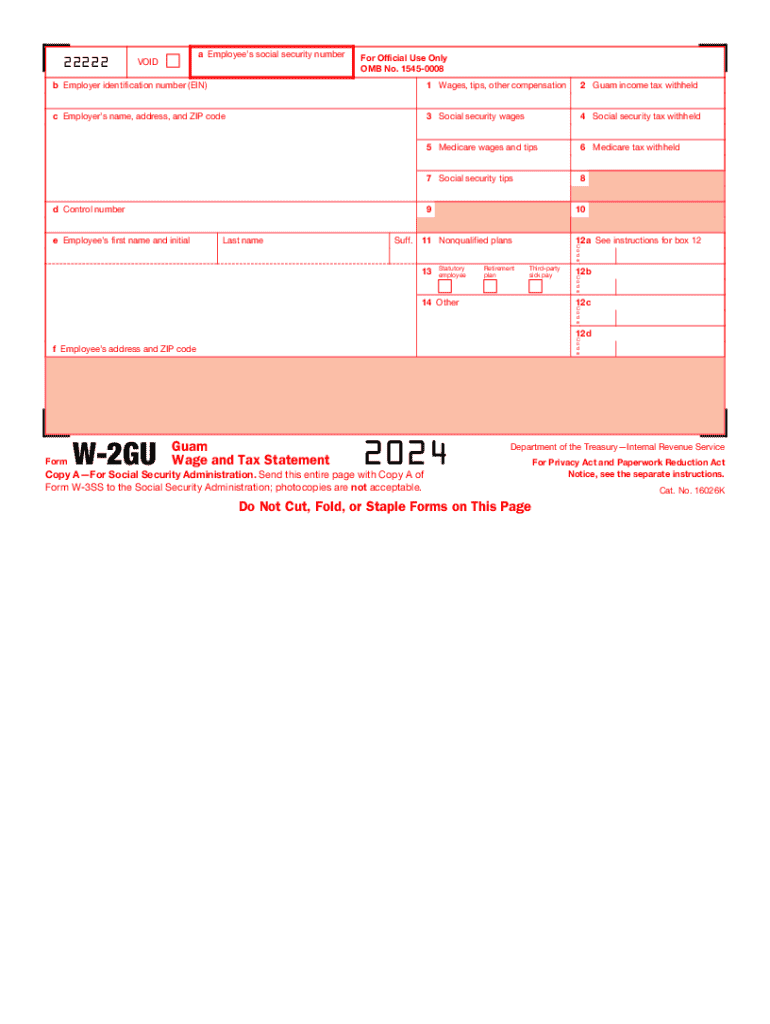

IRS W-2GU 2024 free printable template

Instructions and Help about IRS W-2GU

How to edit IRS W-2GU

How to fill out IRS W-2GU

Latest updates to IRS W-2GU

About IRS W-2GU 2024 previous version

What is IRS W-2GU?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS W-2GU

What should I do if I discover an error after submitting my IRS W-2GU?

If you find an error on your submitted IRS W-2GU, you can submit a corrected form to rectify the mistake. It's important to highlight that the correction process involves completing a new IRS W-2GU with the correct information and indicating that it is a corrected submission. Make sure to keep a copy for your records and check the IRS guidelines for any specific rules regarding amendments.

How can I verify if my IRS W-2GU was received and processed?

To confirm the receipt and processing status of your IRS W-2GU, you can contact the IRS directly or use their online tools if available. Common e-file rejection codes can provide insight into any issues with your submission, so reviewing these codes is essential. Keeping track of submission confirmation emails can also help you ensure everything is on record.

What legal considerations should I keep in mind when filing the IRS W-2GU on behalf of someone else?

When filing the IRS W-2GU for another individual, it's crucial to be aware of the requirements for authorized representatives, including obtaining a Power of Attorney (POA) if needed. Additionally, you must ensure that you maintain the privacy and security of the payee's information throughout the filing process, adhering to data protection regulations.

What common mistakes should I avoid when filling out the IRS W-2GU?

Common errors when completing the IRS W-2GU include incorrect taxpayer information, failing to match names and social security numbers accurately, and neglecting to double-check math calculations. To mitigate these issues, always use the most recent version of the form and verify each entry against official documents before submission.

See what our users say