Get the free California Reverse Mortgage Application Process

Show details

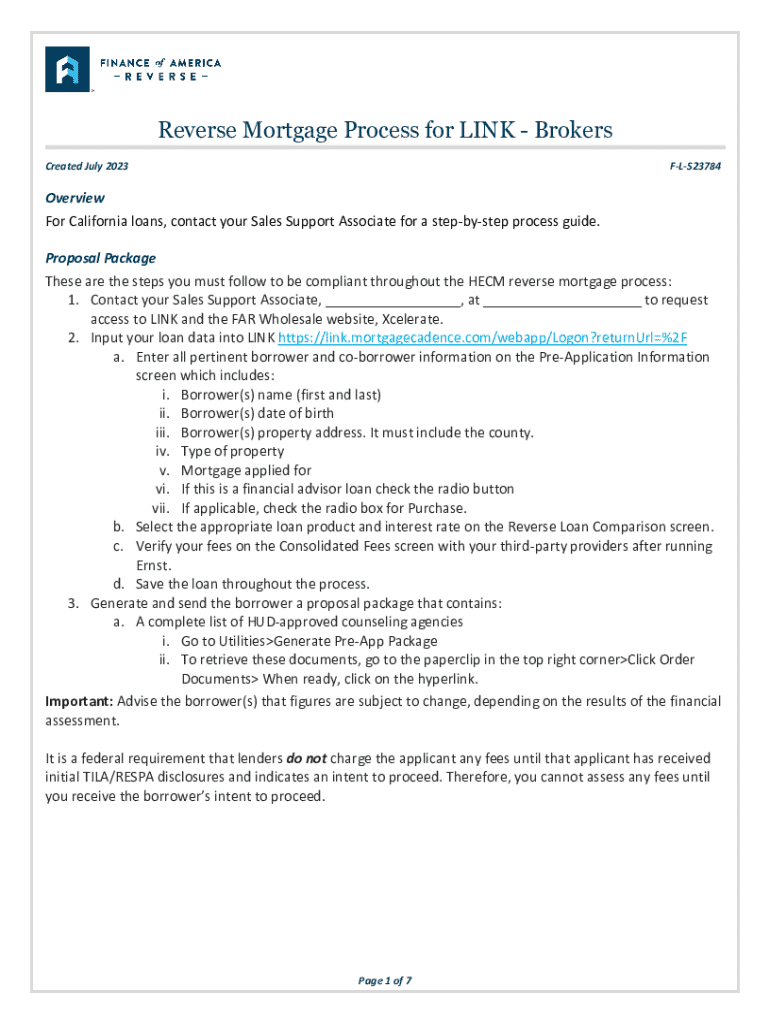

Reverse Mortgage Process for LINK Brokers

Created July 2023FLS23784Overview

For California loans, contact your Sales Support Associate for a stepsister process guide.

Proposal Package

These are the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign california reverse mortgage application

Edit your california reverse mortgage application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california reverse mortgage application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit california reverse mortgage application online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit california reverse mortgage application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out california reverse mortgage application

How to fill out california reverse mortgage application

01

Contact the lender or financial institution offering reverse mortgages in California.

02

Schedule an appointment with a loan officer to discuss your financial situation and determine if you qualify for a reverse mortgage.

03

Complete the application form provided by the lender accurately and honestly.

04

Submit any required documentation, such as proof of income, identification, and property ownership.

05

Attend any required counseling sessions as mandated by the Department of Housing and Urban Development (HUD).

06

Review the terms of the reverse mortgage agreement carefully before signing.

Who needs california reverse mortgage application?

01

Homeowners in California who are 62 years of age or older and own their primary residence outright or have a low mortgage balance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the california reverse mortgage application in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your california reverse mortgage application.

How can I edit california reverse mortgage application on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing california reverse mortgage application.

Can I edit california reverse mortgage application on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign california reverse mortgage application right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is california reverse mortgage application?

The California reverse mortgage application is a process through which homeowners aged 62 and older can apply for a loan that allows them to convert a portion of their home equity into cash without having to sell their home.

Who is required to file california reverse mortgage application?

Homeowners aged 62 and older who wish to access their home equity through a reverse mortgage must file the application.

How to fill out california reverse mortgage application?

To fill out the California reverse mortgage application, homeowners need to provide personal information, details about their property, financial information, and any other required documentation as specified by the lender.

What is the purpose of california reverse mortgage application?

The purpose of the California reverse mortgage application is to enable eligible seniors to access their home equity as a source of income, helping them to cover living expenses, healthcare costs, or other financial needs.

What information must be reported on california reverse mortgage application?

Applicants must report personal identifying information, property details, income sources, debts, and other financial obligations on the California reverse mortgage application.

Fill out your california reverse mortgage application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

California Reverse Mortgage Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.