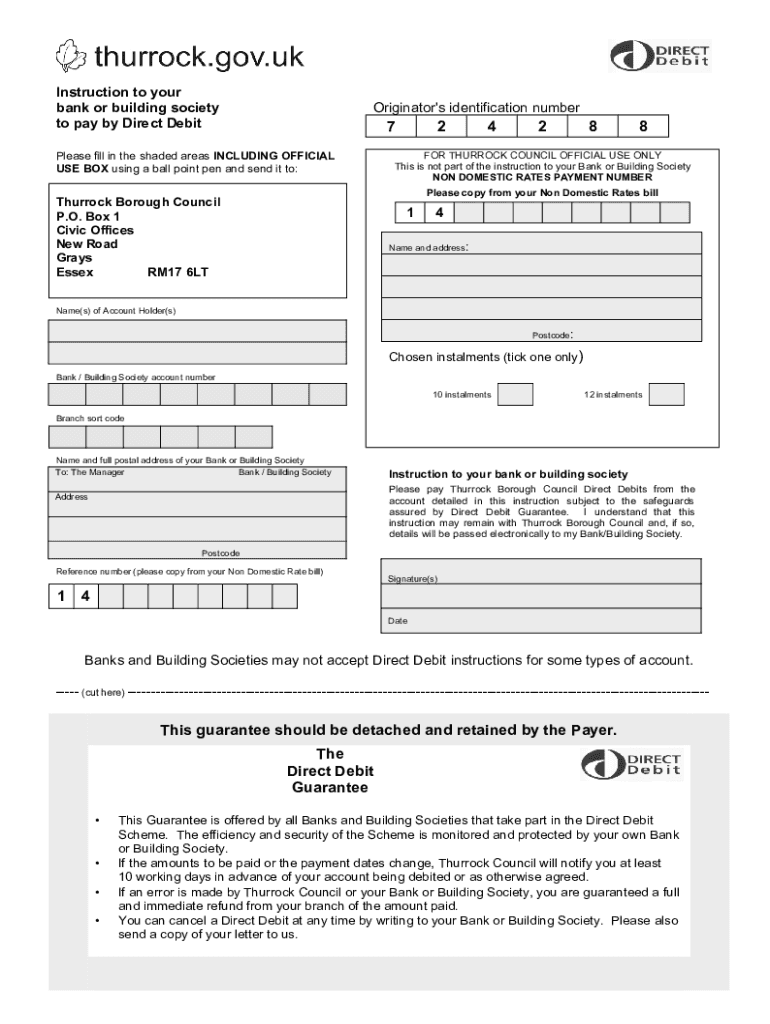

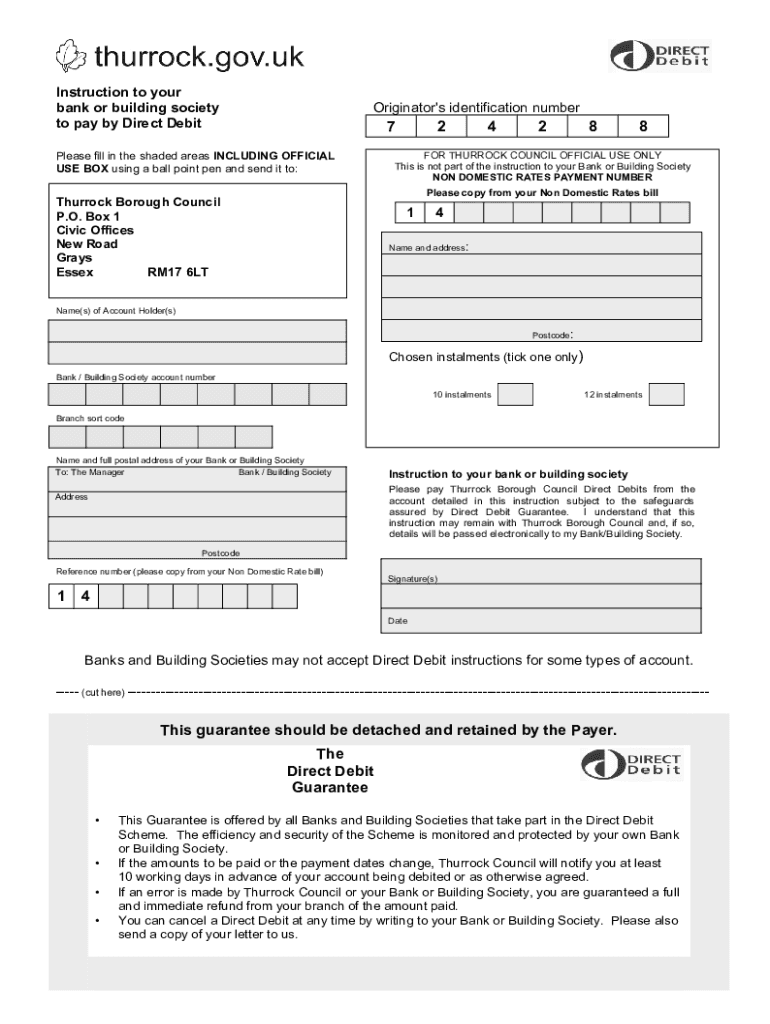

UK Thurrock Council Direct Debit Form for Business Rates 2017-2026 free printable template

