Get the free Investment Adviser Firm

Show details

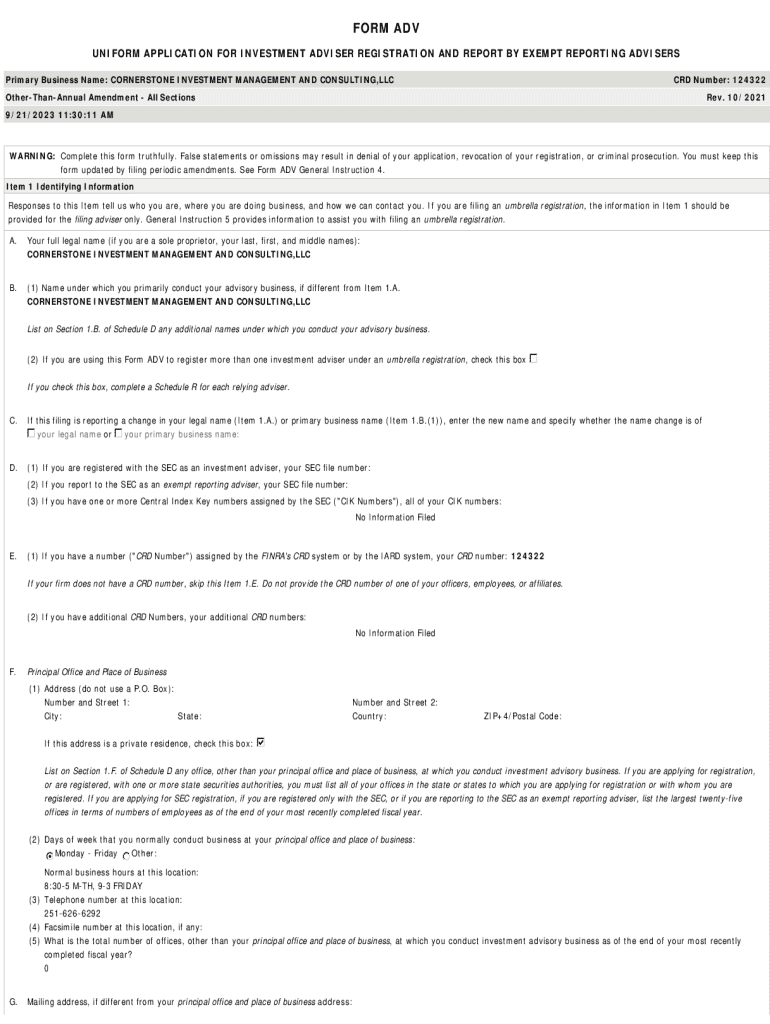

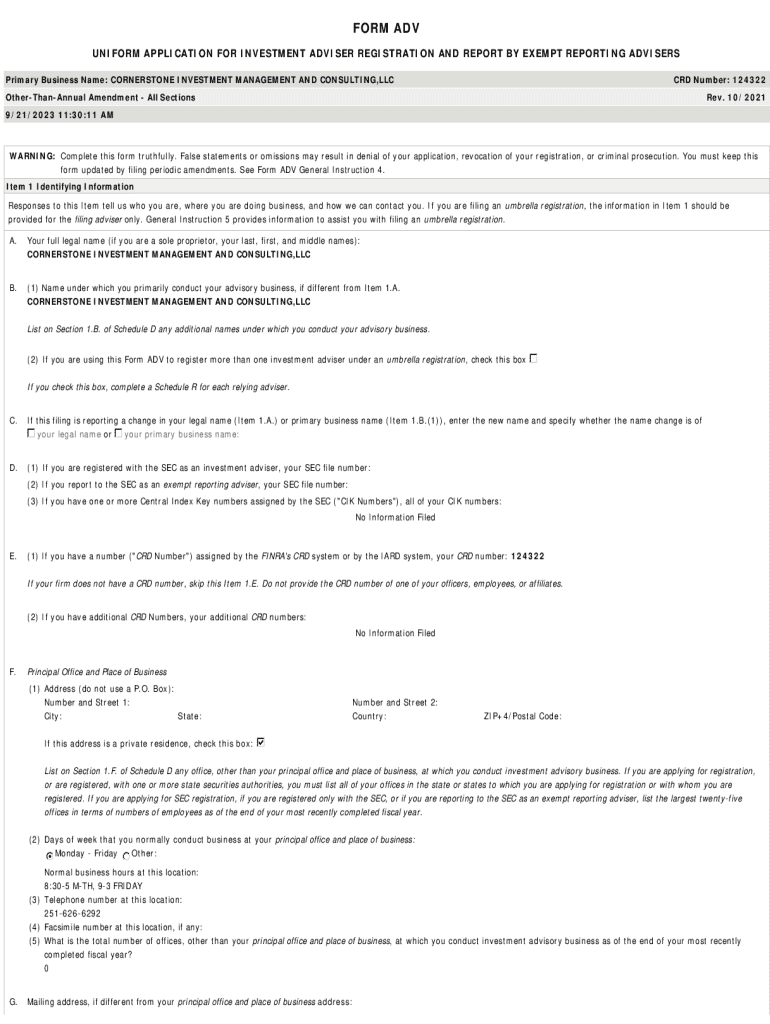

FORM ADV

UNIFORM APPLICATION FOR INVESTMENT ADVISER REGISTRATION AND REPORT BY EXEMPT REPORTING ADVISERS

Primary Business Name: CORNERSTONE INVESTMENT MANAGEMENT AND CONSULTING, LLCCRD Number: 124322OtherThanAnnual

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign investment adviser firm

Edit your investment adviser firm form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your investment adviser firm form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit investment adviser firm online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit investment adviser firm. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out investment adviser firm

How to fill out investment adviser firm

01

Start by gathering all the necessary documents and information required to fill out the investment adviser firm registration. This may include but not limited to: legal entity formation documents, identification documents for key personnel, financial statements, and background information.

02

Familiarize yourself with the regulatory requirements and guidelines for investment adviser registration. This may include understanding the specific rules and regulations set by the regulatory authority responsible for overseeing investment advisers in your jurisdiction.

03

Complete the necessary application forms provided by the regulatory authority. Ensure that all the information provided is accurate and up-to-date.

04

Submit the completed application along with the required supporting documents and any applicable fees. It is important to review the submission checklist provided by the regulatory authority to ensure that nothing is missed.

05

Await the review and approval process. The regulatory authority will conduct a thorough review of the application and may request additional information or clarification if needed.

06

Once the application is approved, you will receive a registration certificate or confirmation from the regulatory authority. Make sure to comply with any post-registration requirements or ongoing compliance obligations as stipulated by the regulatory authority.

Who needs investment adviser firm?

01

Individuals or entities who engage in the business of providing investment advice to others on a professional basis.

02

Financial firms or institutions that manage or oversee the investment activities of clients, such as asset management firms, hedge funds, private equity firms, and mutual funds.

03

