Get the free Customs ValuationUnited States Trade Representative

Show details

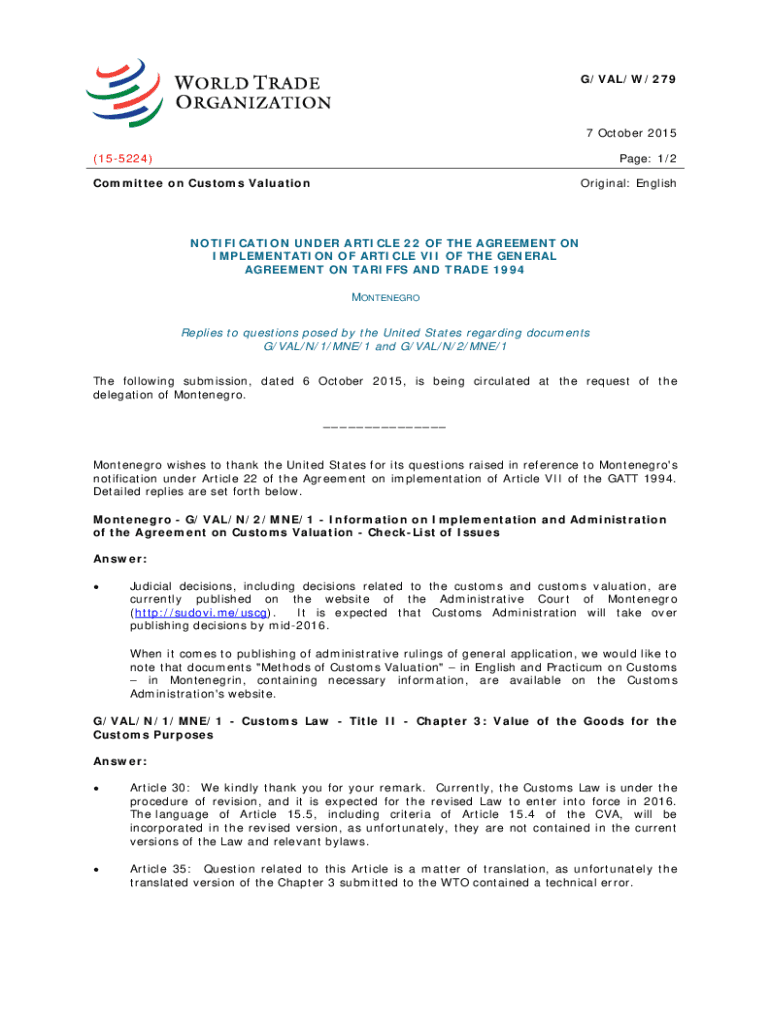

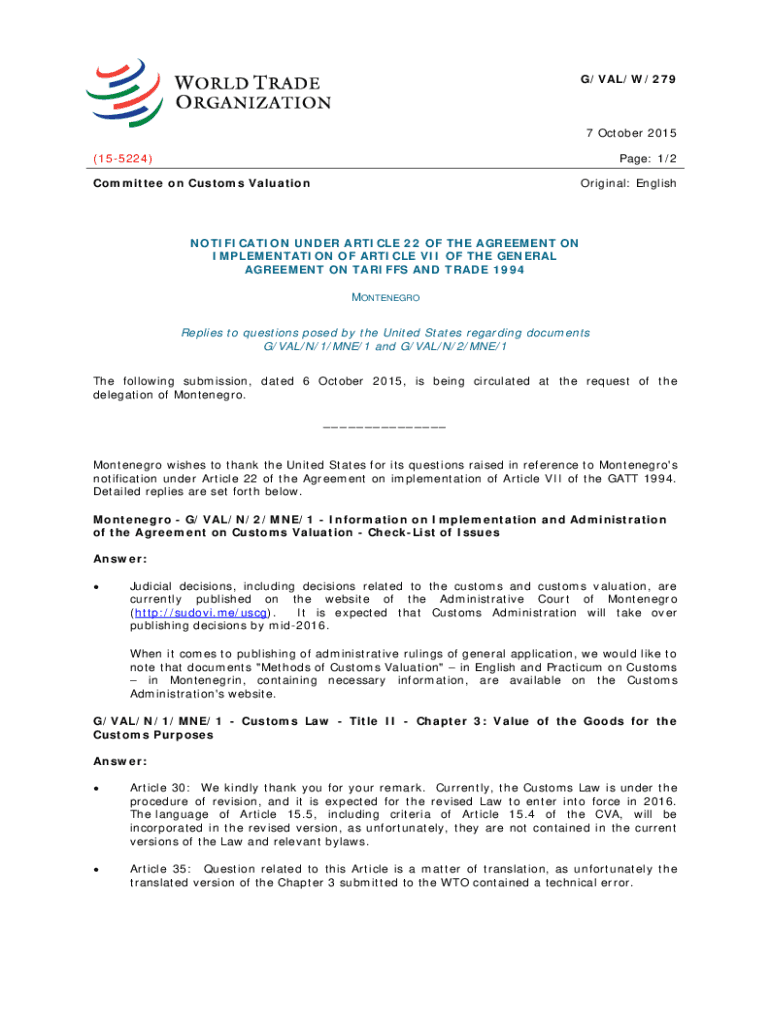

G/VAL/W/2797 October 2015 (155224)Page: 1/2Committee on Customs ValuationOriginal: EnglishNOTIFICATION UNDER ARTICLE 22 OF THE AGREEMENT ON IMPLEMENTATION OF ARTICLE VII OF THE GENERAL AGREEMENT ON

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign customs valuationunited states trade

Edit your customs valuationunited states trade form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your customs valuationunited states trade form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit customs valuationunited states trade online

Follow the guidelines below to use a professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit customs valuationunited states trade. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out customs valuationunited states trade

How to fill out customs valuationunited states trade

01

To fill out customs valuation for United States trade, follow these steps:

02

- Gather all relevant documentation, such as invoices, bills of lading, and packing lists.

03

- Determine the correct Harmonized System (HS) codes for the goods being traded. This code classifies products for customs purposes.

04

- Calculate the value of the goods being traded. This includes the transaction value, adjustments for any additional costs or discounts, and any applicable taxes or duties.

05

- Complete the appropriate customs valuation form provided by the United States Customs and Border Protection (CBP). Provide accurate and detailed information regarding the goods, their value, and any additional necessary information.

06

- Submit the completed customs valuation form along with the supporting documentation to the CBP.

07

- Pay any applicable fees or duties associated with the customs valuation process.

08

- Await confirmation and approval of the customs valuation from the CBP.

09

- If necessary, provide any further information or clarification as requested by the CBP.

10

- Comply with any additional requirements or procedures as directed by the CBP.

11

Note: It is advisable to consult with a customs broker or trade professional to ensure compliance with all applicable regulations and to navigate the customs valuation process smoothly.

Who needs customs valuationunited states trade?

01

Anyone involved in importing or exporting goods to or from the United States may need customs valuation. This includes:

02

- Importers: Individuals or companies importing goods into the United States

03

