Get the free VAT Invoice Template

Show details

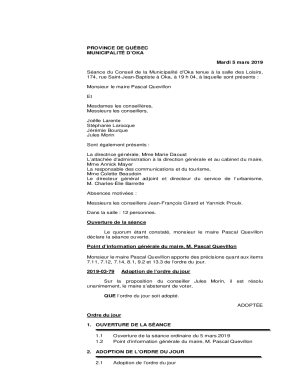

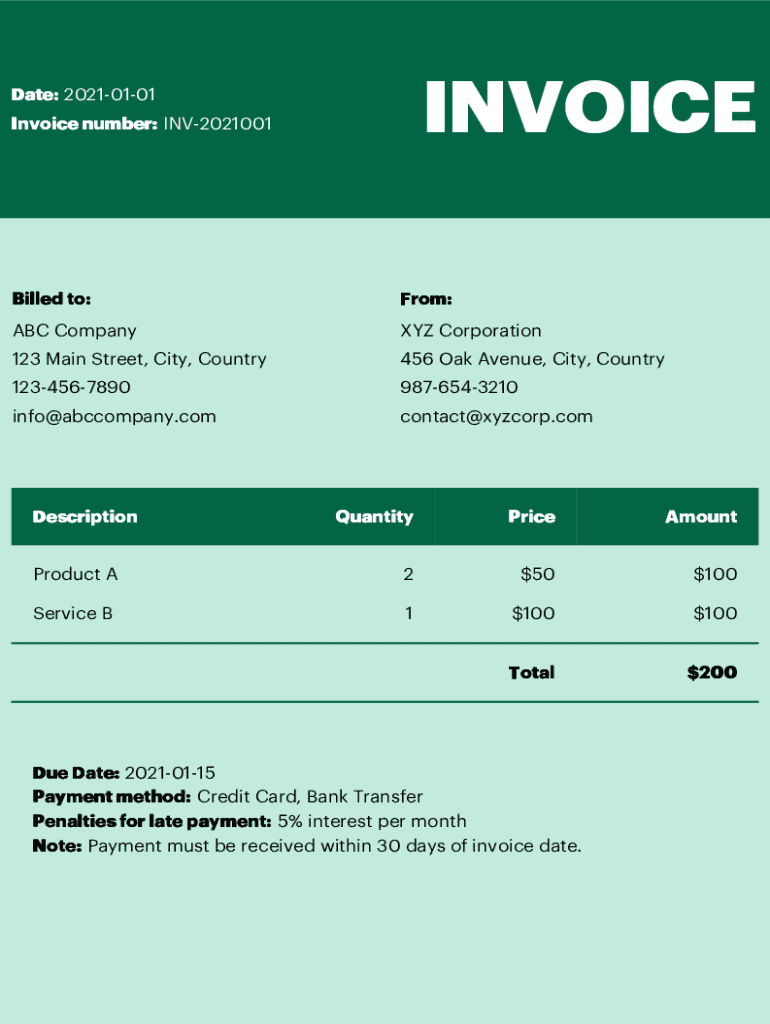

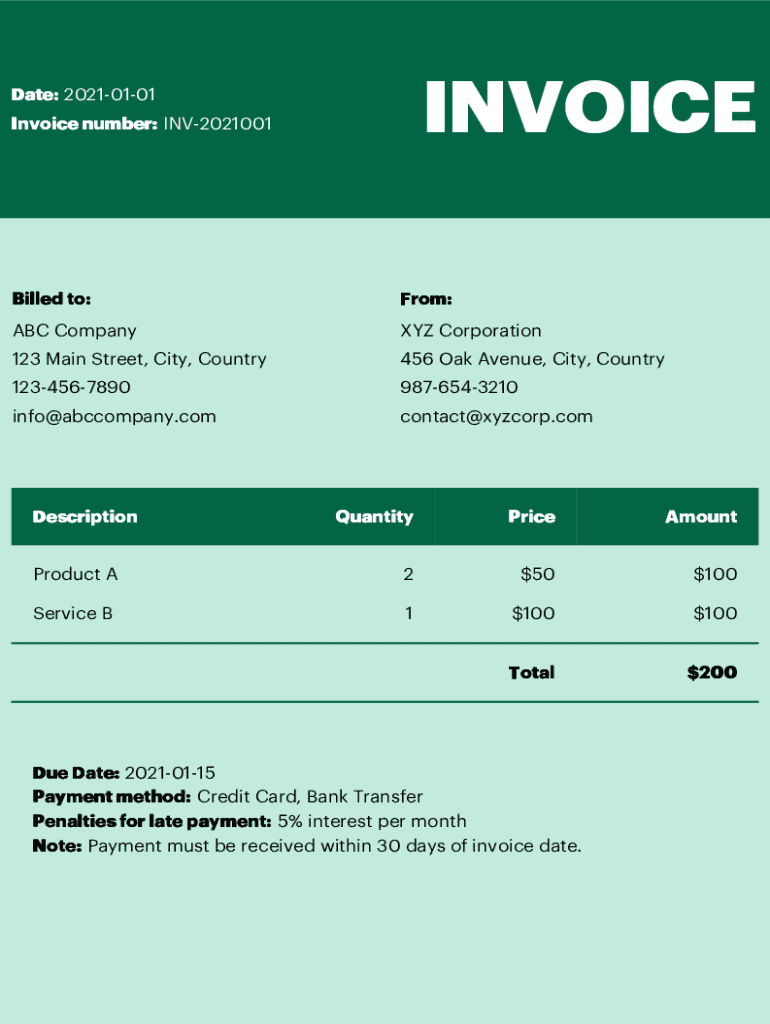

INVOICED ate: 20210101

Invoice number: INV2021001Billed to:From:ABC Company XYZ Corporation123 Main Street, City, Country456 Oak Avenue, City, Country12345678909876543210info@abccompany.comcontact@xyzcorp.comDescriptionQuantityPriceAmountP$2duct

We are not affiliated with any brand or entity on this form

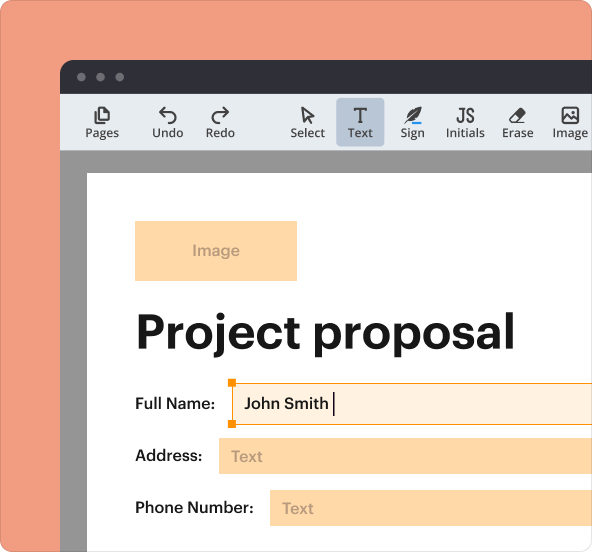

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is vat invoice template

A VAT invoice template is a pre-designed document that incorporates required elements for invoicing and is compliant with VAT regulations.

pdfFiller scores top ratings on review platforms

Who needs vat invoice template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to VAT Invoice Template Form

How to fill out a VAT invoice template form

Filling out a VAT invoice template form requires attention to detail to ensure compliance and accuracy. Start by including the relevant details like invoice number, date, billed to information, and payment terms. Properly structuring a VAT invoice will aid in avoiding common mistakes and streamline your invoicing process.

What is a VAT invoice?

A VAT (Value Added Tax) invoice is a crucial document for businesses dealing with VAT. It reflects the tax charged on goods and services sold, allowing businesses to reclaim VAT on purchases. Moreover, it's essential for maintaining transparency and legality in business dealings.

-

VAT is a consumption tax levied on the sale of goods and services. It is relevant to businesses as it affects pricing and tax reporting.

-

VAT invoices contain specific details like the VAT amount and tax identification numbers that standard invoices might not include.

-

Businesses must meet legal criteria, including issuing a VAT invoice with required information, maintaining records, and reporting to tax authorities.

-

Maintaining compliance with VAT regulations is crucial, as violations can lead to penalties and legal issues.

What are the key components of a VAT invoice?

A VAT invoice must include several key components to be valid. A clear structure helps prevent misunderstandings and ensures smooth transactions between businesses and customers.

