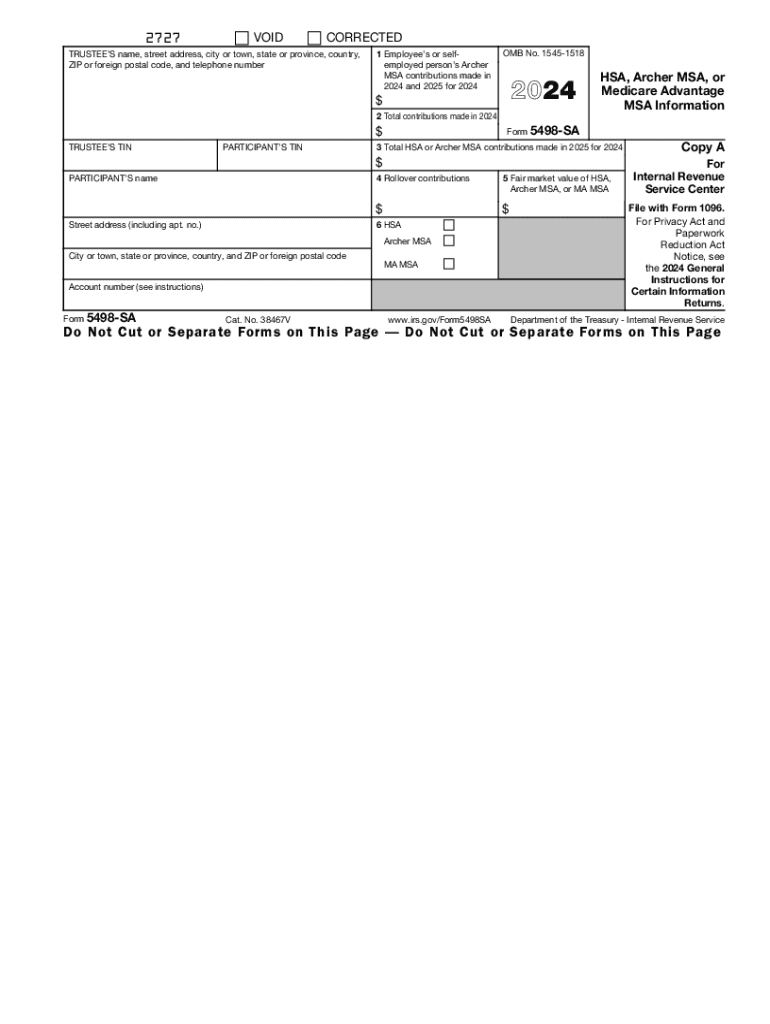

IRS 5498-SA 2024 free printable template

Instructions and Help about IRS 5498-SA

How to edit IRS 5498-SA

How to fill out IRS 5498-SA

Latest updates to IRS 5498-SA

About IRS 5498-SA 2024 previous version

What is IRS 5498-SA?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 5498-SA

What should I do if I discover an error after submitting the IRS 5498-SA?

If you find an error after submission, you will need to file a corrected IRS 5498-SA. Make sure to indicate that the form is a correction, and provide the correct information. It's important to submit it promptly to ensure accurate reporting to the IRS.

How can I verify that my IRS 5498-SA form was received by the IRS?

To check the status of your IRS 5498-SA, you can contact the IRS directly or check through your authorized e-file provider if you submitted electronically. Keep your records handy, as they will help you verify the submission details.

Are e-signatures accepted for the IRS 5498-SA?

Yes, e-signatures are typically accepted for the IRS 5498-SA form when filed electronically. Ensure your e-filing software supports this feature and adheres to IRS regulations regarding electronic submissions.

What common mistakes should I avoid when filing the IRS 5498-SA?

Some common errors include incorrect taxpayer identification numbers, mailing to the wrong address, and failing to report contributions accurately. Double-check all entries and ensure compliance with filing requirements to avoid these issues.

What should I do if my IRS 5498-SA submission is rejected?

If your submission is rejected, you will receive an error code detailing the reason. Follow the instructions specific to the error to correct it, and resubmit the IRS 5498-SA promptly. Keep track of any communication regarding the rejection for your records.