Fidelity Defined Contribution Retirement Plan — 401(k) Salary Reduction Agreement 2023-2025 free printable template

Show details

PrintResetSaveDefined Contribution Retirement Plan

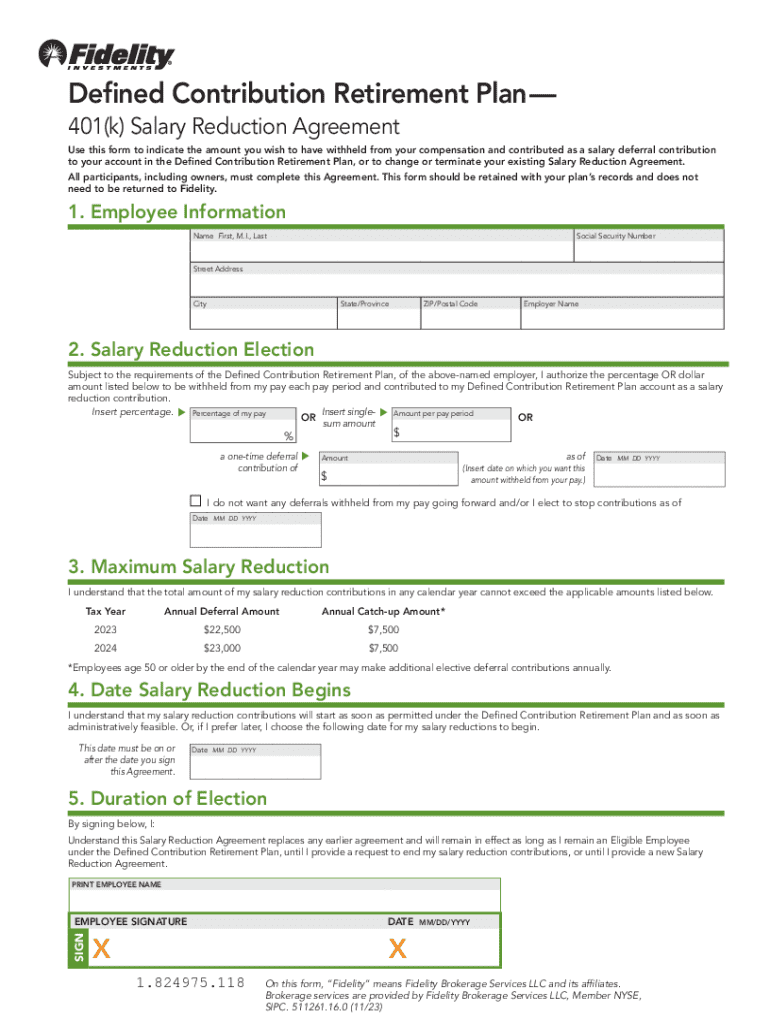

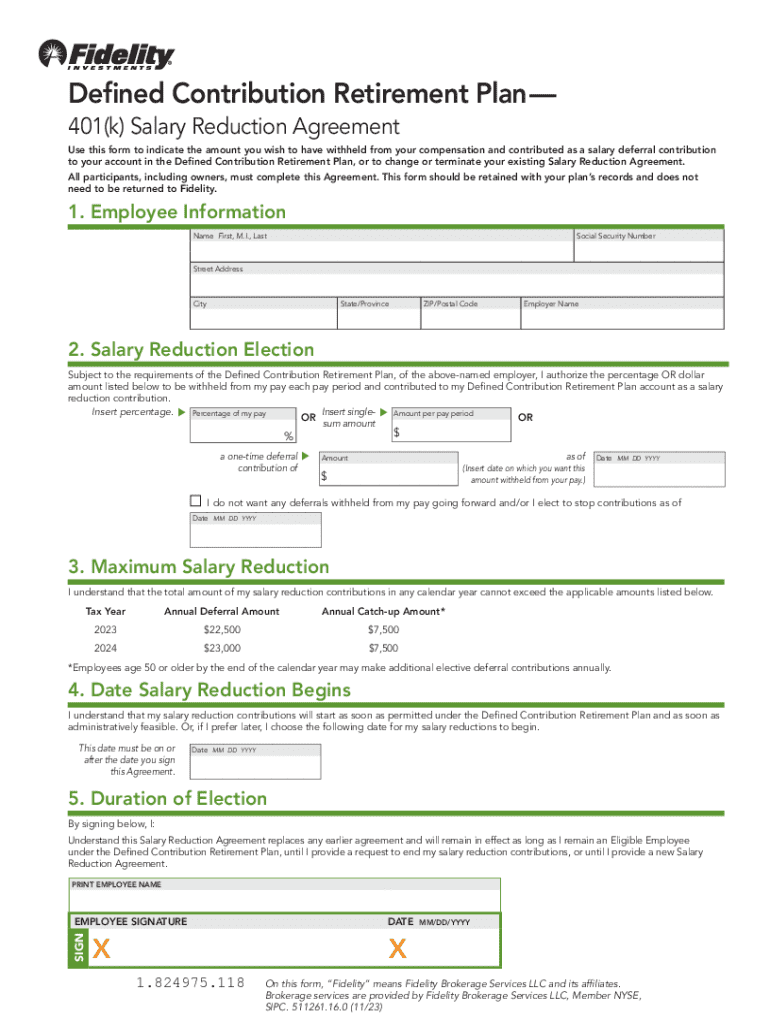

401(k) Salary Reduction Agreement

Use this form to indicate the amount you wish to have withheld from your compensation and contributed as a salary

