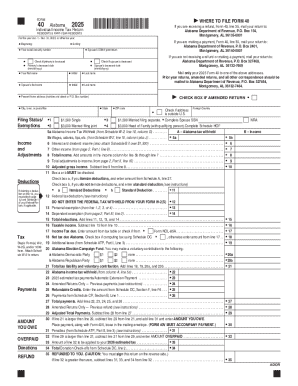

AL ADoR 40 2023 free printable template

Instructions and Help about AL ADoR 40

How to edit AL ADoR 40

How to fill out AL ADoR 40

Latest updates to AL ADoR 40

About AL ADoR 40 2023 previous version

What is AL ADoR 40?

Who needs the form?

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Where do I send the form?

FAQ about AL ADoR 40

What should I do if I realize I've made a mistake on my AL ADoR 40 after submission?

If you discover an error on your AL ADoR 40 after submission, you should file an amended form to correct the mistake. It's important to clearly indicate that the submission is an amendment to help avoid processing issues. Keep a copy of both the original and amended forms for your records.

How can I check the status of my filed AL ADoR 40?

To verify the status of your filed AL ADoR 40, check the online tracking system provided by the relevant tax authority. You may need to input specific details such as your filing date and identification number. This ensures you stay updated on processing times and any potential issues.

What happens if my AL ADoR 40 gets rejected during e-filing?

If your AL ADoR 40 is rejected during e-filing, carefully review the rejection code provided. Common reasons include mismatches in information or missing required fields. Correct the noted issues and resubmit the form to ensure compliance with filing requirements.

Are there specific legal requirements for signature when submitting an AL ADoR 40 electronically?

When filing AL ADoR 40 electronically, e-signature is typically acceptable if it meets the standards set by the tax authority. Ensure that your electronic signature complies with any legal specifications to avoid processing delays. Review the guidelines for your jurisdiction regarding signature requirements.

What should I do if I receive an audit notice related to my AL ADoR 40?

If you receive an audit notice concerning your AL ADoR 40, respond promptly and assemble all relevant documentation, such as your original filing and any supporting materials. It's advisable to consult with a tax professional to help navigate the audit process and ensure your records are in order.

See what our users say