IRS 2678 2024-2025 free printable template

Show details

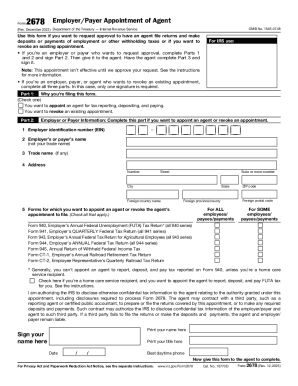

Form2678Employer/Payer Appointment of Agent

OMB No. 15450029(Rev. December 2024) Department of the Treasury Internal Revenue ServiceUse this form if you want to request approval to have an agent

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign 2678 form

Edit your irs 2678 fillable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs appointment agent form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2024 irs appointment online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit irs payer appointment form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 2678 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out irs 2678 form

How to fill out IRS 2678

01

Obtain Form IRS 2678 from the IRS website or your tax professional.

02

Fill in the name, address, and identification number of the entity applying for the employer status.

03

Enter the name and title of the individual completing the form.

04

Indicate the type of business entity (e.g., corporation, partnership).

05

Provide information about the client(s) on behalf of whom you are applying.

06

Detail the effective date for the employer status.

07

Sign and date the form to certify that the information provided is accurate.

Who needs IRS 2678?

01

Any business entity that wishes to act as a common paymaster for employees of multiple related employers.

02

Employers who want to elect or change the common paymaster status for payroll tax purposes.

03

Organizations that need to ensure proper withholding and reporting requirements.

Fill

form

: Try Risk Free

People Also Ask about

What are the rules for the common paymaster?

What is the Common Paymaster Rule? A solution is the common paymaster rule. The rule states that the parent entity is allowed to calculate payroll taxes for these wandering employees as though they had a single employer for the entire calendar year.

What is a common pay agent?

What is a Common Pay Agent? The appointment of a Common Pay Agent allows for the consolidation of FICA (Social Security & Medicare), as well as income tax withholding, reporting and remittance under the Agent's federal employer identification number (FEIN).

How do I revoke form 8655?

Write “REVOKE” across the top of the form. If you do not have a copy of the authorization you want to revoke, send a statement to the IRS. The statement of revocation must indicate that the authority of the reporting agent is revoked and must be signed by the taxpayer.

What is the common pay agent for the IRS?

The common paymaster is responsible for withholding, depositing, and paying FICA and FUTA taxes, and filing and furnishing information returns associated with wages it disburses. If the common paymaster fails to remit these taxes, it remains liable for the full amount of the unpaid portion of these taxes.

What is a Section 3504 agent?

A Section 3504 agent performs acts such as the withholding, reporting and paying of employment taxes. The Section 3504 agent files one return for each period on behalf of all the employers it represents using its own EIN and address on the returns (“aggregate return”).

How do I fill out a w4 for max withholdings?

It is impossible to max out federal withholding because the amount of federal taxes withheld from your paycheck is determined by the information you provide on your W-4 form and the IRS tax tables, which are based on your income and filing status.

How do I fill out a w4 for maximum withholding?

It is impossible to max out federal withholding because the amount of federal taxes withheld from your paycheck is determined by the information you provide on your W-4 form and the IRS tax tables, which are based on your income and filing status.

What is the maximum allowances I can claim on w4?

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

How do I fill out a new W-4 form?

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. Step 2: Indicate Multiple Jobs or a Working Spouse. Step 3: Add Dependents. Step 4: Add Other Adjustments. Step 5: Sign and Date Form W-4.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IRS 2678 from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including IRS 2678, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I make changes in IRS 2678?

The editing procedure is simple with pdfFiller. Open your IRS 2678 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I sign the IRS 2678 electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your IRS 2678 in minutes.

What is IRS 2678?

IRS Form 2678 is the 'Employer Appointment of Agent' form used by employers to authorize an agent to act on their behalf regarding employment tax responsibilities.

Who is required to file IRS 2678?

Employers who wish to appoint an agent to handle their employment tax obligations must file IRS 2678.

How to fill out IRS 2678?

To fill out IRS 2678, employers should provide their business identification details, the agent's information, and specify the type of tax for which the agent is being appointed. Ensure all required signatures are included.

What is the purpose of IRS 2678?

The purpose of IRS 2678 is to establish a formal relationship between an employer and an agent, allowing the agent to manage tax matters on behalf of the employer.

What information must be reported on IRS 2678?

IRS 2678 requires reporting of the employer's name, address, Employer Identification Number (EIN), the agent's name and address, and the specific tax responsibilities the agent will handle.

Fill out your IRS 2678 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 2678 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.