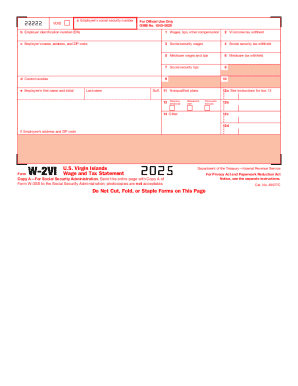

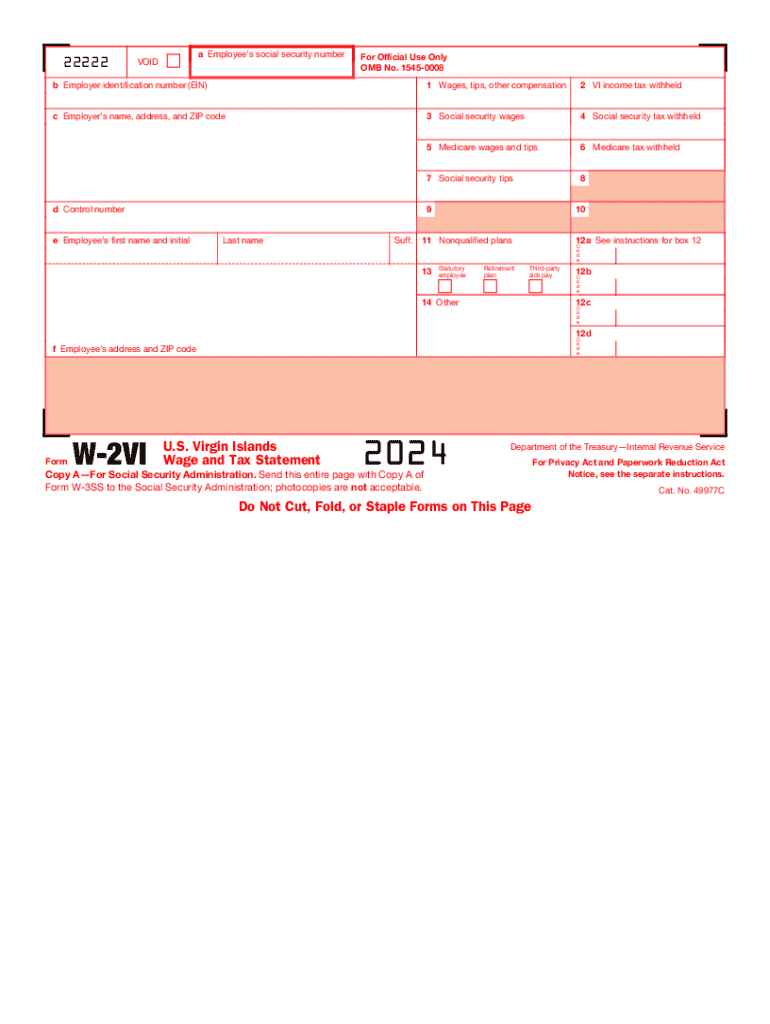

IRS W-2VI 2024 free printable template

Instructions and Help about W 2VI

How to edit W 2VI

How to fill out W 2VI

Latest updates to W 2VI

All You Need to Know About W 2VI

What is W 2VI?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS W-2VI

What should I do if I realize I've made an error after filing my w 2vi?

If you discover a mistake after submitting your w 2vi, it's important to file an amended version as soon as possible. You can correct most errors by using Form W-2c, which allows you to adjust the information you previously submitted. Make sure to double-check the details you're amending to avoid future issues.

How can I verify if my w 2vi has been received and processed?

To confirm the receipt of your w 2vi, you can track the status through the IRS's online system if e-filed, or check with your financial institution or accounting service if it was sent by mail. Some common e-file rejection codes can signal issues to address immediately, so stay alert for any notices.

What are some common mistakes to avoid when filing the w 2vi?

When filing the w 2vi, ensure that the Social Security numbers are correct and match the IRS records. Common errors include wrong income reporting and incorrect formatting. Double-check that all necessary boxes are filled out before submission to minimize the chance of rejection or delays.

What do I need to know about e-signatures when filing my w 2vi?

E-signatures are generally acceptable when filing the w 2vi electronically, provided that the service you are using supports this feature. Ensure that you retain the necessary electronic records for your files and maintain compliance with applicable e-sign regulations.

How should I prepare if I receive an audit notice related to my w 2vi filing?

If you receive an audit notice concerning your w 2vi, gather all related documentation, such as your filed forms, supporting records, and any correspondence you’ve had with the IRS. Respond promptly to the notice and follow the instructions given, ensuring you have clear records to substantiate your reported information.