Get the free California Pension Valuation / Tracing Intake Form

Show details

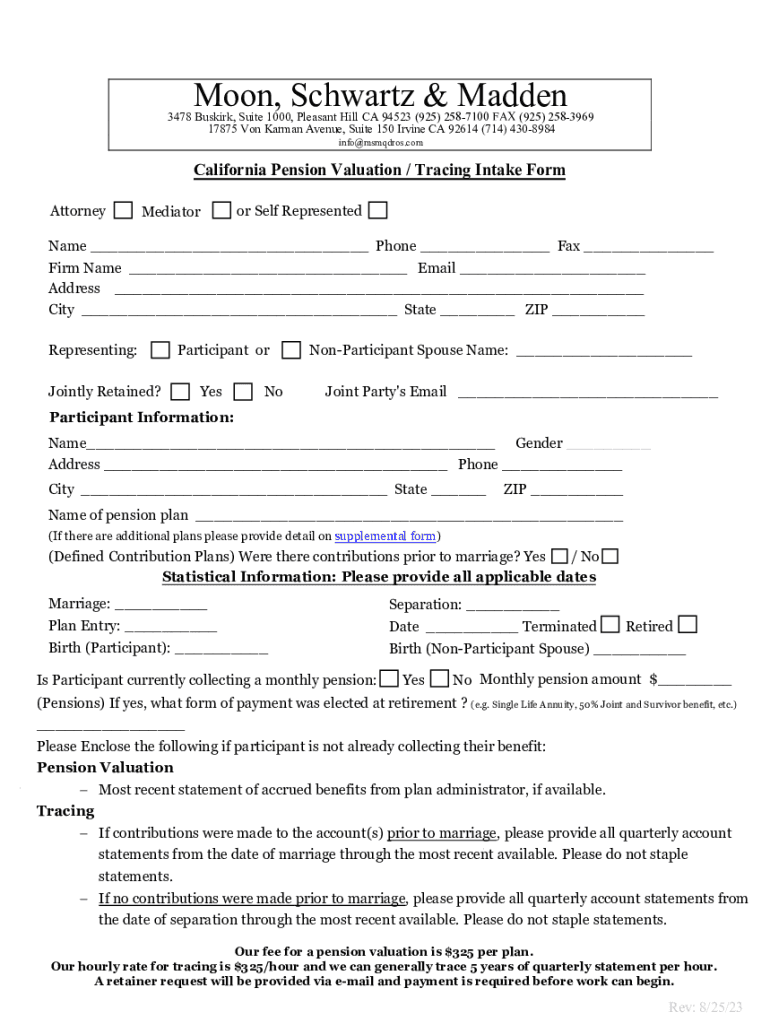

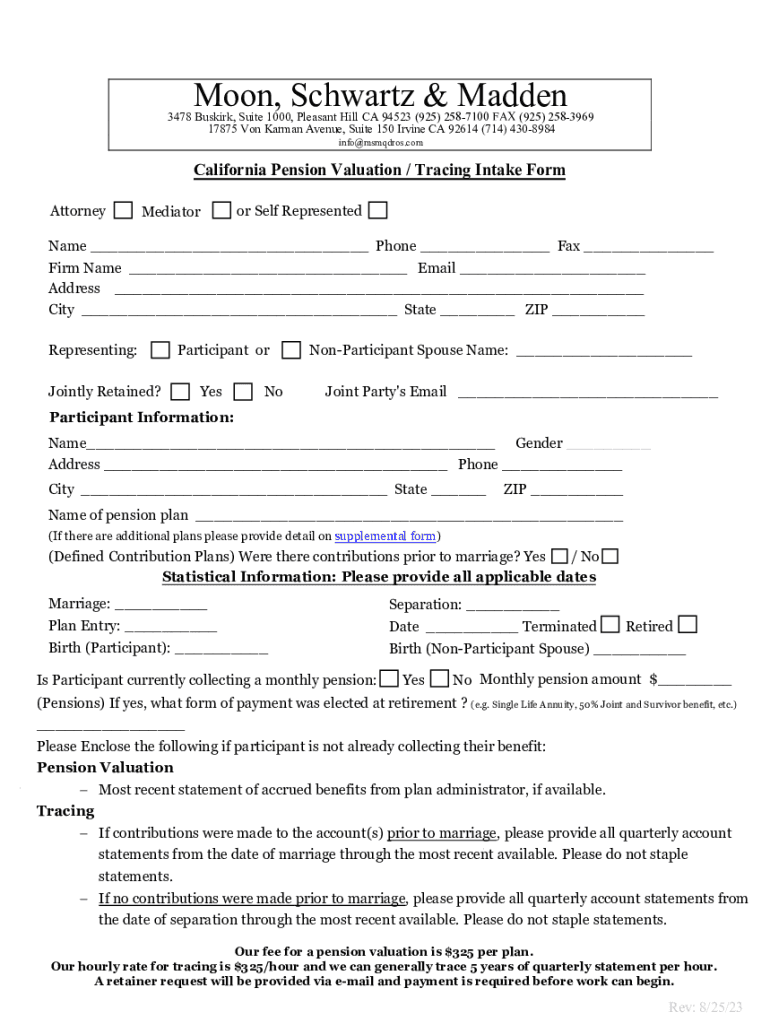

Moon, Schwartz & Madden3478 Buskirk, Suite 1000, Pleasant Hill CA 94523 (925) 2587100 FAX (925) 2583969 17875 Von Karman Avenue, Suite 150 Irvine CA 92614 (714) 4308984 info@msmqdros.comCalifornia

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign california pension valuation tracing

Edit your california pension valuation tracing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california pension valuation tracing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit california pension valuation tracing online

To use the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit california pension valuation tracing. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out california pension valuation tracing

How to fill out california pension valuation tracing

01

To fill out California pension valuation tracing, follow these steps:

02

Gather all relevant documents related to your pension plan, including retirement plan statements, pension plan documents, and any other related paperwork.

03

Identify the valuation date, which is usually provided on the pension plan statement.

04

Determine the total value of the pension plan as of the valuation date.

05

Calculate your percentage of the pension plan, if applicable. This is usually determined by the number of years you have contributed to the plan.

06

Calculate the present value of your portion of the pension plan using a discount rate. This rate is typically provided by the pension plan administrator or can be estimated using financial tools.

07

Fill out the necessary forms or worksheets provided by the California pension valuation tracing system, ensuring all information is accurate and complete.

08

Submit the completed forms along with any supporting documentation to the appropriate California pension valuation tracing office.

09

Follow up with the pension plan administrator to ensure your valuation tracing is processed correctly and to address any additional requirements or steps.

10

Remember to consult with a financial advisor or pension expert for assistance with any complex calculations or legal considerations.

Who needs california pension valuation tracing?

01

California pension valuation tracing is typically needed by individuals who are part of a pension plan in California and wish to determine the value of their pension benefits.

02

