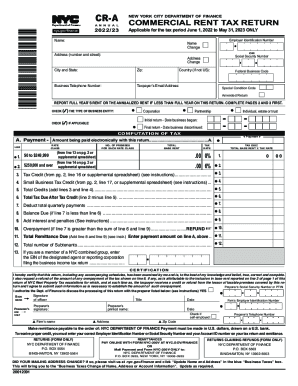

NYC DoF CR-A 2024-2025 free printable template

Get, Create, Make and Sign commercial rent return 2024-2025

Editing commercial rent return 2024-2025 online

Uncompromising security for your PDF editing and eSignature needs

NYC DoF CR-A Form Versions

How to fill out commercial rent return 2024-2025

How to fill out NYC DoF CR-A

Who needs NYC DoF CR-A?

Video instructions and help with filling out and completing commercial rent return

Instructions and Help about commercial rent return 2024-2025

Welcome to part 2 of my investing term video we're going to continue off the same scenario while speaking of in my investing terms part 1 video which discussed an ax Y cap rate and cash-on-cash as a refresher of what the details were in regard to the property we're looking at a two million dollar income property that made 150 thousand dollars NOI we figured the cap rate with 7.5 percent and that if we use the leverage our cash on cash return jumped to eight point seven five percent now we're going to get into them to more complex formulas I'll do my best to explain them as simple as possible the first one we're going to go over is called internal rate of return or IRR the second is called net present value or NPV both of these can correlate with each other quite often but let's take them one at a time okay by the way there are software calculators and Excel programs that you can use to verify my calculations because of the complexity of the IRR and NPV formulas and the time it would take to redundantly explain it on a video let's say the technicalities for a different time shall be first the IRR concept let's take a look at that same two million dollar property that makes $150,000 a year we already know it has a seven and a half percent cap rate, and we've seen the additional potential it can make using leverage, and it's fairly easy to see how we can compare these to a bank account right so let's keep using the bank account example let's go back and say we give the bank two million dollars all cash and in return we make $150,000 a year then let's say after three years or so of collecting 7.5 percent of our money we decide to leave the bank and do something else we go to the bank and request a withdrawal of our two million dollars and instead of them only giving us two million dollars after three years they give us back four million dollars double what we put in there now wait we've been making 7.5 percent this whole time but at the end of our third year we doubled our money plus the other two years 7.5 percent wait so how much did I make overall this is exactly where the internal rate of return comes in internal rate of return is basically looking at the investment overall from start to finish and the keyword there is finished because there must be an exit strategy and then determining how and what percentage you made so let's look at our property two million dollars divided all cash one hundred fifty thousand dollars for three years and then at the end of the third year there's a huge bonus of four million dollars using IRR we've made thirty-two point one percent as I explained without getting all technical and wasting your time with the mathematics and how it works out our money has made thirty-two point one percent every year from start to finish and again the key word there is finish to make sure you're still with me, and you know how to keep the four terms discuss so far let's do a quick recap Not which is short for a net operating income...

People Also Ask about

What is the average return on commercial property UK?

Is UK commercial property still a good investment?

What is considered as a good rent yield?

How do you calculate ROI for commercial property?

Is commercial property still a good investment?

What is a good ROI for a commercial property?

What is considered a good yield?

What is a good return on a commercial property?

What is a good rental yield UK 2022?

What type of commercial property is most profitable?

What is the 2% rule in real estate?

What is a good yield on commercial property UK?

What is the average rate of return on commercial real estate?

What is the 1% rule commercial real estate?

What type of commercial real estate makes the most money?

What is the 2% rule in real estate?

What is a good rate of return on commercial property?

What is a good yield on a commercial property?

How to calculate if a commercial property is a good investment?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find commercial rent return 2024-2025?

How can I edit commercial rent return 2024-2025 on a smartphone?

How do I fill out the commercial rent return 2024-2025 form on my smartphone?

What is NYC DoF CR-A?

Who is required to file NYC DoF CR-A?

How to fill out NYC DoF CR-A?

What is the purpose of NYC DoF CR-A?

What information must be reported on NYC DoF CR-A?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.