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Fidelity Defined Contribution Retirement Plan 401k

Edit your Fidelity Defined Contribution Retirement Plan 401k form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Fidelity Defined Contribution Retirement Plan 401k form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Fidelity Defined Contribution Retirement Plan 401k online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Fidelity Defined Contribution Retirement Plan 401k. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fidelity Defined Contribution Retirement Plan — 401(k) Salary Reduction Agreement Form Versions

Version

Form Popularity

Fillable & printabley

4.7 Satisfied (43 Votes)

4.2 Satisfied (51 Votes)

4.3 Satisfied (52 Votes)

How to fill out Fidelity Defined Contribution Retirement Plan 401k

How to fill out Fidelity Defined Contribution Retirement Plan — 401(k)

01

Review the plan details provided by Fidelity.

02

Gather necessary personal information such as Social Security number and employment details.

03

Choose your contribution percentage from your eligible salary.

04

Select your investment options based on your risk tolerance and retirement goals.

05

Complete the enrollment form or process online through Fidelity’s website.

06

Submit the form and confirm your contributions and investment selections.

07

Monitor your account periodically to adjust contributions or investments as needed.

Who needs Fidelity Defined Contribution Retirement Plan — 401(k)?

01

Employees looking to save for retirement through tax-advantaged accounts.

02

Individuals wanting to benefit from employer matching contributions.

03

Workers seeking to take control of their retirement savings and investments.

04

People who want to prepare financially for their post-employment years.

Fill

form

: Try Risk Free

People Also Ask about

What is a voluntary employee salary reduction?

Voluntary cuts occur when a professional willingly accepts less pay. Someone might change employers and sacrifice some compensation for overall satisfaction, or someone might want to change departments in their company and accept a position that pays less.

What happens to my 401k if I quit my job Fidelity?

401(k)—Your options may include leaving the money in your old employer's plan, rolling the money into an IRA, rolling it into your new employer's plan, or even withdrawing the money (in which case you'll potentially face taxes, plus a penalty if you're under the age of 59½).

How does a salary reduction agreement work?

Salary Reductions are an agreement between employee and employer to reduce Employee's salary and direct the amount reduced to the investment account that the employee has established on a pre-tax basis.

What is a 401k salary reduction agreement?

What is a Salary Reduction Agreement? A salary reduction agreement is a written legal agreement between a company and its employee outlining the terms of transferring percentages of the employee's salary to a 401(k), 403(b), or IRA retirement plan.

How long does it take to cash out 401k after leaving job Fidelity?

If you choose to cash out your 401k, the money will usually be available within a few days. However, remember that you'll be subject to taxes and early withdrawal penalties if you don't roll over the account within 60 days.

Is a salary reduction plan the same as a 401k?

A salary reduction plan helps workers save and invest for retirement through their employer via several types of retirement accounts. Money is typically deposited in a retirement account such as a 401k, 403b, or SIMPLE IRA on a pre-tax basis through recurring deferrals (a.k.a. contributions) on behalf of the employee.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the Fidelity Defined Contribution Retirement Plan 401k electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your Fidelity Defined Contribution Retirement Plan 401k in minutes.

How do I edit Fidelity Defined Contribution Retirement Plan 401k straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing Fidelity Defined Contribution Retirement Plan 401k right away.

How do I fill out the Fidelity Defined Contribution Retirement Plan 401k form on my smartphone?

Use the pdfFiller mobile app to fill out and sign Fidelity Defined Contribution Retirement Plan 401k on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is Fidelity Defined Contribution Retirement Plan — 401(k)?

Fidelity Defined Contribution Retirement Plan — 401(k) is a retirement savings plan offered by Fidelity that allows employees to save a portion of their wages in a tax-advantaged account for retirement.

Who is required to file Fidelity Defined Contribution Retirement Plan — 401(k)?

Employers who sponsor a 401(k) plan are required to file certain forms with the IRS, particularly if they offer these plans to their employees.

How to fill out Fidelity Defined Contribution Retirement Plan — 401(k)?

To fill out the Fidelity Defined Contribution Retirement Plan — 401(k), participants typically need to provide information such as personal details, contribution amounts, and investment choices, often through an online platform or form provided by Fidelity.

What is the purpose of Fidelity Defined Contribution Retirement Plan — 401(k)?

The purpose of Fidelity Defined Contribution Retirement Plan — 401(k) is to allow employees to save for retirement in a tax-efficient manner while providing employers a way to enhance employee benefits and potentially match contributions.

What information must be reported on Fidelity Defined Contribution Retirement Plan — 401(k)?

Information that must be reported on Fidelity Defined Contribution Retirement Plan — 401(k) includes participant contribution amounts, employer contributions, total assets, investment performance, and any distributions made during the year.

Fill out your Fidelity Defined Contribution Retirement Plan 401k online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fidelity Defined Contribution Retirement Plan 401k is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.