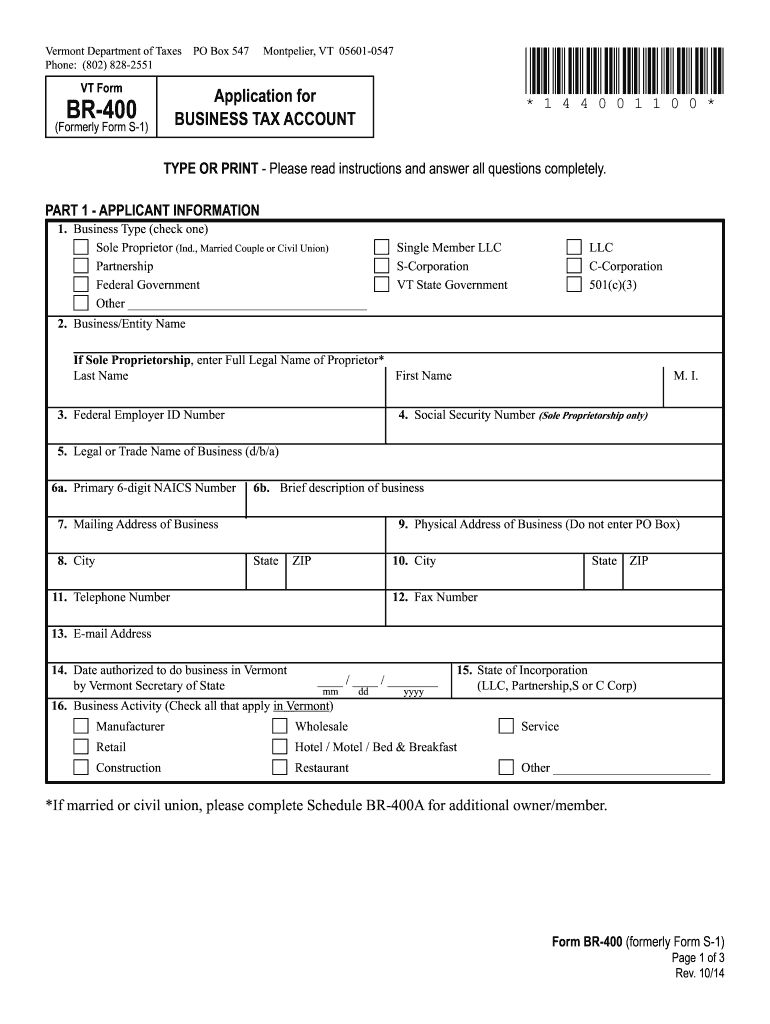

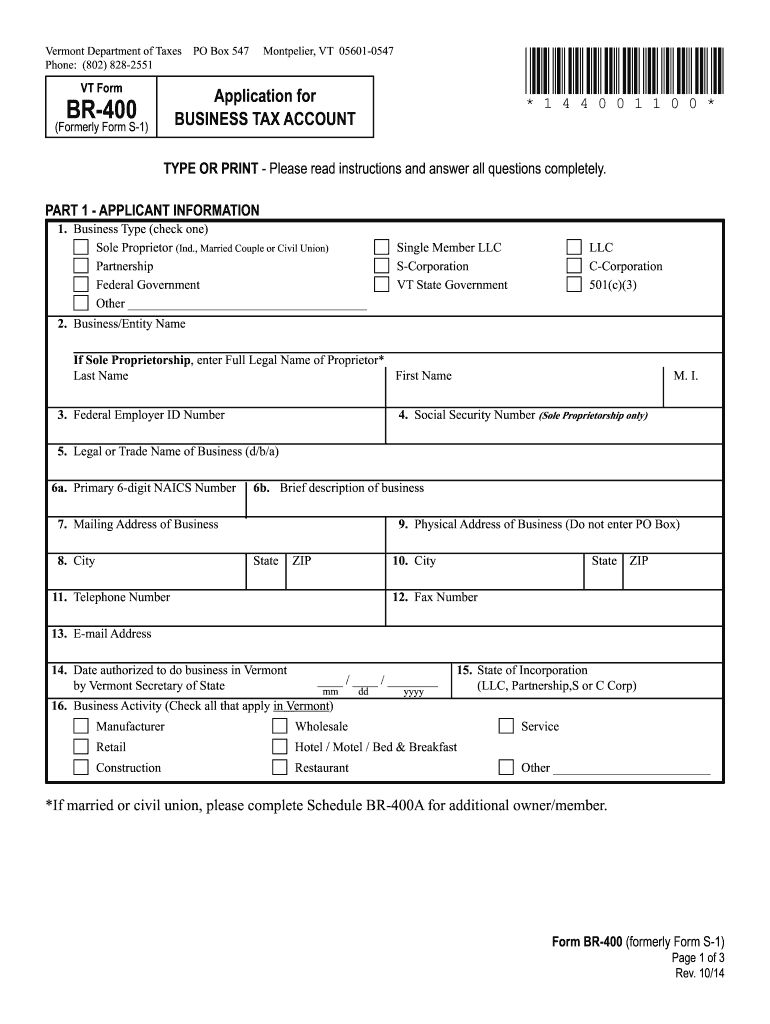

VT DoT BR-400 (Formerly S-1) 2014 free printable template

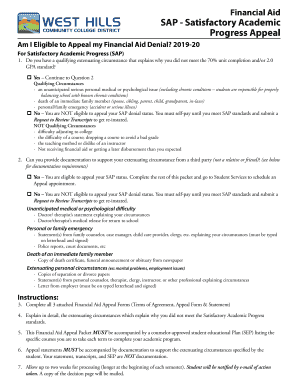

Get, Create, Make and Sign vermont br 400 2014

How to edit vermont br 400 2014 online

Uncompromising security for your PDF editing and eSignature needs

VT DoT BR-400 (Formerly S-1) Form Versions

How to fill out vermont br 400 2014

How to fill out VT DoT BR-400 (Formerly S-1)

Who needs VT DoT BR-400 (Formerly S-1)?

Instructions and Help about vermont br 400 2014

What's up YouTube out in the garage working on some small engines with this blower this is a steel Beau for hundreds an old one they got this in a yard stuff like 40 bucks about a year ago I used it all last year on the job, and it's been giving me some problems it'll, it'll start it'll run for a little, and then she'll die, and then it's real hard to get it going again so all I've been doing some tests they did a compression test again I got 150 pounds it's been holding, so the compression is good, so that's a good thing I rebuilt the carburetor took their old paw cleaned it put a rebuild kit put that back in there I checked the muffler pull the screen out make sure it wasn't clogged and if that thing is if that's clogged you'll be running an awfully hard to start, so the muffler looks all clear you got good compression the copper is all rebuilt, and I'm still having problems with it, so I'm thinking it might be to the magneto the coil, so I ordered one I was like 25 dollars and I took it off I was testing it with a multi tester, but I was getting some readings on some people were saying suppose out this certain amount of readings but hearing there's all different kind of machines at different readings on it so $25 I only paid 40 bucks for it in yard sale, so I'll take the chance in and put it on and see what happens I mean it did everything else on it, I don't see what else it could be I'm getting a spark did my test us it's getting it's actually getting a spark, but this fault might not be strong enough, and