pay agent?

What is a Common Pay Agent? The appointment of a Common Pay Agent allows for the consolidation of FICA (Social Security & Medicare), as well as income tax withholding, reporting and remittance under the Agent's federal employer identification number (FEIN).

How do I revoke form 8655?

Write “REVOKE” across the top of the form. If you do not have a copy of the authorization you want to revoke, send a statement to the IRS. The statement of revocation must indicate that the authority of the reporting agent is revoked and must be signed by the taxpayer.

What is the common pay agent for the IRS?

The common paymaster is responsible for withholding, depositing, and paying FICA and FUTA taxes, and filing and furnishing information returns associated with wages it disburses. If the common paymaster fails to remit these taxes, it remains liable for the full amount of the unpaid portion of these taxes.

What is a Section 3504 agent?

A Section 3504 agent performs acts such as the withholding, reporting and paying of employment taxes. The Section 3504 agent files one return for each period on behalf of all the employers it represents using its own EIN and address on the returns (“aggregate return”).

How do I fill out a w4 for max withholdings?

It is impossible to max out federal withholding because the amount of federal taxes withheld from your paycheck is determined by the information you provide on your W-4 form and the IRS tax tables, which are based on your income and filing status.

How do I fill out a w4 for maximum withholding?

It is impossible to max out federal withholding because the amount of federal taxes withheld from your paycheck is determined by the information you provide on your W-4 form and the IRS tax tables, which are based on your income and filing status.

What is the maximum allowances I can claim on w4?

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

How do I fill out a new W-4 form?

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. Step 2: Indicate Multiple Jobs or a Working Spouse. Step 3: Add Dependents. Step 4: Add Other Adjustments. Step 5: Sign and Date Form W-4.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS 2678 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your IRS 2678 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send IRS 2678 for eSignature?

Once your IRS 2678 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit IRS 2678 straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing IRS 2678, you can start right away.

What is IRS 2678?

IRS Form 2678 is a form used to allow an employer to request that the Internal Revenue Service recognize an individual as an employee for federal tax purposes.

Who is required to file IRS 2678?

Employers who wish to classify a worker as an employee and report their wages and tax withholding must file IRS Form 2678.

How to fill out IRS 2678?

To fill out IRS Form 2678, employers need to provide details about the employer and employee, including names, addresses, and taxpayer identification numbers, and then specify the nature of the employment.

What is the purpose of IRS 2678?

The purpose of IRS Form 2678 is to clarify the relationship between an employer and an employee for tax purposes, leading to proper classification and tax treatment.

What information must be reported on IRS 2678?

The information that must be reported on IRS Form 2678 includes the employer’s information, the employee's information, the effective date of employment, and any necessary signatures.

Fill out your IRS 2678 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 2678 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.