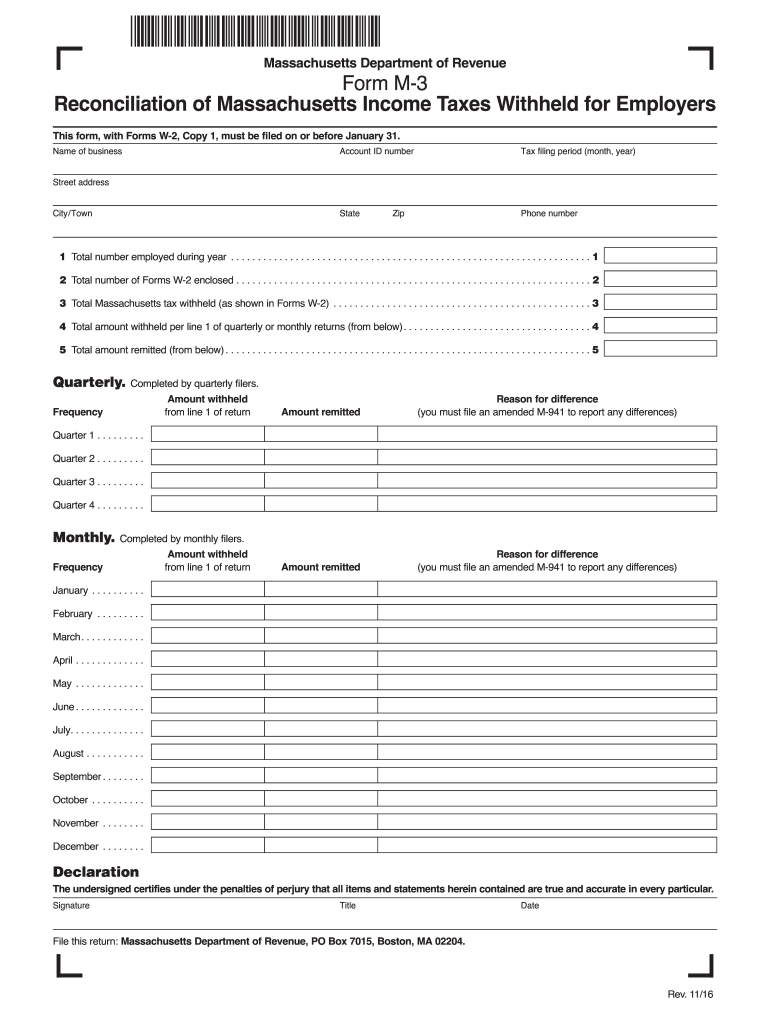

MA Form M-3 2016-2025 free printable template

Get, Create, Make and Sign massachusetts form m 3

Editing ma form m 3 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out m 3 form

How to fill out MA Form M-3

Who needs MA Form M-3?

Video instructions and help with filling out and completing mass form m 3 fillable

Instructions and Help about mass form m3

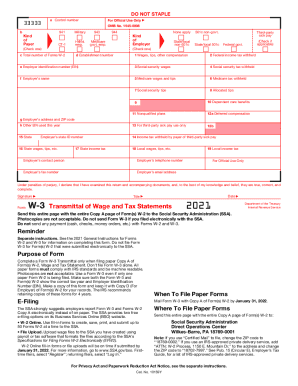

In this brief tutorial I'm going to show how you can take form documents from Microsoft Word or from a PDF document and create fill-in fields, so the form can be filled out online or the user can type in the information and then print it out for this purpose we are going to use Adobe professional 9.0 so here's how it's done supposedly we have this form and now this we want to convert this into PDF and then have the users fill this out, so basically you would go into Adobe and then if you go under forms click on start form wizard choose an existing electronic document, so you're opening a PDF or a word or Excel file or some other type of document click on next, and then you import the file from the file system, so basically you're browsing for the file with a Word document and click on open next and then the Adobe profession online is going to scan the document for any fields that can be filled out and then create the fields automatically this takes a few seconds actually probably could take even a few minutes depending on how long the original document is at this point it has determined where all the possible fields are so in this case we have some fields that are not necessary, so we can click on them and then press the lead from a keyboard to delete the fields those are not necessary well that's working correctly check also at this time we can right-click on these fields choose properties and then customize it as far as the font presumably the font size is although depending on the size of a field you can choose the type of font and the color and additional options as well now in the cases where some components are not detected like in this case here for the checkboxes what you need to do is you click on add new field and then in this case we want a checkbox so just click on checkbox and then just draw a little box right in front of it if you want to mark that box is required click on required and then repeat the same process for the other items here as well, so that's how you basically import a document that you might have in Word or some other format into Adobe writer, and then you create fields, or you run the wizard, and it creates the fields automatically by the way at this point you just save this, and then you send it to the users once the form has been saved and the users will be able to fill it out to fill in the fields by default if they just have Adobe Reader in their computer they'll not be able to save the contents of those fields however if they have something of a writer option like a PDF creator or some other type of taken then they will be able to save the form that you have just created there's another way to create to distribute the form and this involves basically having an adobe account, and then you send the forms to the users, and then you get the responses back from the users automatically but for this you would need to have an Adobe account the other way to fill in the forms or to create forms is manually so let's say...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit m3 form from Google Drive?

How can I send MA Form M-3 to be eSigned by others?

How can I fill out MA Form M-3 on an iOS device?

What is MA Form M-3?

Who is required to file MA Form M-3?

How to fill out MA Form M-3?

What is the purpose of MA Form M-3?

What information must be reported on MA Form M-3?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.