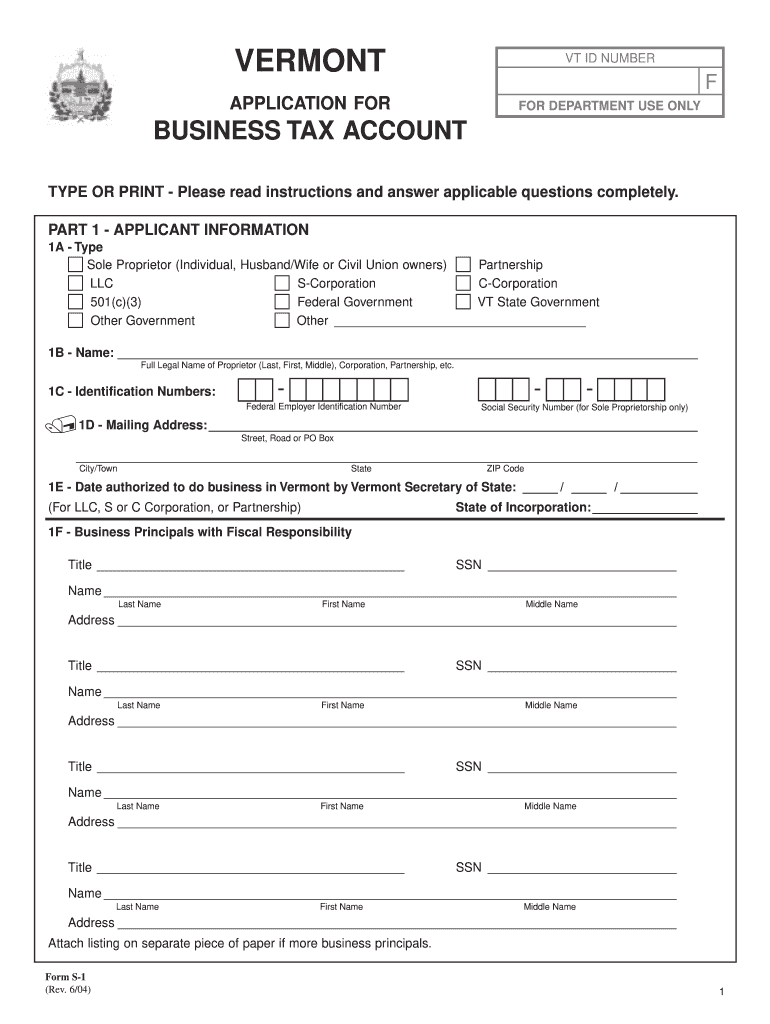

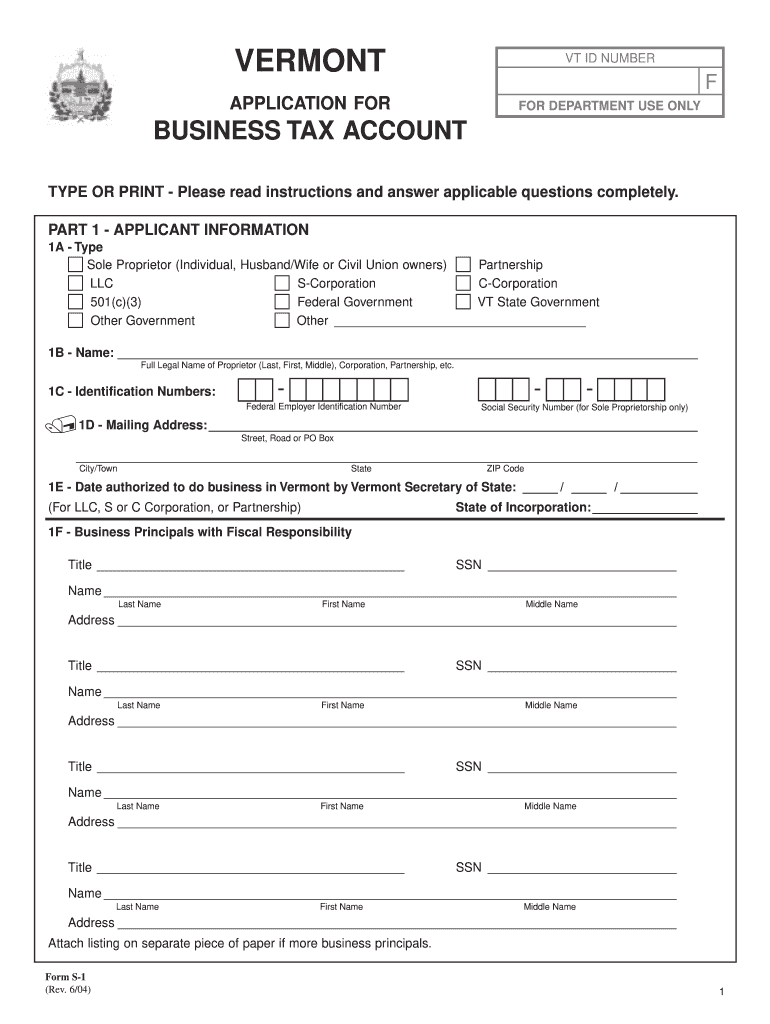

VT DoT BR-400 (Formerly S-1) 2004 free printable template

Get, Create, Make and Sign vermont business tax 2004

Editing vermont business tax 2004 online

Uncompromising security for your PDF editing and eSignature needs

VT DoT BR-400 (Formerly S-1) Form Versions

How to fill out vermont business tax 2004

How to fill out VT DoT BR-400 (Formerly S-1)

Who needs VT DoT BR-400 (Formerly S-1)?

Instructions and Help about vermont business tax 2004

[Applause] thank you you can [Applause] [Music] [Applause] [Music] but Oh [Applause] to me hey boo EJ see [Music] [Applause] [Music] [Applause] [Music] [Applause] [Music] see [Music] [Applause] [Music] [Applause] here three [Music] hey who he [Music] [Applause] [Music] [Music] can you see [Music] [Music] Oh [Applause] [Music] to me say goop you can see [Music] Oh [Music] [Applause] to me say move children see [Music] [Music] here to me [Music] say who powder see [Music] you [Music] Oh [Music]

People Also Ask about

Who must file Vermont partnership return?

What are the exclusions for capital gains tax?

What is the long term capital gains tax in Vermont?

Where can I get VT state tax forms?

What is the capital gains exclusion in Vermont?

How much capital gains can be excluded from gross income?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send vermont business tax 2004 for eSignature?

How do I complete vermont business tax 2004 online?

Can I create an eSignature for the vermont business tax 2004 in Gmail?

What is VT DoT BR-400 (Formerly S-1)?

Who is required to file VT DoT BR-400 (Formerly S-1)?

How to fill out VT DoT BR-400 (Formerly S-1)?

What is the purpose of VT DoT BR-400 (Formerly S-1)?

What information must be reported on VT DoT BR-400 (Formerly S-1)?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.