Get the free calendar days of receipt of this shipment. When filing a ...

Show details

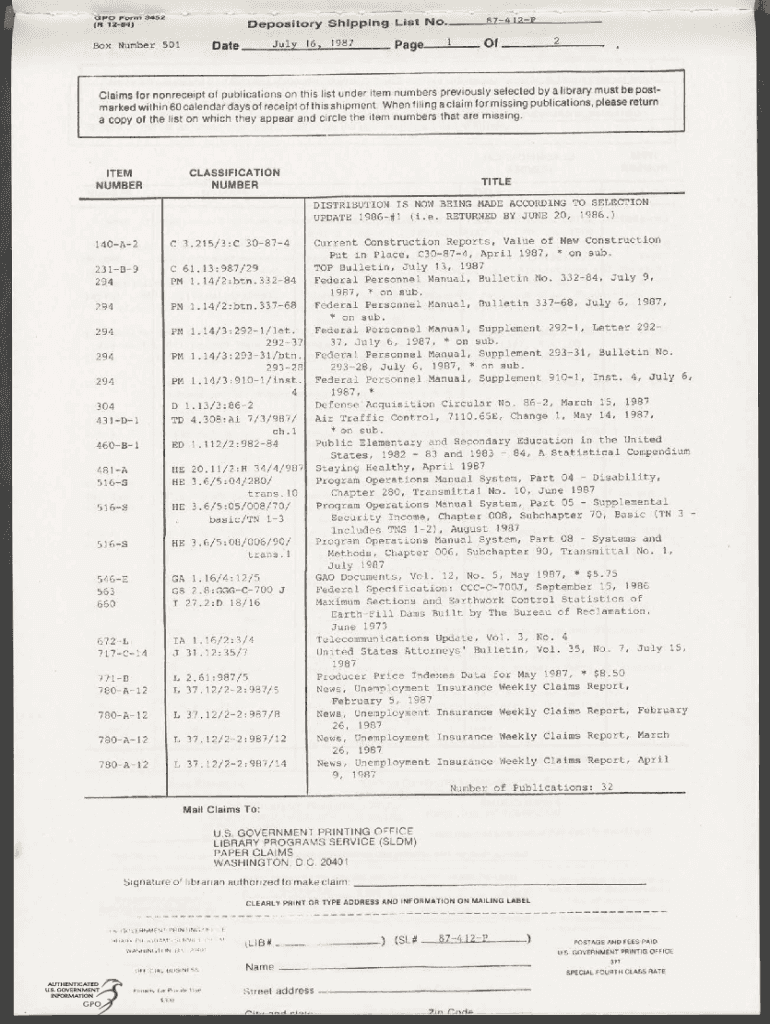

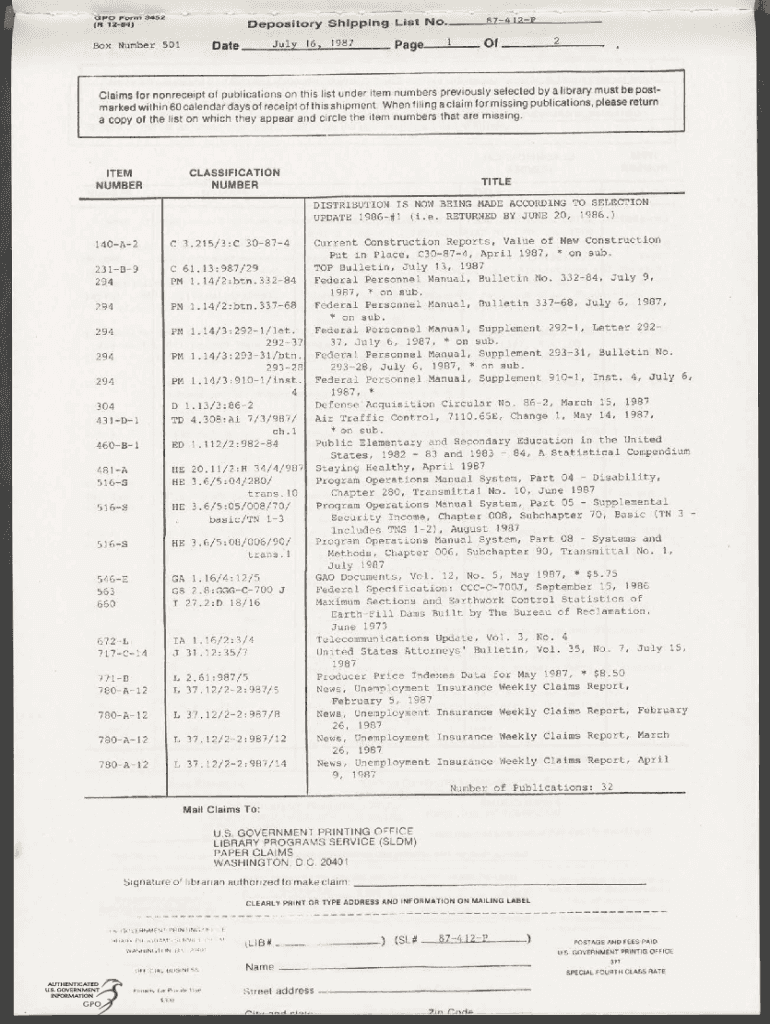

Wo3452GPOFormBoxNumber(R 12:34)ores87412PList No.Shipping16,JulyDate501iSwSuDepository2Of1Page1987a library must be postClaims for nonreceipt of publications on this list under item numbers previously

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign calendar days of receipt

Edit your calendar days of receipt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your calendar days of receipt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit calendar days of receipt online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit calendar days of receipt. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out calendar days of receipt

How to fill out calendar days of receipt

01

To fill out the calendar days of receipt, follow these steps:

02

Start by locating the calendar days of receipt form.

03

Ensure that you have the necessary information available, such as the start and end dates of the receipt period.

04

Begin filling out the form by entering the start date in the designated field. Make sure to follow the specified date format.

05

Move on to the end date field and enter the respective date of the receipt period's end.

06

Double-check all the entered information for accuracy and completeness.

07

Once all the necessary details are provided, submit the form as per the instructions given on the form or by the relevant authority.

08

Keep a copy of the filled-out form for your records.

09

If required, submit the form along with any supporting documents or attachments.

Who needs calendar days of receipt?

01

Calendar days of receipt are typically needed by individuals or organizations that require documentation or proof of the receipt period.

02

Common examples of those who might need calendar days of receipt include:

03

- Employees submitting expense claims or reimbursement requests

04

- Freelancers or self-employed individuals maintaining records for tax purposes

