NY PTEA1099 2015 free printable template

Show details

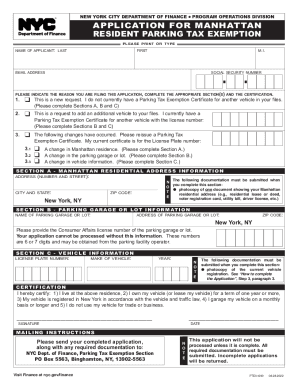

New York, NY. Please provide the Consumer Affairs license number of the parking garage or lot, or the. Department of Finance assigned number, if the facility is ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY PTEA1099

Edit your NY PTEA1099 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY PTEA1099 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY PTEA1099 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NY PTEA1099. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY PTEA1099 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY PTEA1099

How to fill out NY PTEA1099

01

Obtain the NY PTEA1099 form from the New York State Department of Taxation and Finance website.

02

Enter the taxpayer's identification information including name, address, and Social Security Number (SSN) or Employer Identification Number (EIN).

03

List the income amounts received, categorized by type such as interest, dividends, or other specific payments.

04

Fill in any applicable tax withheld from the income listed.

05

Verify all provided information for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the completed form to the New York State Department of Taxation and Finance and provide copies to recipients.

Who needs NY PTEA1099?

01

Individuals or entities who receive certain types of income that are subject to reporting under New York state tax laws.

02

Taxpayers who need to report income that qualifies under the Personal Income Tax (PIT) criteria in New York.

03

Anyone who has received payments that require state withholding or are considered taxable under New York state regulations.

Fill

form

: Try Risk Free

People Also Ask about

How do I apply for parking tax exemption in NYC?

Completed applications, along with any requested documentation, should be mailed to the Parking Tax Exemption Section. Applications must be received by the last day of the month to ensure that a certificate will be dated for that month. Parking Tax Exemption certificates will not be issued in person.

How can I save on parking in NYC?

Walking a few blocks is always better than paying exorbitant parking rates. If you stay at a hotel, check their parking rates for guests and leave your car at the hotel's parking lot. Choosing self-parking over valet parking can also save a couple of dollars.

What is the tax exemption for parking in NYC?

The Manhattan Resident Parking Tax Exemption lowers the tax you pay on rental parking spaces by 8%. The current tax on rental parking spaces in Manhattan is 18.375%. The exemption lowers the amount of tax by 8% reducing the amount of tax you have to pay to 10.375%.

Is there tax on parking in NYC?

Sales tax is imposed on the services of parking, garaging, or storing motor vehicles in a garage, parking lot, or other place of business that provides these services (but not if the garage is part of a private one- or two-family residence).

How do I get a parking tax exemption in NYC?

You may be exempt from paying the 8% NYC surcharge if: Your primary residence is in Manhattan. You own or lease a vehicle for personal use. The vehicle is registered in your name at your primary Manhattan address. You park in a rented parking space in Manhattan on a monthly basis or longer.

What is a NYC tax exemption certificate parking?

The purpose of the Exemption Certificate is to provide proof to parking garage or lot operators that the owner or lessee of a motor vehicle is not required to pay the additional New York City 8% Parking Tax. For those who qualify, the tax on parking services will be at a rate of 10.375% instead of 18.375%.

What is the tax exempt form for NYC?

If you have a valid Certificate of Authority, you may use Form ST-121 to purchase, rent, or lease tangible personal property or services exempt from tax to the extent indicated in these instructions. Complete all required entries on the form and give it to the seller.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NY PTEA1099 in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your NY PTEA1099, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit NY PTEA1099 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign NY PTEA1099 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How can I fill out NY PTEA1099 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your NY PTEA1099. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is NY PTEA1099?

NY PTEA1099 is a form used in New York State for reporting income from partnerships, limited liability companies (LLCs), and S corporations to ensure compliance with state tax obligations.

Who is required to file NY PTEA1099?

Entities such as partnerships, LLCs, and S corporations that have New York source income or members/shareholders who are residents of New York are required to file NY PTEA1099.

How to fill out NY PTEA1099?

To fill out NY PTEA1099, you need to provide information about the entity, including its name, address, and taxpayer identification number, as well as the income distributed to each member or shareholder.

What is the purpose of NY PTEA1099?

The purpose of NY PTEA1099 is to report the distribution of income to partners, members, or shareholders for tax purposes, ensuring that individuals report their income accurately on their personal tax returns.

What information must be reported on NY PTEA1099?

NY PTEA1099 must report details such as the entity's name, identification number, the recipient's name and tax identification, the total amount of income distributed, and any applicable withholdings.

Fill out your NY PTEA1099 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY ptea1099 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.