CO DR 2710 2014 free printable template

Show details

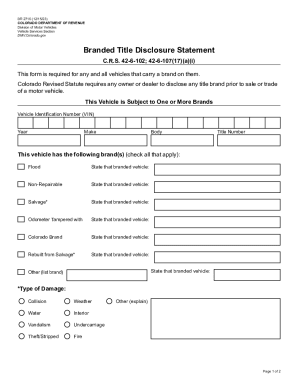

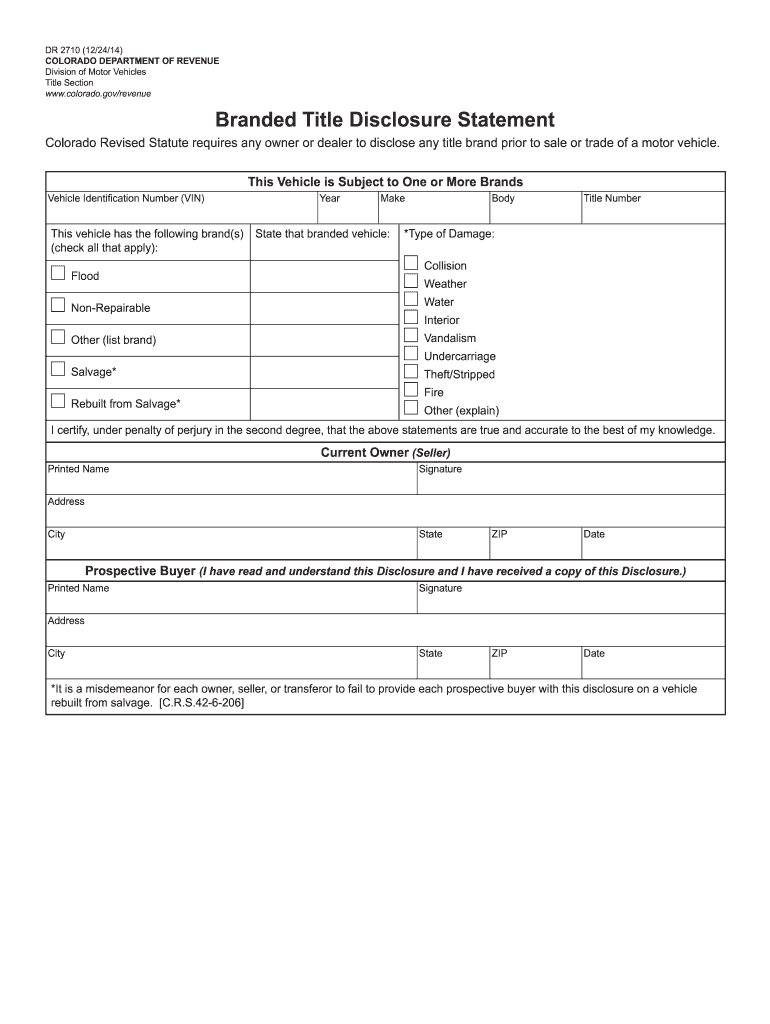

DR 2710 12/24/14 COLORADO DEPARTMENT OF REVENUE Division of Motor Vehicles Title Section www. colorado. gov/revenue Branded Title Disclosure Statement Colorado Revised Statute requires any owner or dealer to disclose any title brand prior to sale or trade of a motor vehicle. This Vehicle is Subject to One or More Brands Vehicle Identification Number VIN This vehicle has the following brand s check all that apply Flood Non-Repairable Other list brand Year Make State that branded vehicle Body...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CO DR 2710

Edit your CO DR 2710 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CO DR 2710 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CO DR 2710 online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CO DR 2710. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO DR 2710 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CO DR 2710

How to fill out CO DR 2710

01

Obtain the CO DR 2710 form from the official website or your local governmental office.

02

Fill out the personal information section, including your name, address, and contact details.

03

Provide the necessary details related to your situation, such as the type of service or assistance you are requesting.

04

Attach any supporting documents that may be required, such as identification or previous correspondence.

05

Review the completed form for accuracy and completeness.

06

Submit the form either online, via mail, or in-person as per the instructions provided.

Who needs CO DR 2710?

01

Individuals or businesses seeking specific state services or assistance related to Colorado regulations.

02

Those who need to report information or request waivers concerning state requirements.

03

Anyone involved in a legal or regulatory process that requires formal documentation in Colorado.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file a Denver income tax return?

You must file a Colorado income tax return if during the year you were: A full-year resident of Colorado, or. A part-year resident of Colorado with taxable income during that part of the year you were a resident, or.

What is City and state tax in Denver?

What is the sales tax rate in Denver, Colorado? The minimum combined 2023 sales tax rate for Denver, Colorado is 8.81%. This is the total of state, county and city sales tax rates. The Colorado sales tax rate is currently 2.9%.

What are the state and local taxes in Denver Colorado?

Colorado has a 4.40 percent corporate income tax rate. There are jurisdictions that collect local income taxes. Colorado also has a 2.90 percent state sales tax rate, a max local sales tax rate of 8.30 percent, and an average combined state and local sales tax rate of 7.78 percent.

How much is Denver state tax?

The state income tax in Colorado is assessed at a flat rate of 4.40%, which means that everyone in Colorado pays that same rate, regardless of their income level.

Should I fill out Colorado DR 0004?

It is not meant to completely replace IRS form W-4 for Colorado withholding, but to help employees in a few specific situations fine-tune their Colorado withholding. If an employee asks about adjusting their withholding, you are required to provide form DR 0004 to them.

What is the tax code for the City of Denver?

Sales Tax. The Denver Revised Municipal Code (DRMC) imposes a 4.81% sales tax on the purchase price paid or charged on retail sales including retail sales made online to Denver customers, leases, or rentals of taxable tangible personal property, products, and on certain services.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my CO DR 2710 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your CO DR 2710 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit CO DR 2710 straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing CO DR 2710, you can start right away.

How do I fill out CO DR 2710 on an Android device?

Complete your CO DR 2710 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is CO DR 2710?

CO DR 2710 is a document used for reporting certain financial and demographic information by organizations in Colorado.

Who is required to file CO DR 2710?

Organizations that are subject to specific state requirements related to financial reporting and accountability must file CO DR 2710.

How to fill out CO DR 2710?

To fill out CO DR 2710, follow the instructions provided on the form, ensuring that all required sections are completed accurately with the necessary financial data.

What is the purpose of CO DR 2710?

The purpose of CO DR 2710 is to promote transparency and accountability by collecting essential information from organizations for regulatory and oversight purposes.

What information must be reported on CO DR 2710?

The information required on CO DR 2710 typically includes financial statements, demographic data, and any other relevant details as specified in the form's instructions.

Fill out your CO DR 2710 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CO DR 2710 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.