This may include individuals who are planning for retirement, going through divorce or separation, or need to report pension values for financial or legal purposes.

03

It is important to consult with a legal or financial professional to determine if California pension valuation tracing is necessary in your specific situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the california pension valuation tracing electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your california pension valuation tracing in seconds.

Can I create an electronic signature for signing my california pension valuation tracing in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your california pension valuation tracing and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I complete california pension valuation tracing on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your california pension valuation tracing, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is california pension valuation tracing?

California pension valuation tracing refers to the process of evaluating and reporting the funding status of pension plans within the State of California. It involves assessing the assets and liabilities of pension plans to ensure they meet their financial obligations.

Who is required to file california pension valuation tracing?

Entities, including public agencies and retirement systems in California that maintain pension plans, are required to file California pension valuation tracing.

How to fill out california pension valuation tracing?

To fill out California pension valuation tracing, an organization must provide detailed financial information about their pension plan, including asset values, liabilities, and actuarial assumptions, using the prescribed forms provided by the California pension authority.

What is the purpose of california pension valuation tracing?

The purpose of California pension valuation tracing is to ensure transparency and compliance in pension funding practices, to monitor the financial health of pension plans, and to protect the interests of pension beneficiaries.

What information must be reported on california pension valuation tracing?

The information that must be reported includes the current value of plan assets, the expected liabilities, actuarial assumptions, contribution rates, and any other relevant financial data that reflects the funding status of the pension plan.

Fill out your california pension valuation tracing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

California Pension Valuation Tracing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.