-

The date when the invoice is issued; vital for tracking and payment timelines.

-

A unique identifier for the invoice, essential for record-keeping.

-

Details of the customer, including name and address; ensure accuracy to avoid errors.

-

Information regarding the seller must be included to identify the issuing entity.

-

Clarity in describing the items sold or services rendered is paramount for compliance.

-

Clearly state quantities and prices for accuracy in billing.

-

Clearly present the total owed by the customer, including VAT.

-

Specify acceptable payment methods and due dates to avoid confusion.

-

Detail any additional charges, such as penalties for late payments.

How to fill out a VAT invoice template?

Filling out a VAT invoice template requires a systematic approach and adherence to the outlined structure.

-

Place these at the top of the invoice as they are critical for tracking.

-

Ensure the details provided are accurate and complete.

-

Clearly present your business's name and contact information.

-

Include descriptive terms that clearly communicate what is billed.

-

Double-check these figures to avoid discrepancies.

-

Total must reflect the sum of all costs plus VAT.

-

State the accepted payment methods for easier transactions.

-

Mention any important information regarding payments or additional charges.

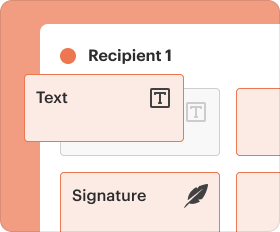

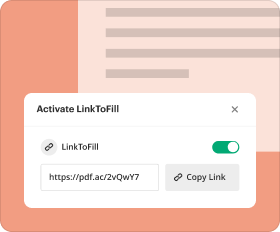

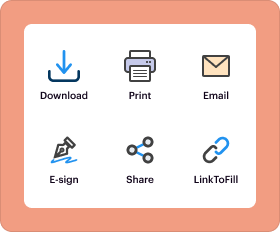

What interactive tools can assist in creating VAT invoices?

Interactive tools like those found on pdfFiller streamline the invoice creation process, making it easier for users.

-

Customizable templates allow you to adapt the invoice to your needs.

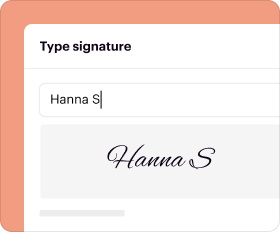

-

Quickly obtain signatures for approvals without the need for printing.

-

Teams can interact and collaborate in real-time to finalize invoices.

-

Store invoices securely online and access them whenever needed.

What are common mistakes when issuing VAT invoices?

Awareness of common mistakes can save businesses from costly penalties.

-

Missing details can lead to non-compliance and penalties.

-

Mistakes in calculations can result in financial discrepancies.

-

Not staying updated with local VAT regulations can lead to legal issues.

-

Not sending invoices promptly can affect cash flow.

How to ensure compliance with local VAT regulations?

Compliance with local VAT regulations requires regular updates and knowledge of the rules.

-

Understand how VAT operates within your region.

-

Different industries may have varied compliance needs.

-

Failure to comply can have serious financial repercussions.

How are VAT invoice templates tailored by industry?

Different industries often have specific needs that demand tailored VAT invoice templates.

-

Assess how VAT invoicing differs in practices between sectors.

-

Some industries require templates designed with unique specifications.

-

Choose templates that fit the specific requirements of your business sector.

Where to find resources and examples of VAT invoices?

Utilizing resources can enhance your understanding of VAT invoicing practices.

-

Visual examples provide clarity on how a proper invoice should look.

-

Access VAT invoice templates on pdfFiller for direct use.

-

Find best practices for effective invoicing through comprehensive resources.

How to fill out the vat invoice template

-

1.Open the VAT invoice template in pdfFiller.

-

2.Locate the invoice date field and enter the date of the transaction.

-

3.Fill in the invoice number to ensure within your accounting records.

-

4.Provide your business name and contact details in the sender section.

-

5.In the recipient section, input the client's name and contact information.

-

6.List the goods or services provided along with a brief description for each item.

-

7.Specify the quantity and the unit price for all goods or services.

-

8.Calculate and input the total price for each line item, including VAT.

-

9.Add VAT percentage and total VAT amount at the bottom of the invoice.

-

10.Ensure all details are accurate, then save or download your completed invoice.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.