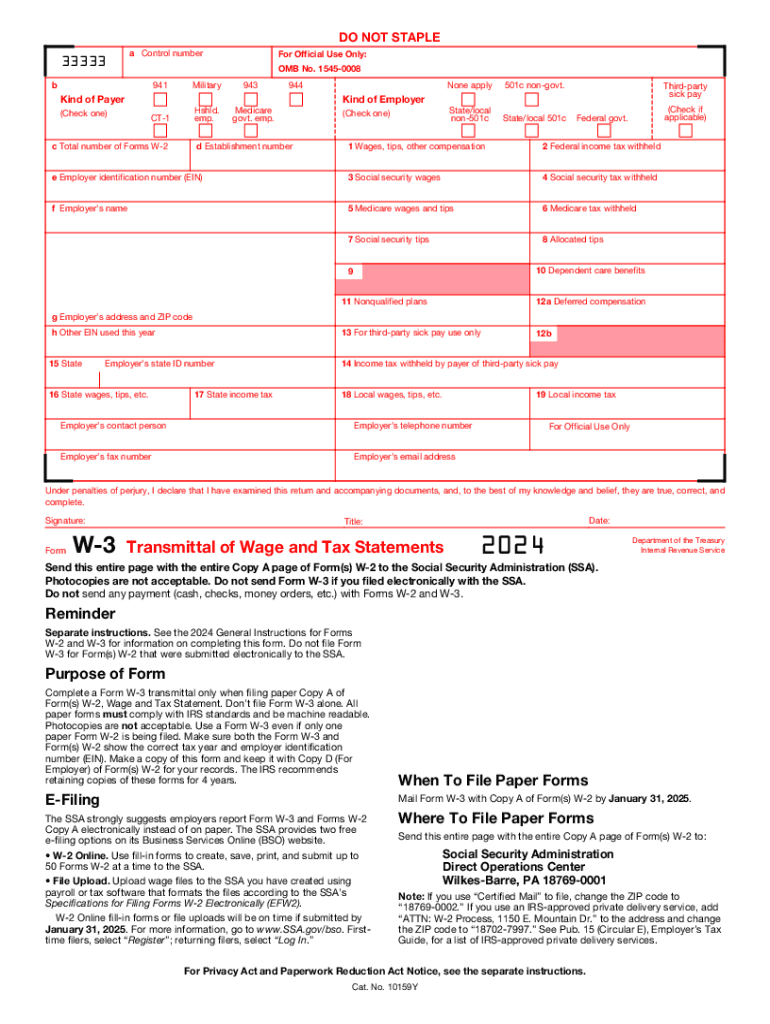

IRS W-3 2024 free printable template

Instructions and Help about W-3 transmittal of

How to edit W-3 transmittal of

How to fill out W-3 transmittal of

Latest updates to W-3 transmittal of

All You Need to Know About W-3 transmittal of

What is W-3 transmittal of?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS W-3

What should I do if I realize there’s an error in my submitted W-3 transmittal?

If you discover an error after filing, you can submit a corrected W-3 transmittal. Make sure to clearly indicate the changes on the corrected form and include any necessary documentation to support your corrections. It's essential to take action promptly to avoid potential penalties or issues with the IRS.

How can I check the status of my W-3 transmittal after submission?

To verify the status of your submitted W-3 transmittal, you can contact the IRS or use any online tracking services they provide for e-filed forms. Keep your submission confirmation on hand, as it will help in the inquiry process about your filing status.

Are electronic signatures valid when submitting a W-3 transmittal?

Yes, electronic signatures are acceptable for W-3 transmittals filed electronically, provided that the e-filing software you are using complies with IRS requirements. Always ensure that your electronic filing method meets all legal standards for security and verification.

What should I consider if I'm filing a W-3 transmittal for a foreign payee?

When filing a W-3 transmittal for a foreign payee, there are specific requirements and forms that must accompany it, like the Form 1042-S. Ensure that you provide accurate tax identification numbers and documentation, and confirm the tax treaty benefits applicable to the foreign individual.

What are common mistakes to avoid when submitting the W-3 transmittal?

Common mistakes when submitting a W-3 transmittal include incorrect information on payee names or taxpayer identification numbers, failing to sign the form if required, and not including all necessary accompanying documents. Double-check your form against IRS guidelines to prevent these common pitfalls.

See what our users say