Show details

Instruction to your bank or building society to pay by Direct DebitOriginator\'s identification number7Please fill in the shaded areas INCLUDING OFFICIAL USE BOX using a ball point pen and send it

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign thurrock council business rates form

Edit your UK Thurrock Council Direct Debit Form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK Thurrock Council Direct Debit Form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK Thurrock Council Direct Debit Form online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit UK Thurrock Council Direct Debit Form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK Thurrock Council Direct Debit Form for Business Rates Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK Thurrock Council Direct Debit Form

How to fill out direct debit form rents

01

Obtain the direct debit form from your landlord or property management company.

02

Fill in your personal details such as name, address, and contact information.

03

Provide your bank details including account number and sort code.

04

Specify the amount and frequency of the rent payments to be debited from your account.

05

Sign and date the form to authorize the direct debit payments.

Who needs direct debit form rents?

01

Tenants who wish to automate their rent payments without the need for manual transfers each month.

02

Landlords or property management companies who prefer a reliable and consistent method of collecting rent payments from tenants.

Fill

form

: Try Risk Free

People Also Ask about

How do I pay my Thurrock rent?

How to pay your rent and charges Pay by direct debit or standing order. You can set up a direct debit to pay your rent from your bank account every month. Pay online. You can pay online using a debit or credit card. Pay by phone. PayPoint. Post Office. Our bank details. Rent payment cards.

How do I pay council tax in England?

You can usually pay your Council Tax online. You can also use 'Paypoint', 'Payzone' or 'Quickcards' for cash payments at post offices, banks, newsagents and convenience stores. Check your bill to find out which other payment methods you can use.

How much is Band B council tax in Thurrock?

get your bills electronically. check your payment amounts and dates. check the household details we use to work out your bill. set up a direct debit.How much you pay. Valuation bandCouncil tax 2023/24Council tax 2022/23A£1,265.94£1,156.74B£1,476.93£1,349.53C£1,687.92£1,542.32D£1,898.91£1,735.114 more rows

How do I set up a Direct Debit for council tax in Dudley?

Setting up a direct debit to pay your council tax in monthly instalments is simple, call 0300 555 8000 (for quality and training purposes calls may be recorded and monitored) to sign up over the phone, or just complete and return a direct debit instruction.

How much is council tax in Thurrock?

get your bills electronically. check your payment amounts and dates. check the household details we use to work out your bill.How much you pay. Valuation bandCouncil tax 2023/24Council tax 2022/23A£1,265.94£1,156.74B£1,476.93£1,349.53C£1,687.92£1,542.32D£1,898.91£1,735.114 more rows

How much is council tax going up in Thurrock?

At a meeting of Full Council on Wednesday 1 March, Thurrock councillors approved a council tax increase of 7.99%, plus a 2% adult social care precept. The changes will take affect from 1 April 2023.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find UK Thurrock Council Direct Debit Form?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific UK Thurrock Council Direct Debit Form and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an eSignature for the UK Thurrock Council Direct Debit Form in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your UK Thurrock Council Direct Debit Form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How can I edit UK Thurrock Council Direct Debit Form on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit UK Thurrock Council Direct Debit Form.

What is direct debit form rents?

A direct debit form for rents is a document that authorizes landlords to automatically withdraw rent payments from a tenant's bank account on specified dates.

Who is required to file direct debit form rents?

Tenants who wish to set up automatic rent payments are required to fill out and submit a direct debit form to their landlords.

How to fill out direct debit form rents?

To fill out a direct debit form for rents, provide your personal information, the landlord's details, your bank account information, the amount to be debited, and the frequency of payments.

What is the purpose of direct debit form rents?

The purpose of a direct debit form for rents is to ensure timely and automatic payment of rent, reducing the risk of late payments and simplifying the payment process for both tenants and landlords.

What information must be reported on direct debit form rents?

The information that must be reported includes the tenant's name, address, bank account details, landlord's name, amount of rent, and payment schedule.

Fill out your UK Thurrock Council Direct Debit Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK Thurrock Council Direct Debit Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.