NYC DoF CR-A 2011 free printable template

Show details

REPORT FULL YEAR S RENT OR THE ANNUALIZED RENT Is LESS THAN FULL YEAR ON THIS ... COMMERCIAL RENT TAX .... CR-A 2010/11 Rev. 02.17.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NYC DoF CR-A

Edit your NYC DoF CR-A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NYC DoF CR-A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NYC DoF CR-A online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NYC DoF CR-A. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NYC DoF CR-A Form Versions

Version

Form Popularity

Fillable & printabley

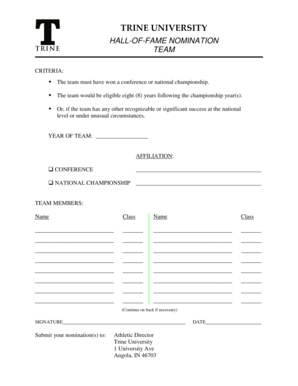

How to fill out NYC DoF CR-A

How to fill out NYC DoF CR-A

01

Obtain the NYC DoF CR-A form from the official NYC Department of Finance website.

02

Begin filling out the property information section, including the property address and tax block and lot number.

03

Complete the owner information section with your name, address, and contact information.

04

If applicable, provide details about the income and expenses related to the property.

05

Ensure you check the box confirming you understand the form's requirements and that the information provided is accurate.

06

Sign and date the form where indicated.

07

Submit the completed form according to the submission guidelines outlined on the NYC Department of Finance website.

Who needs NYC DoF CR-A?

01

Property owners in New York City who are looking to apply for property tax exemptions or financial benefits from the city.

02

Individuals or entities managing properties that may qualify for certain programs needing documentation of income and expenses.

Fill

form

: Try Risk Free

People Also Ask about

What is the average return on commercial property UK?

The prime yields of commercial real estate in the United Kingdom (UK) were the lowest in the industrial multi-let, distribution, and London West End offices markets at 3.25 percent, respectively, as of May 2022. In contrast, shopping centers stood at 7.5 percent.

Is UK commercial property still a good investment?

Investing in commercial property has many benefits and is considered a good long-term investment. It is said that commercial landlords have greater protection under the law if the tenant fails to pay rent on time.

What is considered as a good rent yield?

A. A property with a low rental yield, which is anywhere between 2-4 percent, implies that it is overvalued. Investors generally aim for properties with a rental yield above 5.5 percent because of the stability in rental income.

How do you calculate ROI for commercial property?

10,000 and that has grown to Rs. 20,000 then the absolute return will be as follows- 20000-10000/10000= 100%. An annualised return can be calculated in the following manner: End value- beginning value/beginning value *100* (1/holding period of the investment).

Is commercial property still a good investment?

Yes, commercial property can be a very good investment because overall returns can be higher than those associated with investing in residential properties.

What is a good ROI for a commercial property?

For instance, a good ROI for rental property is generally above 10%, but anywhere from 5% to 10% may work for you, depending on the level of risk you assume and your own financial expectations.

What is considered a good yield?

From 2% to 6% is considered a good dividend yield, but a number of factors can influence whether a higher or lower payout suggests a stock is a good investment. A financial advisor can help you figure out if a certain dividend-paying stock is worth considering.

What is a good return on a commercial property?

A good return on investment for commercial properties falls between 5% and 12%. While this is an average figure, it should be noted that a 'good' return is based on conditions such as property type and the local market.

What is a good rental yield UK 2022?

The average UK rental yield in 2022 is 4.71%, meaning anything above this can be considered a high rental yield. This yield is achieved thanks to an average property price of £270,768 and rents hitting a high of £1,064 per month.

What type of commercial property is most profitable?

Properties that are capable of bringing in the highest return on investments are typically those with the highest number of tenants. These commercial real estate properties can include multifamily projects, student housing, office space, self storage facilities, and mixed use buildings.

What is the 2% rule in real estate?

The 2% rule states that the monthly rent for an investment property should be equal to or no less than 2% of the purchase price. Here's an example of the 2% rule for a home with the purchase price of $150,000: $150,000 x 0.02 = $3,000.

What is a good yield on commercial property UK?

As a general rule of thumb, a rental yield of around 7% or higher tends to be considered a very good yield for a buy-to-let property. If you're a landlord looking for the best cities in the UK to purchase buy-to-let property, then you've arrived at the right place.

What is the average rate of return on commercial real estate?

What is an average ROI on real estate? ing to the S&P 500 Index, the average annual return on investment for residential real estate in the United States is 10.6 percent. Commercial real estate averages a slightly lower ROI of 9.5 percent, while REITs average a slightly higher 11.8 percent.

What is the 1% rule commercial real estate?

The 1% rule of real estate investing measures the price of the investment property against the gross income it will generate. For a potential investment to pass the 1% rule, its monthly rent must be equal to or no less than 1% of the purchase price.

What type of commercial real estate makes the most money?

Properties With a High Number of Tenants Properties capable of bringing in the highest return on investments are typically those with the highest number of tenants. These properties include RV parks, apartment complexes, student housing, office buildings, and storage facilities.

What is the 2% rule in real estate?

The rule holds that the rental amount should equal two percent of the property's purchase price. By that calculation, if you purchase a house for $100,000, the monthly rent should be $2,000.

What is a good rate of return on commercial property?

A good return on investment for commercial properties falls between 5% and 12%. While this is an average figure, it should be noted that a 'good' return is based on conditions such as property type and the local market.

What is a good yield on a commercial property?

A good yield on commercial property usually falls between 5% and 10% per annum, which is significantly higher than the 1% to 3% usually generated by residential properties.

How to calculate if a commercial property is a good investment?

To determine the NOI of a property add all sources of revenue (rent, leases, parking) then subtract all expenses (utilities, maintenance, taxes, but not mortgage) from that number. A property with a high NOI is the better investment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute NYC DoF CR-A online?

Filling out and eSigning NYC DoF CR-A is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit NYC DoF CR-A on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share NYC DoF CR-A from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I complete NYC DoF CR-A on an Android device?

Use the pdfFiller mobile app to complete your NYC DoF CR-A on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is NYC DoF CR-A?

NYC DoF CR-A is a form used by the New York City Department of Finance to report certain financial information, particularly focused on compliance for property owners regarding their real estate transactions.

Who is required to file NYC DoF CR-A?

Property owners and other entities involved in real estate transactions in New York City are required to file NYC DoF CR-A, particularly those that are subject to specific tax regulations.

How to fill out NYC DoF CR-A?

To fill out NYC DoF CR-A, individuals must complete the designated fields with accurate information regarding the property and transaction details, and ensure that supportive documents are attached as needed.

What is the purpose of NYC DoF CR-A?

The purpose of NYC DoF CR-A is to ensure compliance with local tax laws and regulations, facilitate accurate property valuations, and maintain transparent records of real estate transactions.

What information must be reported on NYC DoF CR-A?

NYC DoF CR-A requires reporting information such as the property address, owner details, transaction specifics, financial data, and any relevant tax identification numbers.

Fill out your NYC DoF CR-A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NYC DoF CR-A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.