Professionals or consultants who provide investment recommendations or analyses to clients as part of their services, such as financial advisors, investment managers, and wealth managers.

04

Startups or entrepreneurs who are planning to establish an investment advisory firm as their core business model.

05

Any individual or entity that is required by law or regulation to register as an investment adviser firm in order to comply with the regulatory requirements and provide their services legally.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my investment adviser firm directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your investment adviser firm along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send investment adviser firm for eSignature?

When your investment adviser firm is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit investment adviser firm in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your investment adviser firm, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

What is investment adviser firm?

An investment adviser firm is a business that provides advice to clients about investment strategies and securities, managing portfolios and offering tailored financial planning services.

Who is required to file investment adviser firm?

Any individual or firm that provides investment advice for compensation, and manages client investments, is required to file as an investment adviser firm, including those offering advice on stocks, bonds, mutual funds, and other investment vehicles.

How to fill out investment adviser firm?

To fill out the investment adviser firm application, one must complete the Form ADV filings, including providing detailed information about the firm's business, types of clients served, and services offered, as well as disclosing any disciplinary history.

What is the purpose of investment adviser firm?

The purpose of an investment adviser firm is to help individuals and institutions make informed investment decisions, manage their assets according to their financial goals, and ensure proper allocation of resources in a manner that aligns with clients' risk tolerance.

What information must be reported on investment adviser firm?

Investment adviser firms must report information such as firm ownership, business structure, the background of key personnel, types of services provided, fees charged, and any material disciplinary information or conflicts of interest.

Fill out your investment adviser firm online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Investment Adviser Firm is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.