Get the free Tax rebates for film and television producers

Show details

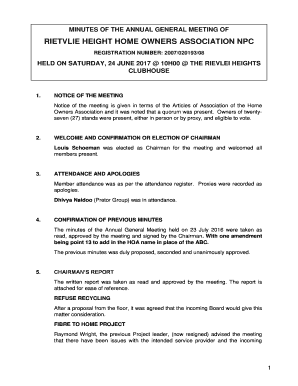

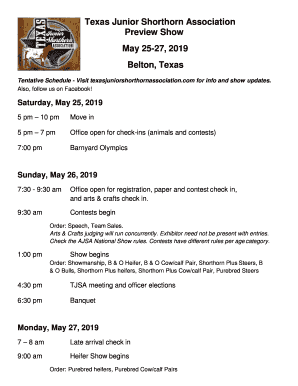

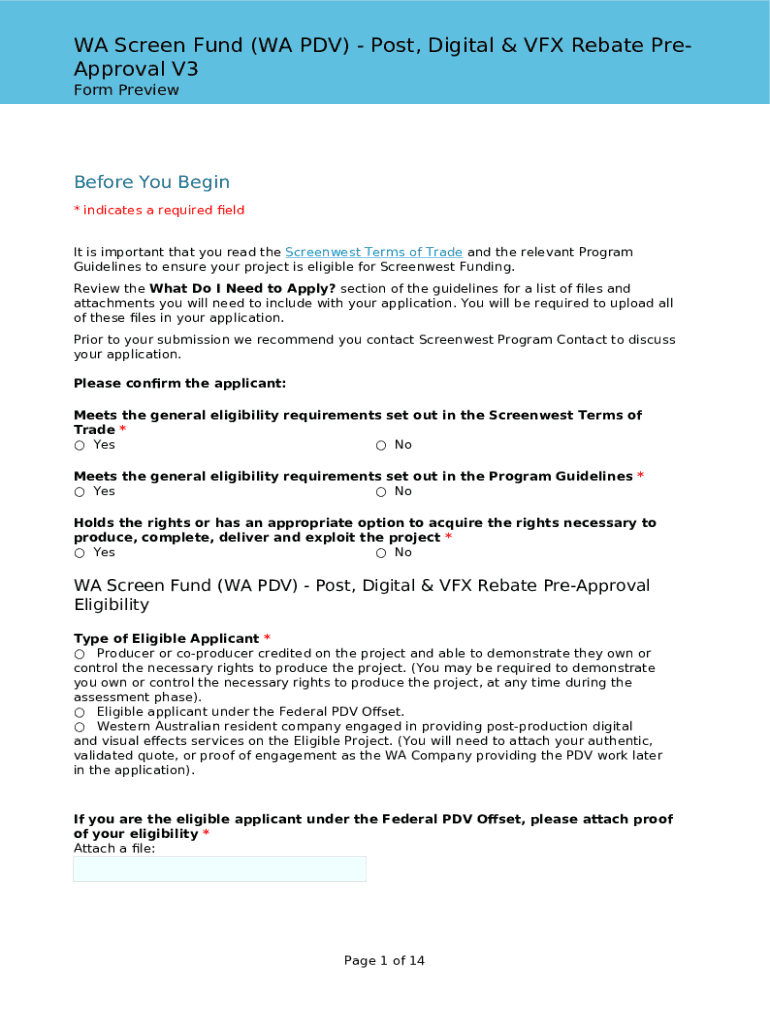

WA Screen Fund (WA PDV) Post, Digital & VFX Rebate PreApproval V3

Form PreviewBefore You Begin

* indicates a required eld

It is important that you read the Screenwest Terms of Trade and the relevant

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax rebates for film

Edit your tax rebates for film form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax rebates for film form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax rebates for film online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax rebates for film. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax rebates for film

How to fill out tax rebates for film

01

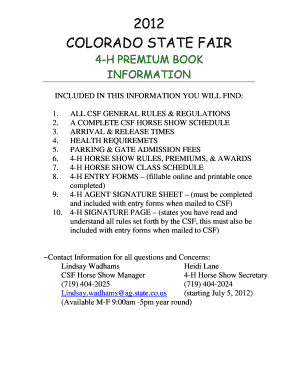

Gather all necessary documents such as production expenses, receipts, and financial records related to the film.

02

Determine the tax rebates or incentives available for filmmakers in your specific location.

03

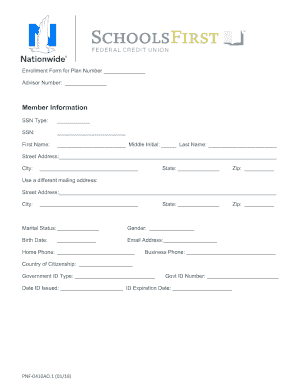

Fill out the application form for tax rebates, providing accurate and detailed information about the film production.

04

Attach all the required documents and supporting evidence to the application.

05

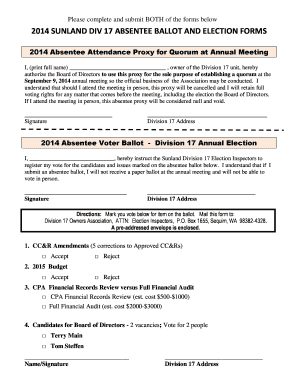

Double-check the application for any errors or missing information before submission.

06

Submit the completed tax rebate application along with the necessary documents to the appropriate government agency or film commission.

07

Follow up with the agency to track the progress of your application and provide any additional information if required.

08

After the review process, receive notification of approval or denial of the tax rebate.

09

If approved, complete any further requirements or steps specified by the agency to receive the tax rebate.

10

Keep a record of all correspondence and documentation related to the tax rebate for future reference or audit purposes.

Who needs tax rebates for film?

01

Filmmakers and production companies involved in the production of eligible films.

02

Independent filmmakers and small-scale production teams that can benefit from financial incentives offered by tax rebates.

03

Film studios and major production houses that aim to maximize their budget and profitability through tax incentives.

04

Locations or regions that want to attract or boost their film industry and encourage local film production.

05

Investors or financiers looking for financial incentives and returns on their investment in the film industry.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax rebates for film for eSignature?

When you're ready to share your tax rebates for film, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I sign the tax rebates for film electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your tax rebates for film in minutes.

How do I edit tax rebates for film straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit tax rebates for film.

What is tax rebates for film?

Tax rebates for film are financial incentives provided by governments to encourage film production in a specific location. These rebates often allow filmmakers to recover a percentage of their production costs, thereby reducing their overall tax liability.

Who is required to file tax rebates for film?

Filmmakers, production companies, and sometimes distributors who have incurred eligible production expenses while shooting a film in a qualifying location are required to file for tax rebates.

How to fill out tax rebates for film?

To fill out tax rebates for film, applicants typically need to complete a specific application form provided by the governing authority, supply necessary documentation, such as production budgets and receipts, and demonstrate eligibility according to the local tax laws.

What is the purpose of tax rebates for film?

The purpose of tax rebates for film is to stimulate local economies, create jobs, and promote tourism by incentivizing filmmakers to choose particular regions for their productions.

What information must be reported on tax rebates for film?

Information that must be reported includes details about production expenses, the total amount of incentives being claimed, documentation of expenditures, and information about the cast and crew employed during production.

Fill out your tax rebates for film online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Rebates For Film is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.