05

- Students or researchers documenting their study or research periods

06

- Businesses or organizations providing evidence of service or delivery periods to clients

07

- Legal professionals keeping track of timelines and deadlines

08

In general, anyone who needs to accurately record the start and end dates of a receipt period can benefit from calendar days of receipt.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit calendar days of receipt from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including calendar days of receipt, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send calendar days of receipt for eSignature?

calendar days of receipt is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit calendar days of receipt online?

The editing procedure is simple with pdfFiller. Open your calendar days of receipt in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

What is calendar days of receipt?

Calendar days of receipt refers to the total number of days, including weekends and holidays, from the date a document is received until a specific deadline.

Who is required to file calendar days of receipt?

Entities that receive specific documents or communications subject to regulatory timelines are required to file calendar days of receipt.

How to fill out calendar days of receipt?

To fill out calendar days of receipt, you need to record the date of receipt, count the total calendar days, and submit the form according to the specified guidelines.

What is the purpose of calendar days of receipt?

The purpose of calendar days of receipt is to ensure compliance with deadlines and regulations by accurately tracking the time elapsed since a document was received.

What information must be reported on calendar days of receipt?

Information that must be reported includes the date of receipt, the type of document received, and the calculated calendar days until the deadline.

Fill out your calendar days of receipt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Calendar Days Of Receipt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.