Get the free 2023 Preliminary Tax Roll - Taxable Value Summary

Show details

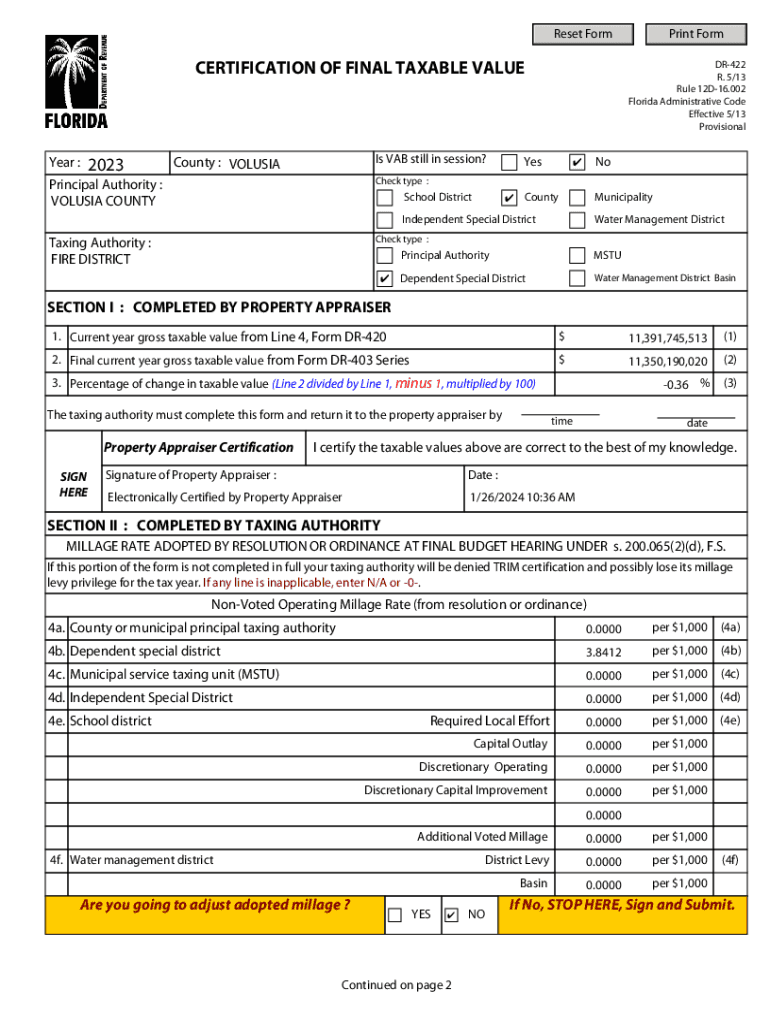

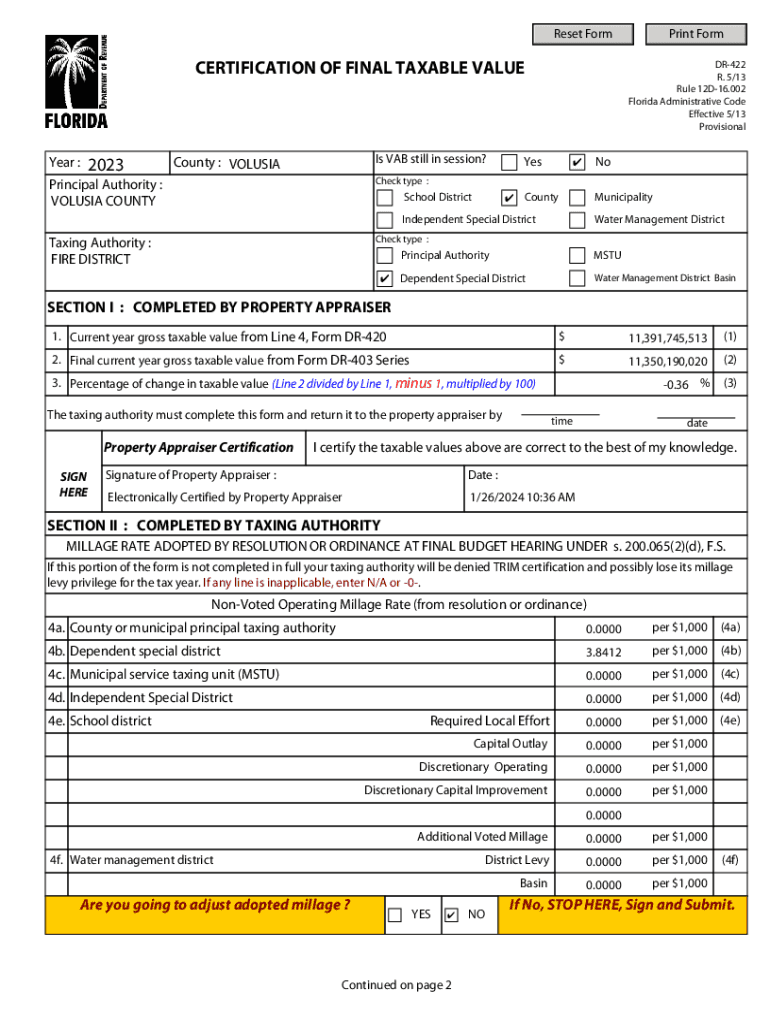

Reset Recertification OF FINAL TAXABLE Valerie :2023Is VAB still in session? County : VOLUSIAPrincipal Authority :

VOL USIA Soundcheck type :Taxing Authority :

FIRE DISTRICTCheck type :School DistrictDR422

R.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2023 preliminary tax roll

Edit your 2023 preliminary tax roll form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2023 preliminary tax roll form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2023 preliminary tax roll online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2023 preliminary tax roll. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2023 preliminary tax roll

How to fill out 2023 preliminary tax roll

01

Obtain the blank 2023 preliminary tax roll form.

02

Fill in the property owner's information, including name, address, and contact information.

03

List each property separately on the form, including the property address and legal description.

04

Calculate the assessed value of each property based on the current tax assessment guidelines.

05

Determine the applicable tax rate for each property based on the current municipal tax rates.

06

Multiply the assessed value of each property by the tax rate to calculate the property tax amount.

07

Ensure all calculations are accurate and double-check the information before submitting the completed form.

Who needs 2023 preliminary tax roll?

01

Property assessors

02

Property tax administrators

03

Local government agencies

04

Property owners

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2023 preliminary tax roll for eSignature?

2023 preliminary tax roll is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make changes in 2023 preliminary tax roll?

With pdfFiller, it's easy to make changes. Open your 2023 preliminary tax roll in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I sign the 2023 preliminary tax roll electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your 2023 preliminary tax roll in minutes.

What is preliminary tax roll?

A preliminary tax roll is an initial listing of properties and their assessed values, prepared by the local government to determine the amount of property taxes owed for the upcoming tax year.

Who is required to file preliminary tax roll?

Typically, property assessors and local governments are required to file a preliminary tax roll, which includes all taxable properties in their jurisdiction.

How to fill out preliminary tax roll?

To fill out a preliminary tax roll, an assessor must collect property data, determine assessed values, complete required forms, and submit the listings to the appropriate taxing authority.

What is the purpose of preliminary tax roll?

The purpose of a preliminary tax roll is to provide a basis for determining property taxes and ensures that property owners are notified of their assessed values before finalization.

What information must be reported on preliminary tax roll?

The preliminary tax roll must report information such as property owner names, property addresses, assessed values, property descriptions, and any exemptions or abatements.

Fill out your 2023 preliminary tax roll online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2023 Preliminary Tax Roll is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.