Get the free Mutual Fund - IRA New Account

Show details

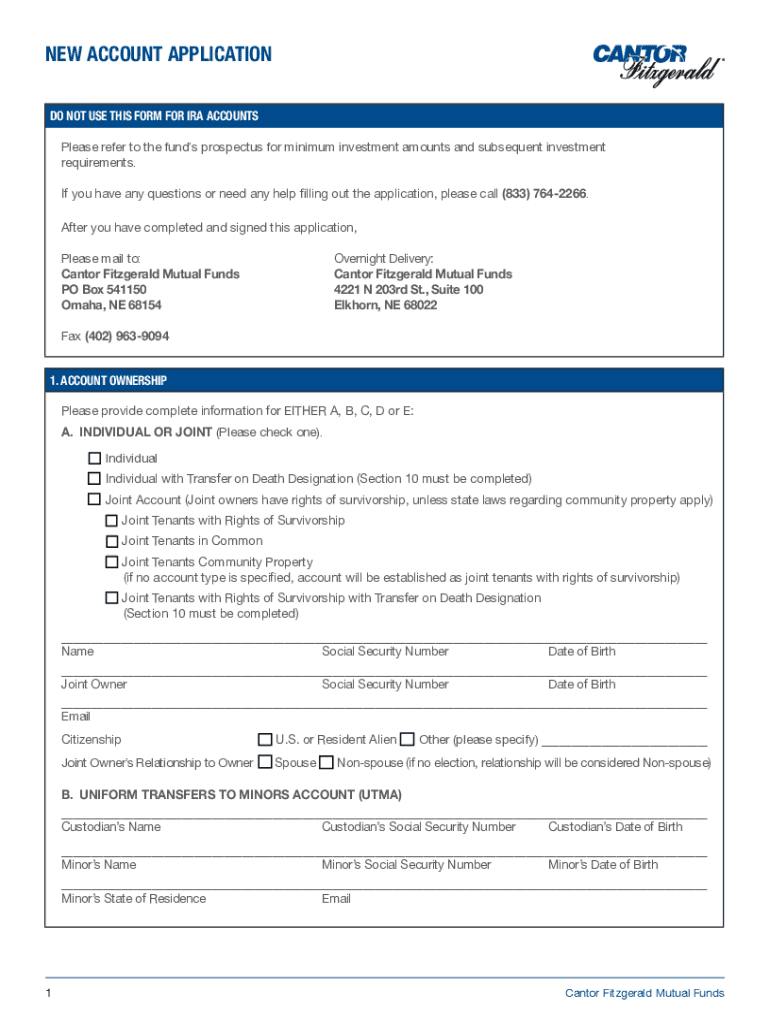

NEW ACCOUNT APPLICATION

DO NOT USE THIS FORM FOR IRA ACCOUNTS

Please refer to the funds' prospectus for minimum investment amounts and subsequent investment

requirements.

If you have any questions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mutual fund - ira

Edit your mutual fund - ira form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mutual fund - ira form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mutual fund - ira online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mutual fund - ira. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mutual fund - ira

How to fill out mutual fund - ira

01

Decide on the type of mutual fund - IRA you want to invest in (such as growth, income, or balanced).

02

Open an IRA account with a financial institution that offers mutual funds.

03

Choose the mutual fund you want to invest in and review its performance history and fees.

04

Fill out the necessary paperwork provided by the financial institution, including information about your investment goals and risk tolerance.

05

Specify the amount you want to invest in the mutual fund and transfer the funds to your IRA account.

06

Monitor the performance of your mutual fund - IRA regularly and make adjustments as needed.

Who needs mutual fund - ira?

01

Individuals who are looking to save for retirement in a tax-advantaged account.

02

Investors who want to diversify their portfolio by investing in a variety of securities through mutual funds.

03

People who prefer a hands-off approach to investing and would rather leave the investment decisions to professional fund managers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete mutual fund - ira online?

With pdfFiller, you may easily complete and sign mutual fund - ira online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I fill out the mutual fund - ira form on my smartphone?

Use the pdfFiller mobile app to fill out and sign mutual fund - ira on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit mutual fund - ira on an iOS device?

You certainly can. You can quickly edit, distribute, and sign mutual fund - ira on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is mutual fund - ira?

A mutual fund IRA is an Individual Retirement Account that allows investors to hold mutual fund shares as part of their retirement savings portfolio. It combines the tax advantages of an IRA with the diversification potential of mutual funds.

Who is required to file mutual fund - ira?

Individuals who have contributed to a mutual fund IRA or are withdrawing funds from it may be required to file certain forms with the IRS to report their accounts and transactions.

How to fill out mutual fund - ira?

To fill out mutual fund IRA paperwork, provide your personal identification information, specify the type of IRA, report your financial contributions, and include any relevant details regarding your mutual fund holdings. Ensure all sections are complete and accurate.

What is the purpose of mutual fund - ira?

The purpose of a mutual fund IRA is to provide a tax-advantaged savings vehicle for retirement, allowing individuals to invest in a diversified portfolio of mutual funds while enjoying tax-deferral on earnings until withdrawal.

What information must be reported on mutual fund - ira?

Information that must be reported on a mutual fund IRA includes account holder details, contributions made, withdrawals taken, and any gains or losses on investments held within the IRA.

Fill out your mutual fund - ira online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mutual Fund - Ira is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.