Get the free Tax Abatement and Economic Development Agreements ...

Show details

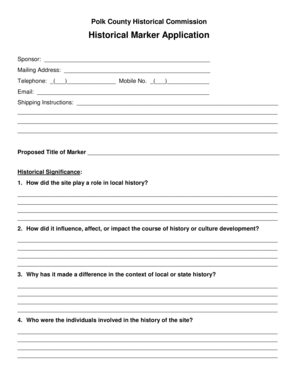

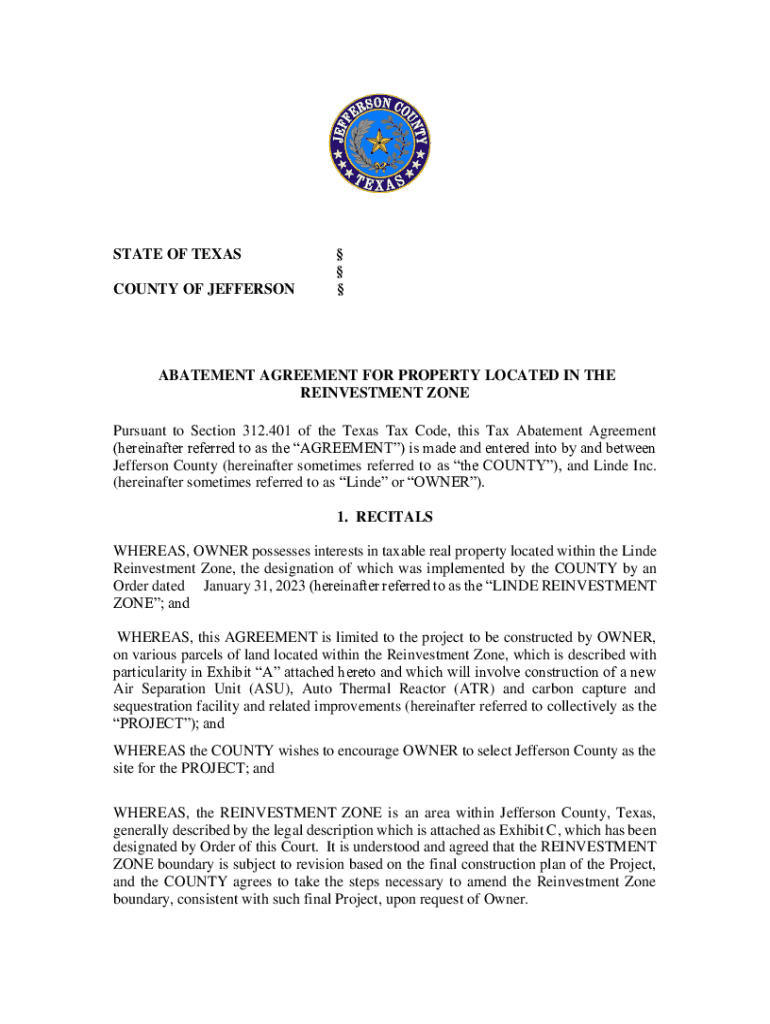

STATE OF TEXAS COUNTY OF JEFFERSON ABATEMENT AGREEMENT FOR PROPERTY LOCATED IN THE REINVESTMENT ZONE Pursuant to Section 312.401 of the Texas Tax Code, this Tax Abatement Agreement (hereinafter referred

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax abatement and economic

Edit your tax abatement and economic form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax abatement and economic form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax abatement and economic online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax abatement and economic. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax abatement and economic

How to fill out tax abatement and economic

01

To fill out tax abatement and economic forms, follow these steps:

02

Determine the type of tax abatement or economic incentive you are applying for.

03

Gather all the necessary documentation and information required for the application, such as business identification numbers, financial statements, and property details.

04

Download or obtain the tax abatement and economic forms from the relevant government department or agency.

05

Read the instructions and requirements carefully before filling out the forms.

06

Fill in the forms accurately and completely, providing all the requested information.

07

Attach any supporting documents that may be required, such as business plans, market analysis, or project proposals.

08

Review the completed forms and documentation to ensure everything is accurate and complete.

09

Submit the filled-out forms and supporting documents to the appropriate government department or agency, following the specified submission procedures.

10

Keep copies of all submitted documents for your records.

11

Follow up with the government department or agency to track the progress of your application and address any additional questions or requirements that may arise.

12

Await a response from the government department or agency regarding the approval or denial of your tax abatement or economic incentive application.

13

If approved, comply with any ongoing reporting or monitoring requirements as specified by the government department or agency.

14

Note: The specific steps and requirements may vary depending on the jurisdiction and type of tax abatement or economic incentive being applied for. It is advisable to consult with a tax professional or seek guidance from the relevant government department or agency for accurate and up-to-date instructions.

Who needs tax abatement and economic?

01

Tax abatement and economic incentives are primarily needed by businesses and individuals who meet certain criteria, such as:

02

- Businesses looking to expand, relocate, or establish operations in a specific jurisdiction.

03

- Startups or small businesses seeking financial assistance or incentives to promote growth and development.

04

- Real estate developers or property owners planning to undertake eligible projects that contribute to economic development.

05

- Companies in industries targeted for strategic growth or economic diversification.

06

- Individuals or businesses investing in renewable energy, green technology, or sustainable practices.

07

- Low-income individuals or families who may qualify for tax abatement or economic incentives aimed at reducing their financial burden.

08

- Certain targeted industries or sectors that are encouraged or supported by government policies.

09

The specific eligibility and requirements for tax abatement and economic incentives may vary depending on the jurisdiction and the goals of the government or local authority offering these incentives. It is advisable to research and consult with the relevant government department or agency to determine if you or your business may qualify for tax abatement and economic incentives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tax abatement and economic in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your tax abatement and economic, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I edit tax abatement and economic straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing tax abatement and economic, you can start right away.

How do I edit tax abatement and economic on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share tax abatement and economic on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is tax abatement and economic?

Tax abatement refers to a reduction or exemption from taxes granted by the government to encourage economic development. It aims to stimulate investment in certain areas or sectors.

Who is required to file tax abatement and economic?

Businesses or property owners who have received a tax abatement or are seeking one typically need to file the necessary forms to report their status and eligibility.

How to fill out tax abatement and economic?

To fill out tax abatement forms, provide the required personal information, details about the property or business, the duration of the abatement, and supporting documents as required by the local tax authority.

What is the purpose of tax abatement and economic?

The purpose of tax abatement is to encourage economic growth by lowering financial barriers for businesses and homeowners, thus promoting investment and development in specific regions.

What information must be reported on tax abatement and economic?

The information typically includes property or business identification, the nature of the abatement, the duration and amount of tax reduction, and compliance with local requirements.

Fill out your tax abatement and economic online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Abatement And Economic is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.