Get the free required to file financial disclosure statements shall file a financial disclosure s...

Show details

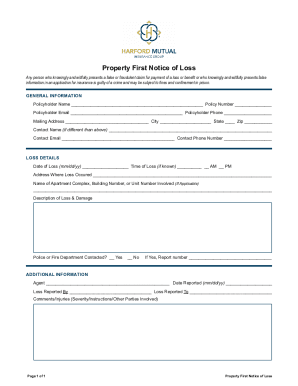

LOUISIANA BOARD OF ETHICS Post Office Box 4368 Baton Rouge, Louisiana 70821 TIER 3 PERSONAL FINANCIAL DISCLOSURE STATEMENT (FOR CANDIDATES) Pursuant to La. R.S. 18:1495.7, any person who becomes a

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign required to file financial

Edit your required to file financial form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your required to file financial form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing required to file financial online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit required to file financial. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out required to file financial

How to fill out required to file financial:

01

Start by gathering all the necessary financial documents, such as bank statements, income statements, and expense records. These documents will be used to accurately report your financial status.

02

Carefully review the required forms or templates provided by the organization or authority requesting the financial information. This will help you understand what specific details need to be included in the filing.

03

Begin filling out the forms by entering your personal information, such as your name, address, and contact details. Double-check for any spelling mistakes or errors.

04

Proceed to input your financial information. This may include your income sources, total assets, total liabilities, and any outstanding debts. Be sure to provide accurate and up-to-date figures to ensure the information is reliable.

05

If applicable, provide supporting documents or attachments to validate the information you have provided. For example, include copies of bank statements, tax returns, or receipts that support your reported income or expenses.

06

Take your time to review the filled forms, ensuring that all necessary fields are completed, and that the information is accurate and consistent. Mistakes or missing information may lead to delays or complications in the processing of your filing.

07

Once you are confident that everything is filled out correctly, sign and date the forms as required. This signifies that the information provided is true and accurate to the best of your knowledge.

08

Make copies of all the completed forms and supporting documents for your own records. It is recommended to keep these in a secure folder or file for future reference.

09

Submit the filled out forms and any required attachments according to the instructions provided by the organization or authority requesting the financial information. This may involve mailing the documents, uploading them electronically, or physically delivering them.

10

Finally, follow up with the organization or authority to ensure that they have received your financial filing and to inquire about any further steps or actions required.

Who needs required to file financial?

01

Individuals: Individuals may be required to file financial statements for various reasons, such as loan applications, mortgage approvals, or tax reporting. This ensures transparency and accountability in their financial affairs.

02

Small Businesses: Small businesses often need to file financial statements to comply with legal and regulatory requirements. These reports provide insight into the financial health of the business and are essential for assessing creditworthiness or applying for loans.

03

Nonprofit Organizations: Nonprofit organizations are generally required to file financial statements to maintain their nonprofit status and to demonstrate transparency in their financial operations. These filings help donors and stakeholders understand how funds are being utilized.

04

Government Entities: Government agencies and departments may require the filing of financial statements to evaluate the financial performance of organizations or individuals. These filings ensure compliance with laws and regulations and support decision-making processes.

05

Investors and Shareholders: Investors and shareholders often require companies to file financial statements to assess the financial soundness and profitability of their investments. These reports provide insight into the performance, assets, and liabilities of a company.

06

Regulatory Authorities: Regulatory bodies, such as financial regulators or securities commissions, may require financial statements to monitor and regulate the activities of financial institutions, including banks, insurance companies, or investment firms. These filings help ensure compliance with regulations and protect the interests of consumers and investors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is required to file financial?

Financial reports, documents, and statements are required to file financial.

Who is required to file required to file financial?

Businesses, organizations, and individuals who have financial transactions need to file required to file financial.

How to fill out required to file financial?

Required to file financial can be filled out by providing accurate and detailed information about financial transactions and activities.

What is the purpose of required to file financial?

The purpose of required to file financial is to provide transparency and accountability in financial matters.

What information must be reported on required to file financial?

Information such as income, expenses, assets, liabilities, and financial performance must be reported on required to file financial.

How do I edit required to file financial online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your required to file financial to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I edit required to file financial on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign required to file financial right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I complete required to file financial on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your required to file financial. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Fill out your required to file financial online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Required To File Financial is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.