also you know this is an old machine, so I figure I'd get into one and put it on we'll see what happens we'll go from there well she's still holding that one 50 I think anything that's below 100 100 L below is pretty much ain't got good compression in these little engines anymore, so we'll see I'll be coming in the mail probably this week maybe hopefully, and I'll put that on I'll see what happens if anybody out there is real familiar with these machines I've watched a lot of videos on them, you know I'll be happy to hear you suggestions maybe what do you think about it, I did a compression test on that little chainsaw there that my brother had over in is born he hasn't used it in a while I rebuilt the cob on out on through, but I can't get it going I use a compression test on, and it only goes up 60, so I'm thinking that that chainsaw might be shot it's I don't know how that could be because he hardly ever used it I have to look at that again, so maybe he's got a leak somewhere maybe the gaskets you know I got I don't have a vacuum test I should probably purchase one of those and do a vacuum test on it, but anyway I'll get them going I'll keep taking around, and I like tinkering with these little engines all right you two take it easy

People Also Ask about

Who must file Vermont partnership return?

What are the exclusions for capital gains tax?

What is the long term capital gains tax in Vermont?

Where can I get VT state tax forms?

What is the capital gains exclusion in Vermont?

How much capital gains can be excluded from gross income?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my vermont br 400 2014 in Gmail?

Can I create an eSignature for the vermont br 400 2014 in Gmail?

How do I fill out vermont br 400 2014 using my mobile device?

What is VT DoT BR-400 (Formerly S-1)?

Who is required to file VT DoT BR-400 (Formerly S-1)?

How to fill out VT DoT BR-400 (Formerly S-1)?

What is the purpose of VT DoT BR-400 (Formerly S-1)?

What information must be reported on VT DoT BR-400 (Formerly S-1)?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.