- Exporters: Individuals or companies exporting goods from the United States

04

- Customs authorities: Responsible for assessing and enforcing customs duties and taxes

05

- Customs brokers: Professionals who help facilitate customs clearance and compliance for importers and exporters

06

- Trade professionals: Such as consultants, lawyers, or accountants who advise on international trade and customs regulations

07

- Freight forwarders: Companies that handle the logistics and transportation of goods across international borders

08

Customs valuation is required to accurately determine the value of goods for customs purposes, assess applicable duties and taxes, and ensure compliance with trade regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get customs valuationunited states trade?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the customs valuationunited states trade in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out customs valuationunited states trade using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign customs valuationunited states trade and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit customs valuationunited states trade on an Android device?

You can edit, sign, and distribute customs valuationunited states trade on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is customs valuation in United States trade?

Customs valuation is the process of determining the appropriate value of imported goods for customs duties purposes under US law.

Who is required to file customs valuation in United States trade?

Importers of record, or those responsible for the importation of goods into the United States, are required to file customs valuation.

How to fill out customs valuation in United States trade?

To fill out customs valuation, importers must provide a completed customs declaration form, including details about the merchandise, and ensure the value declared reflects the transaction value of the goods.

What is the purpose of customs valuation in United States trade?

The purpose of customs valuation is to establish the taxable value of imported goods to determine the appropriate customs duties and taxes that need to be paid.

What information must be reported on customs valuation in United States trade?

Information that must be reported includes the transaction value, description of the goods, country of origin, and any relevant invoices or supporting documents.

Fill out your customs valuationunited states trade online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Customs Valuationunited States Trade is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.