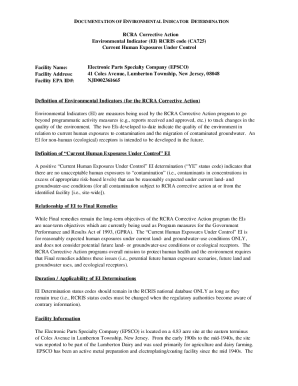

Get the free Term Chattel Loan Appraisal Analysis/Adjustment Worksheet - fsa usda

Show details

Original Chattel Appraisal Date: MN 2-FLP Exhibit 5 Par. 181 Names: Term Chattel Loan Appraisal Analysis/Adjustment Worksheet # Security Item Beginning Appraised Value 1* (-) Insecurity Collateral

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign term chattel loan appraisal

Edit your term chattel loan appraisal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your term chattel loan appraisal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit term chattel loan appraisal online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit term chattel loan appraisal. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out term chattel loan appraisal

How to fill out term chattel loan appraisal:

01

Start by gathering all the necessary information and documents related to the chattel being appraised. This may include the chattel's description, make and model, condition, year of manufacture, and any relevant maintenance or repair records.

02

Begin the appraisal form by entering the basic details such as your name, contact information, and the date of appraisal.

03

Provide the details of the borrower or the person applying for the term chattel loan. This may include their name, address, contact information, and any other relevant identification details.

04

Clearly describe the purpose of the term chattel loan appraisal, including the reason for the loan application and how the funds will be utilized. This helps the appraiser understand the context and value of the chattel being appraised.

05

Enter the terms and conditions of the loan, such as the loan amount, interest rate, repayment period, and any collateral or security provided. This ensures that the appraiser has a complete understanding of the financial aspects associated with the loan.

06

Provide a comprehensive description of the chattel being appraised. Include details such as the make, model, year of manufacture, serial number, condition, and any unique features or modifications. Attach photographs if required.

07

Evaluate the market value of the chattel by conducting research and considering factors such as age, condition, demand, and comparable sales in the market. This helps the appraiser determine an accurate value for the chattel.

08

Include any additional information or supporting documents that may be relevant to the appraisal, such as maintenance records, service history, or any appraisals done in the past.

Who needs term chattel loan appraisal:

01

Individuals or businesses seeking a loan secured by tangible assets such as machinery, vehicles, or equipment may need a term chattel loan appraisal. This helps lenders assess the value of the collateral being offered.

02

Financial institutions, banks, or credit unions that provide term chattel loans require appraisals to ensure appropriate loan-to-value ratios and to mitigate any potential risks associated with the loan.

03

Insurance companies may also request a term chattel loan appraisal to establish the insurable value of the asset being used as collateral or to determine claim settlements in case of damage or loss.

In summary, filling out a term chattel loan appraisal requires gathering necessary information about the chattel, providing personal and loan details, describing the chattel in detail, evaluating its market value, and attaching any supporting documents. Both individuals/businesses seeking term chattel loans and financial institutions may need a term chattel loan appraisal.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is term chattel loan appraisal?

A chattel loan appraisal is an estimation of the value of personal property offered as collateral for a loan.

Who is required to file term chattel loan appraisal?

The lender is usually required to file a term chattel loan appraisal.

How to fill out term chattel loan appraisal?

To fill out a chattel loan appraisal, you need to provide detailed information about the personal property being used as collateral.

What is the purpose of term chattel loan appraisal?

The purpose of a chattel loan appraisal is to determine the value of the collateral in case the borrower defaults on the loan.

What information must be reported on term chattel loan appraisal?

The term chattel loan appraisal must include a description of the property, its condition, and an estimate of its value.

How can I manage my term chattel loan appraisal directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your term chattel loan appraisal along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send term chattel loan appraisal to be eSigned by others?

When you're ready to share your term chattel loan appraisal, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I fill out the term chattel loan appraisal form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign term chattel loan appraisal and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your term chattel loan appraisal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Term Chattel Loan Appraisal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.